Within the first month of 2025, European equities noticed the most important month-to-month capital inflows in 25 years, in keeping with Financial institution of America. This stunning growth comes after the European STOXX EUROPE 600 index recorded simply 6% development for 2024 in comparison with 24% for the US S&P 500 index.

The euro space financial system grew by simply 0.9% within the third quarter, whereas the US financial system grew by 2.7%. Preliminary knowledge for the fourth quarter will probably be printed this week. Though the eurozone managed to tame inflation to 2.4%, this led to a broad-based financial slowdown.

The outlook for 2025 suggests rising divergence between US and eurozone financial coverage, partly as a result of Trump administration’s deliberate actions. ECB rates of interest are already greater than 1% decrease than within the US and the hole might widen additional. Economists count on the ECB to chop charges by as much as one share level this yr, whereas the US is predicted to drop by solely half a share level. This has a destructive impact on the euro-dollar alternate charge, which has already reached parity.

Europe nonetheless faces many dangers. Inflation, an financial slowdown, the danger of a tariff conflict with the US or China, a collapsing automobile business, rising power costs… the record is lengthy.

So what brings buyers again to European markets?

Banks

Within the US, banks historically kicked off the earnings season in type. Most of them beat expectations because of robust curiosity revenue and a restoration in buying and selling exercise on Wall Avenue, particularly in areas comparable to buying and selling and funding banking.

