Decentralized finance (DeFi) has unlocked new monetary prospects, but it surely additionally comes with critical dangers, making DeFi danger administration a prime precedence for builders and establishments alike. Good contract bugs, flash mortgage assaults, and logic flaws have value customers billions of {dollars} over the previous few years. As soon as deployed, these contracts usually run with out a lot oversight, making them a straightforward goal for attackers.

To remain forward of those threats, real-time monitoring instruments have gotten vital. Not like conventional audits that occur as soon as, these instruments regulate good contracts as they function, detecting suspicious exercise the second it begins.

Sayfer, a real-time good contract monitoring platform, was developed to alert builders and customers to potential threats earlier than main injury happens. On this overview, we’ll discover how Sayfer works and whether or not it’s actually serving to make DeFi safer in 2025.

Why DeFi Wants Actual-Time Monitoring

DeFi has come a great distance, but it surely’s additionally been hit onerous by high-profile exploits. Flash mortgage assaults, reentrancy bugs, and flawed logic in good contracts have led to losses exceeding $5.7 billion since 2020.

Notable incidents just like the bZx assaults, Cream Finance hacks, and the Ronin Bridge exploit present how briskly issues can go mistaken, usually inside minutes or seconds.

Whereas many DeFi tasks endure pre-deployment audits, these checks are usually not foolproof. Code can behave in another way in the true world, and attackers usually discover edge instances that auditors miss. As soon as a contract is deployed, it’s normally immutable, which means any vulnerabilities left behind can’t be patched simply.

That’s why steady, real-time monitoring is changing into important. It provides a second layer of safety by recognizing suspicious behaviour because it occurs. With conventional finance establishments displaying rising curiosity in DeFi, instruments that provide stronger, ongoing safety assurances are not a luxurious; they’re a necessity.

What Is Sayfer and How Does It Work?

Sayfer is a blockchain cybersecurity platform providing real-time good contract monitoring and alerting to assist DeFi tasks keep one step forward of threats. It’s designed not simply to seek out vulnerabilities earlier than launch, however to actively watch stay contracts for harmful exercise as quickly as they go stay.

Listed below are the important thing options:

Actual-Time Occasion Monitoring and Anomaly Detection

Sayfer offers steady, automated surveillance of good contracts to identify irregularities in actual time. It tracks on-chain occasions like token transfers, perform executions, and stability modifications, evaluating them in opposition to identified patterns of regular exercise.

When anomalies like unusually massive withdrawals or unauthorized entry makes an attempt happen, Sayfer instantly flags them, permitting builders or safety groups to behave earlier than any injury is finished.

Alerts for Suspicious Behaviours

Sayfer’s system is supplied to detect particular indicators of malicious intent, resembling sudden spikes in gasoline charges (an indication of high-frequency bot exercise), reentrancy makes an attempt, or calls to self-destruct features. These alerts are despatched immediately through dashboards, electronic mail, or built-in messaging instruments, giving safety groups time to reply earlier than funds are compromised.

Transaction Sample Evaluation and Customized Rule Setting

Customers can tailor Sayfer to their particular danger tolerance by establishing customized alert guidelines based mostly on transaction behaviour. For instance, a protocol may need alerts for a sequence of fast pockets creations adopted by small token transfers, behaviour that always precedes an airdrop farming assault. This flexibility permits platforms to deal with threats that matter most to them and adapt their defence methods as new assault vectors emerge.

Consumer Interface: Dashboard with Actual-Time Visualization and Logs

Sayfer presents suspicious behaviour through a clear dashboard that exhibits stay knowledge, occasion timelines, and transaction logs. This visible, actual‑time interface helps each builders and safety groups rapidly interpret alerts, hint incidents, and take well timed motion.

Compliance Readiness: Helps Institutional Customers Meet Audit and Safety Benchmarks

For institutional purchasers, like asset managers or fund operators, Sayfer provides worth by offering documented alerts and logs. These options assist compliance efforts by providing a traceable audit path, proof of monitoring, and fast incident response procedures.

Integration With Dev Environments and Present Safety Stacks

Sayfer integrates with developer toolsets and bug bounty platforms, mixing right into a mission’s current safety workflow. Groups can obtain alerts by way of their ordinary reporting instruments and use Sayfer’s watchlist alongside audits and guide checks.

