After reaching new all-time highs earlier this yr, Bitcoin has entered a multi-month interval of uneven worth motion, main many to surprise if the bull cycle is over. On this article, we dive deep into key metrics and developments to know if the market is simply cooling off or if we have already seen the height for this cycle.

Essentially Overvalued?

One of the vital dependable instruments for gauging Bitcoin’s market cycles is the MVRV Z-Rating. This metric measures the distinction between Bitcoin’s market cap and its realized cap, or cost-basis for all circulating BTC, serving to buyers decide whether or not Bitcoin is over or undervalued in accordance with this ‘elementary’ price of BTC.

Latest information exhibits that the MVRV Z-Rating has demonstrated a sustained downward motion, which could recommend that Bitcoin’s upward trajectory has ended. Nonetheless, a historic evaluation tells a unique story. Throughout earlier bull cycles, together with these in 2016-2017 and 2019-2020, comparable declines within the MVRV Z-Rating had been noticed. These drawdown durations had been adopted by important rallies, resulting in new all-time highs. Thus, whereas the present downtrend could appear regarding, it isn’t essentially indicative of the bull cycle being over.

The MVRV Momentum Indicator helps distinguish between bull and bear cycles by making use of a shifting common to the uncooked MVRV information. It just lately dipped beneath its shifting common and turned crimson, which can sign the beginning of a bear cycle. Nonetheless, historic information exhibits that comparable dips have occurred with out resulting in a protracted bear market.

Struggling Beneath Resistance?

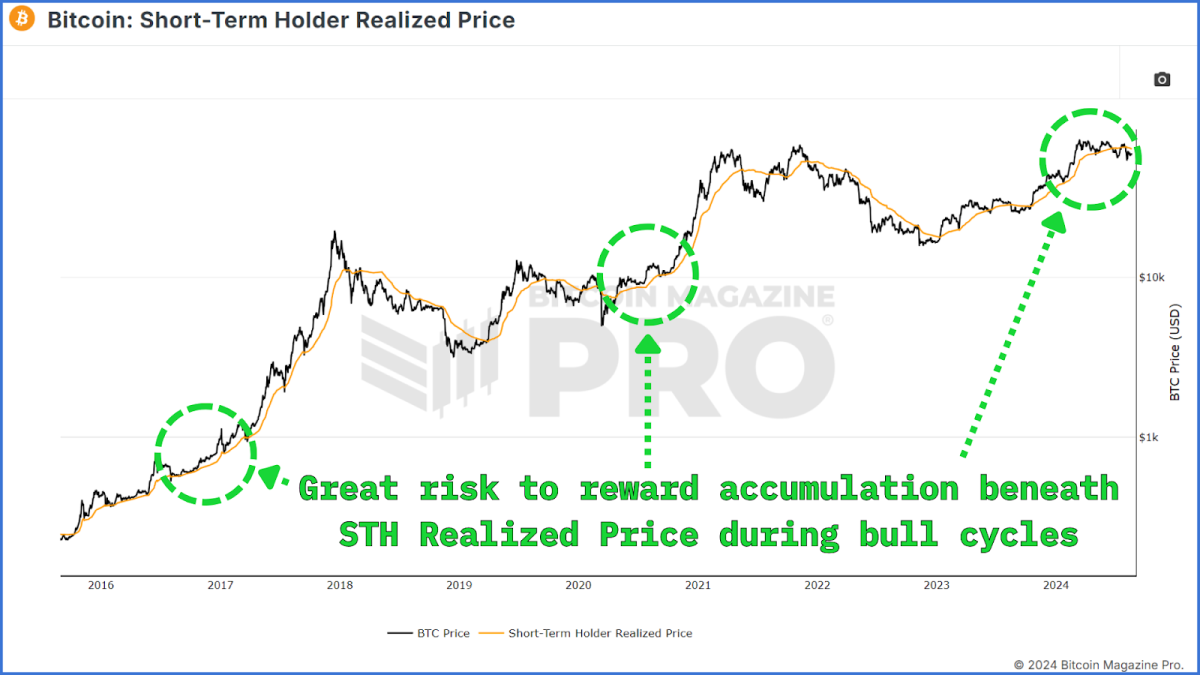

One other important metric to contemplate is the Brief-Time period Holder (STH) Realized Worth, which represents the typical worth at which current market individuals acquired their Bitcoin. Presently, the STH Realized Worth is round $63,000, barely above the present market worth. Which means many new buyers are holding Bitcoin at a loss.