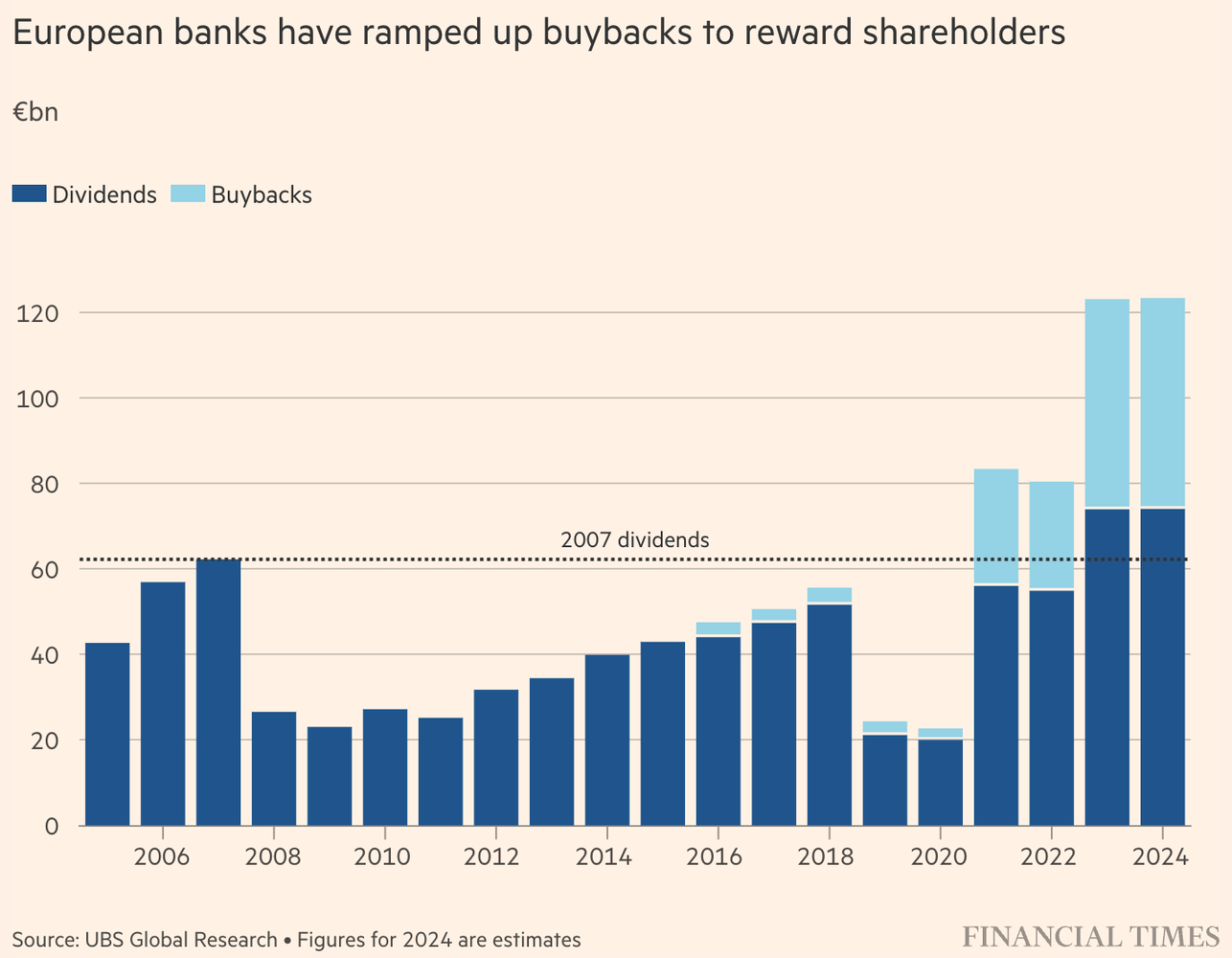

However European banks additionally attracted media consideration. UBS estimates that shareholder compensation for 2024 might exceed $123 billion for the second yr in a row. After a protracted interval of low and even destructive rates of interest, the outlook for banks has improved considerably because the Covid pandemic.

European financial institution shares are reaching all-time highs because of high-interest yields. And though the ECB has already began to chop rates of interest, banks nonetheless have the chance to make the most of this example and maximise income in 2025 because of the financial restoration of shoppers.

Regardless of the constructive developments, nonetheless, valuations of European banks nonetheless lag behind their US counterparts. Many European titles are buying and selling at lower than their e-book worth, suggesting room for development.

Then again, the deregulation of the US banking sector poses a major aggressive danger for European banks. Much less stringent guidelines could enable US banks to increase extra aggressively, which might put strain on European gamers in worldwide markets.

The posh sector

With the beginning of the This fall 2024 earnings season, we had been in a position to get a glimpse into the efficiency of a number of main European gamers within the luxurious items sector. Brunello Cucinelli, Richemont and Burberry reported outcomes, whereas we count on additional studies within the coming weeks. What developments did these outcomes reveal?