Sayfer helps integrations with common Web3 tooling stacks. It will possibly join to dam explorers to complement alert knowledge with transaction metadata, or plug into Gnosis Secure to set off automated responses like multisig approvals for contract pausing.

It additionally works with current safety dashboards, enabling groups to view good contract well being alongside different danger indicators. As a result of Sayfer combines steady monitoring with compliance- and risk-based options, it’s appropriate for each DeFi builders and bigger gamers like institutional funds.

Good Contract Monitoring for Builders and Establishments

Sayfer is designed to assist builders all through the lifecycle of a sensible contract. Through the growth section, it may be built-in into testnets or dev environments to observe contract behaviour underneath simulated circumstances.

Builders can arrange customized guidelines to flag anomalies like unauthorized entry makes an attempt, surprising modifications in gasoline consumption, or edge-case behaviour throughout perform calls.

After deploying the contract, Sayfer continues to run in real-time, monitoring on-chain exercise and alerting the staff to any suspicious patterns which will sign an exploit in progress.

Institutional customers, together with DeFi asset managers and protocol treasuries, can use Sayfer to safeguard on-chain belongings by receiving instant alerts when monitored good contracts behave abnormally.

As an illustration, a yield aggregator managing person funds throughout numerous vaults can monitor for reentrancy assaults or flash mortgage exploits throughout its methods. Alerts from Sayfer can allow fast response, resembling pausing a contract or halting deposits, earlier than main injury happens.

This real-time visibility offers the extent of DeFi danger administration establishments more and more require to function confidently.