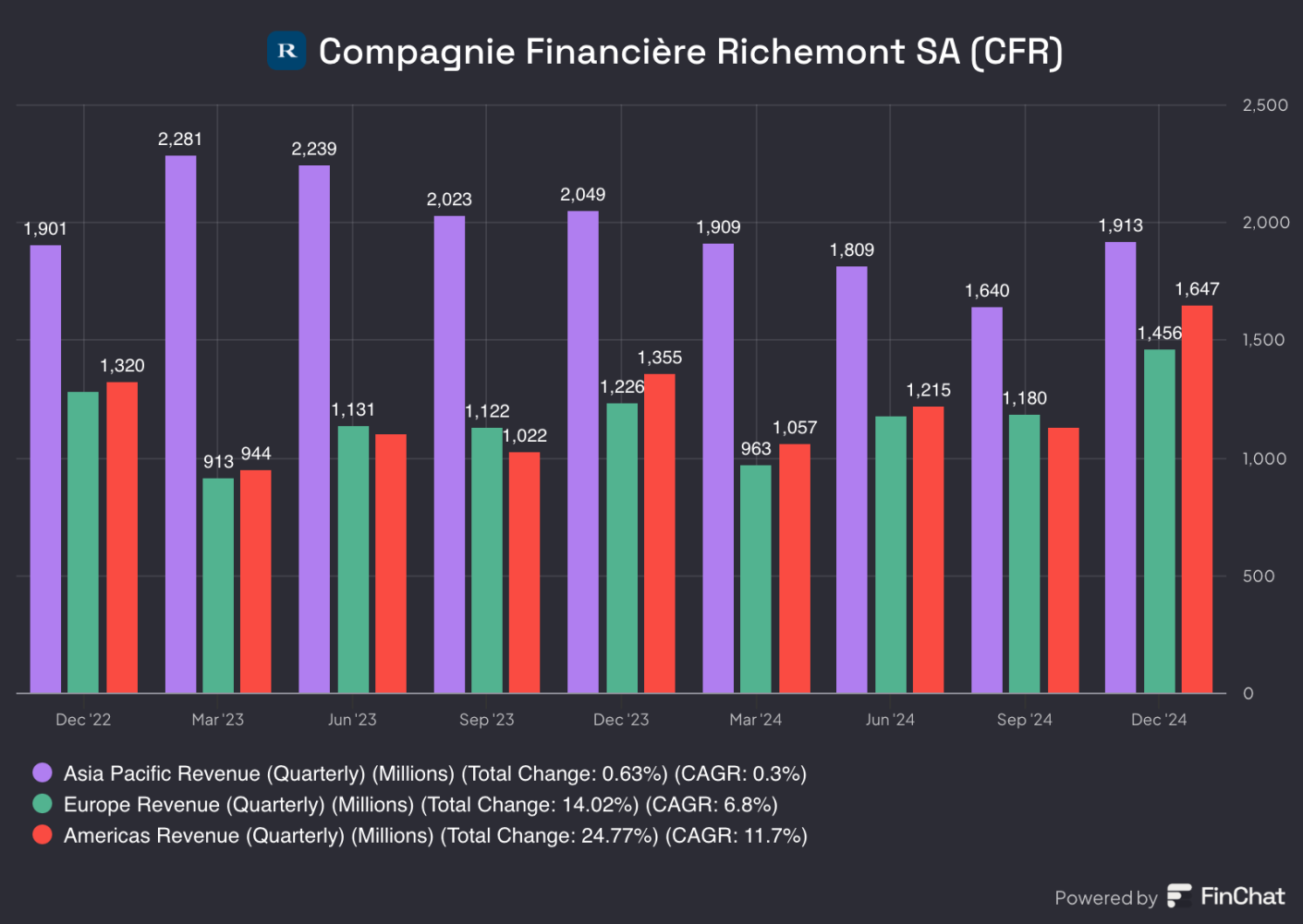

Richemont

Richemont, identified for its luxurious jewelry and watches comparable to Cartier, Piaget and Montblanc, reported double-digit gross sales development in all areas besides Asia.

In Asia, gross sales fell 7%, pushed by an 18% drop in mainland China. However, that is an enchancment on the 16-19% year-on-year decline in earlier quarters. Asia accounts for as much as 40% of Richemont’s gross sales, making it a key area.

Europe recorded robust development of 19%, boosted by tourism from the Americas and the Center East. The Americas grew essentially the most of all areas, pushed by robust client and financial growth. This can be a important acceleration in each areas, as income development in current quarters was solely 5% and 10% respectively.

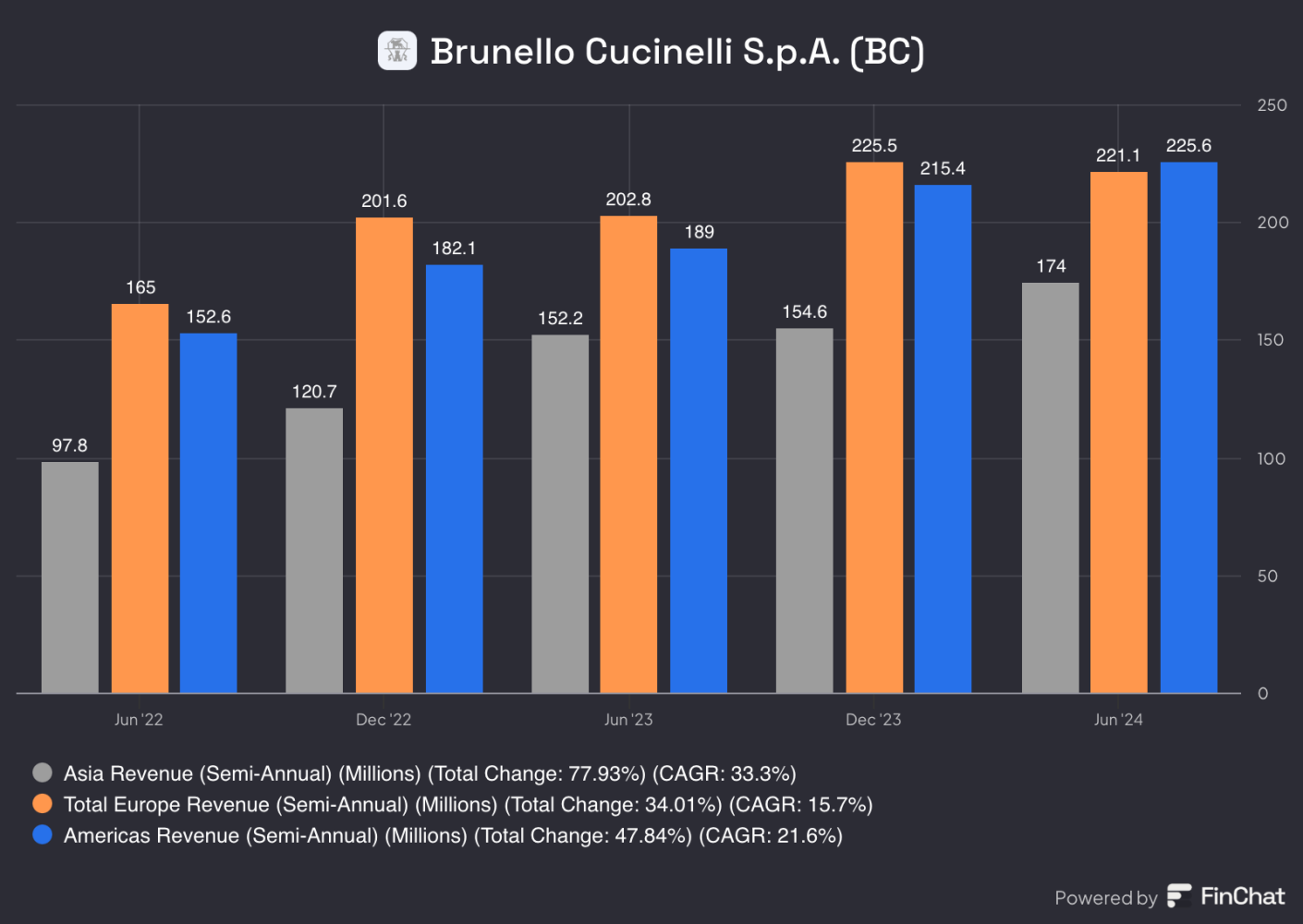

Brunello Cucinelli

Brunello additionally reported ” enchanting” This fall ends in January.

Within the Americas, gross sales rose 17.8%, underlining robust demand from US shoppers. Europe noticed barely extra modest development at 6.6%.

In Brunello’s case, development in Asia was surprisingly robust, even after the corporate raised its expectations to 11-12% development in December from an preliminary 10%. Fourth-quarter gross sales had been up 12.6%.

Brunello advantages from a singular place in Asia because it targets ultra-high-net-worth purchasers that haven’t been affected by the widespread financial slowdown. Hermes can also be in an identical place. Brunello additionally advantages from the truth that Asia accounts for less than ~27% of its gross sales.