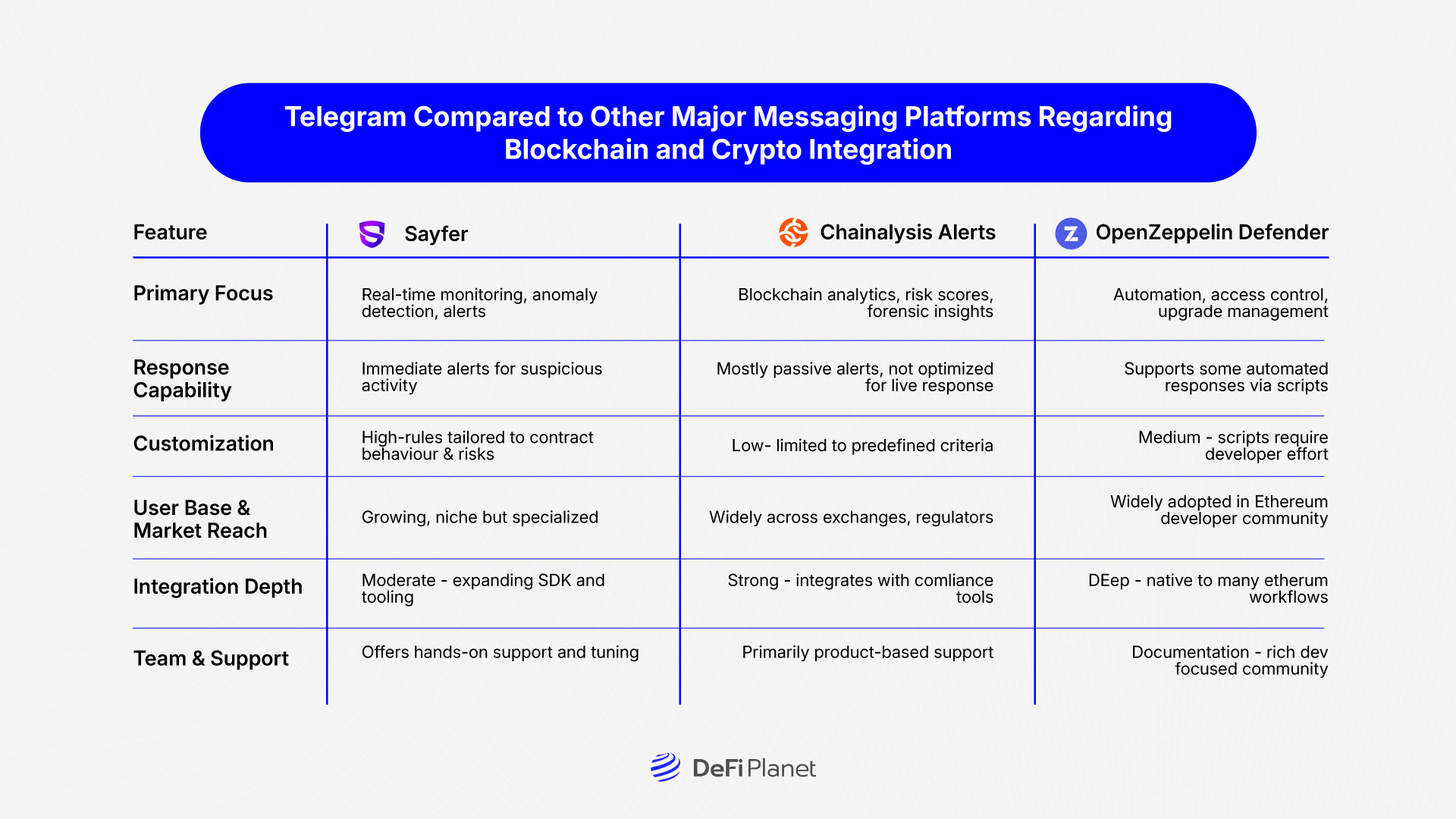

How Sayfer Compares to Different Safety Instruments

Sayfer stands out by emphasizing real-time risk detection and customizable alerts, whereas many different instruments focus extra on audits or post-incident forensics.