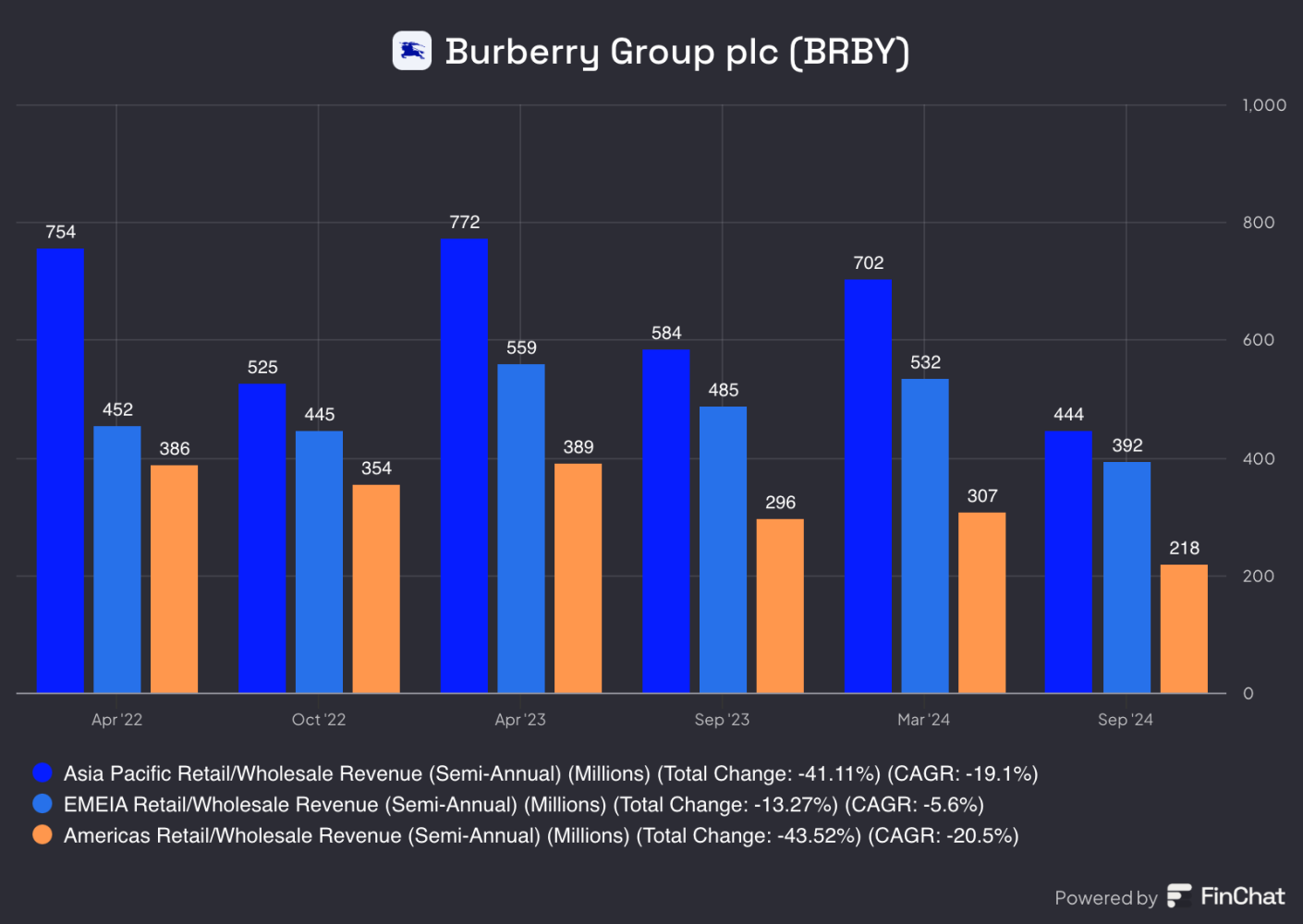

Burberry

Burberry is dealing with a tough time given the continued efforts to revive the model. Regardless of this, gross sales within the Americas recorded 4% development. Europe noticed a 2% decline, whereas gross sales in China unsurprisingly fell essentially the most, down 7%.

Nevertheless, the outcomes had been nonetheless higher than analysts anticipated, main to an enormous rally in Burberry shares.

Your entire sector rode the wave of optimism from these outcomes, particularly the energy within the US and the restoration of European shoppers. Within the second half of final yr, buyers misplaced confidence in some manufacturers provided that the unsure extent of the financial issues in China posed a major danger to a lot of them. However plainly buyers had been a little bit too pessimistic.

Not every thing is as rosy because it appears

Whereas the banking and luxurious items sectors in Europe are exhibiting promising developments, different European favourites face important challenges. The earnings season in Europe could also be off to a slower begin than within the US, however there are already early indicators of dangers that would have an effect on 2025.

For instance, ASML shares not too long ago weakened after Dutch Prime Minister Dick Schoof hinted at the potential for renewing strict export bans on AI chips at a discussion board in Davos, this time beneath the management of Donald Trump. Such restrictions, just like these beneath Joe Biden, might considerably disrupt provide chains and export prospects for European know-how corporations.

Considerations had been additionally expressed by Ericsson, whose shares fell after its outcomes had been printed. The corporate warned of the destructive impression of the tariffs, which it stated posed a severe menace to Europe’s info and telecoms business.

Novo Nordisk, one of many darlings of the European market, is just not within the clear both. Its shares benefited final yr from optimism round weight problems medication, significantly Wegovy and Mounjaro, which had been initially developed as diabetes remedies however have proved efficient in decreasing urge for food. Nevertheless, demand didn’t match investor expectations. Furthermore, the outcomes of scientific trials of the brand new drug have produced combined conclusions. Novo Nordisk is not going to publish its quarterly outcomes till 5 February.

And what about Davos?

Final Friday, probably the most vital world conferences of the yr occurred in Davos, Switzerland. The World Financial Discussion board is a platform that brings collectively leaders from politics, enterprise, academia, economics and different fields. Yearly, greater than 3,000 members collect on this picturesque city within the Swiss Alps to debate and discover options to world issues.

This yr’s occasion, entitled “Cooperation for the Clever Age”, occurred at a pivotal second for world politics – coinciding with the conclusion of the Gaza ceasefire and the inauguration of the brand new President of the USA.

Trump’s “carrot and stick” strategy

Donald Trump was one of many principal subjects of dialogue this yr. Guests had been significantly involved about his strategy to tariffs, deregulation and power coverage. Trump has brazenly careworn that his principal aim is to make sure America’s dominance on the worldwide stage – even at the price of strained relations with its allies. China was additionally a giant subject, because it has quickly reworked from the “manufacturing facility of the world” into a worldwide energy, which Trump sees as a rising menace.

As a result of the discussion board started on the day of his inauguration, Trump joined the world leaders nearly through reside stream. In his speech, he declared, “Below a Donald Trump administration, there will probably be no higher place on Earth to create jobs, construct factories or develop corporations than proper right here within the good previous USA.”

What dangers does Trump pose to Europe?

On his first day as President of the USA, Donald Trump repealed a variety of energy-related laws. In his phrases, America should considerably enhance power manufacturing to make sure not solely its power independence, but additionally adequate power provides for its rising AI infrastructure.

One other key goal of Trump’s coverage is to decrease power costs to fight inflation and scale back Russian revenues from the power sector. In line with him, this step is essential for ending the conflict in Ukraine.

One notable impact of those insurance policies is his push for Europe to buy extra American power. If Europe refuses, Trump has threatened to impose tariffs. His current commerce dispute with Colombia demonstrates that he’s not hesitant to make use of tariffs as a bargaining software.

Trump goals to make use of tariffs to handle commerce imbalances with main companions like Europe and China. Simply final week, he signed a memorandum directing federal businesses to evaluate commerce agreements, with a give attention to addressing unfair commerce practices and market manipulation. Europe is standing on skinny ice on the subject of commerce with the USA, and we have now but to see how this example develops.

What lies forward for Europe in 2025?

Regardless of optimism in just a few chosen areas, Europe’s structural issues stay unchanged. The brand new yr nonetheless holds many unknowns. Key areas for buyers to give attention to embrace:

Geopolitical pressures: competitors with China and the US, who don’t hesitate to resort to unfair practices, could hamper European development.

A robust greenback: It continues to push up the worth of imports and weaken the euro, elevating prices for European corporations.

Power disaster and regulation: Dependence on power imports and regulation could stay key components affecting European companies.