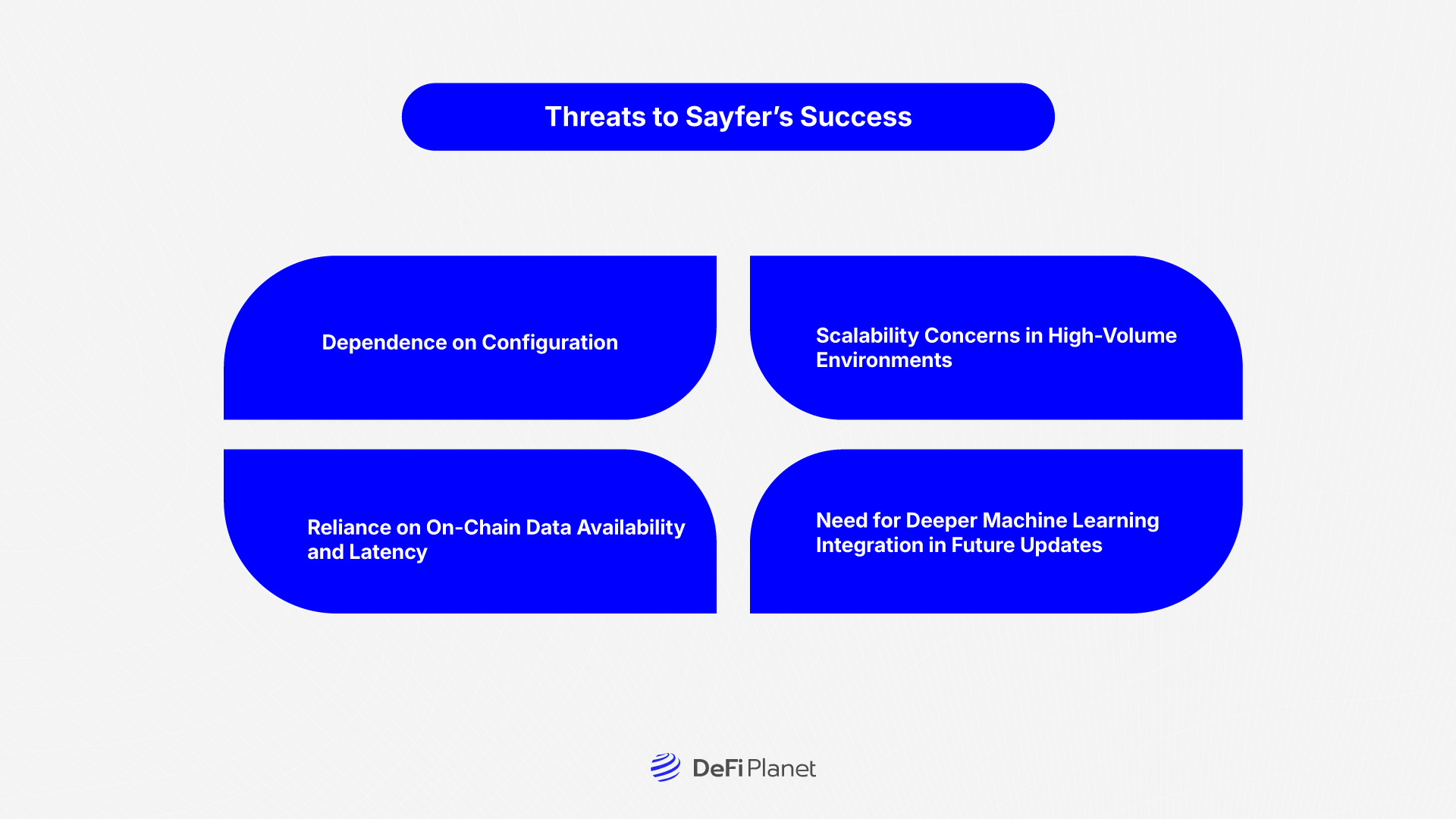

Threats to Sayfer’s Success

Whereas Sayfer affords real-time good contract monitoring to strengthen DeFi safety, it nonetheless faces some challenges that might restrict its broader effectiveness and adoption.

Dependence on Configuration

Sayfer depends on user-defined guidelines and thresholds to detect anomalies, which introduces a margin for error relying on how precisely the principles are set. If the parameters are too broad, they’ll generate extreme false positives, inflicting alert fatigue and doubtlessly main groups to disregard actual threats.

Then again, overly slender configurations can miss vital occasions, creating false negatives that enable exploits to slide by way of undetected. Hanging the best stability requires safety experience, which not each growth staff might have.

Scalability Considerations in Excessive-Quantity Environments

DeFi purposes with high-frequency transactions and complicated multi-contract operations current scalability challenges. Monitoring 1000’s of stay interactions throughout a number of blockchains in actual time requires substantial computing energy and backend optimization.

If Sayfer’s system can’t scale effectively, delays in processing or dropped alerts might compromise its capacity to guard high-volume protocols, significantly throughout peak community congestion or risky market durations.

Reliance on On-Chain Information Availability and Latency

Sayfer’s alert system is just as quick and correct because the blockchain knowledge it receives. Community latency, delayed block finality, or poor knowledge indexing can influence its capacity to ship well timed alerts.

That is particularly problematic throughout fast, coordinated assaults like flash mortgage exploits, the place seconds can decide whether or not a protocol suffers minor or catastrophic losses. And not using a fallback mechanism or redundancy layer, Sayfer’s efficiency could also be weak to community instability.

Want for Deeper Machine Studying Integration in Future Updates

At current, Sayfer’s detection engine is rule-based, counting on patterns and thresholds outlined by customers or preconfigured templates. Whereas that is efficient for identified assault sorts, it lacks adaptability in opposition to novel threats or evolving assault vectors that don’t match current fashions.

Integrating machine studying might assist the system acknowledge refined or surprising behaviours throughout completely different contracts, bettering detection accuracy and lowering the necessity for guide tuning over time. Nevertheless, this requires main R&D funding and cautious dealing with to keep away from new dangers from automated studying.

Ultimate Phrases: Is Sayfer a Recreation-Changer for DeFi Safety?

Sayfer delivers real-time good contract monitoring that advantages each builders and establishments, providing customizable alerts, multi-chain assist, and transaction-level insights. It’s a sensible software for builders seeking to catch threats early and for bigger protocols aiming to strengthen operational safety.

Whereas not a silver bullet, Sayfer provides an important defence layer. Its rule-based system requires cautious setup and lacks machine studying adaptability for now. Nonetheless, it helps scale back response time and alert fatigue, each vital in right this moment’s fast-moving DeFi house.

As a part of a layered DeFi danger administration technique, Sayfer fills a vital hole between audit-time discovery and stay exploit mitigation. As billion-dollar exploits develop extra frequent, instruments like Sayfer might quickly turn out to be commonplace in safe DeFi protocol design, shifting from “good to have” to important.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”