Nonetheless, throughout earlier bull cycles, Bitcoin’s worth dipped beneath the STH Realized Worth a number of instances with out signaling the tip of the bull market. These dips usually offered alternatives for buyers to build up Bitcoin at discounted costs earlier than the following leg up.

Investor Capitulation?

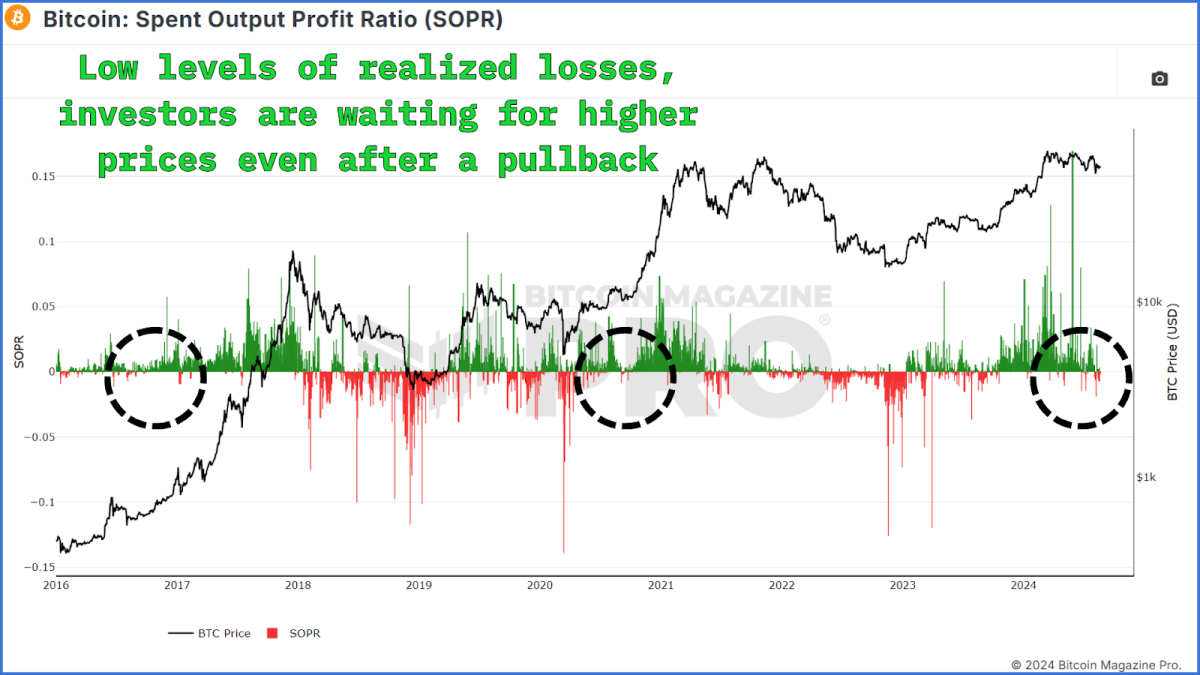

The Spent Output Revenue Ratio (SOPR) assesses whether or not Bitcoin holders are promoting at a revenue or a loss. When the SOPR is beneath 0, it means that extra holders are promoting at a loss, which may sign market capitulation. Nonetheless, current SOPR information exhibits just a few situations of promoting at a loss, which have been temporary. This means that there isn’t a widespread panic amongst Bitcoin holders, sometimes seen throughout a bear market’s early levels.

Prior to now, temporary durations of promoting at a loss throughout a bull cycle have been adopted by important worth will increase, as seen within the 2020-2021 run-up. Subsequently, the shortage of sustained losses and capitulation within the SOPR information helps the view that the bull cycle remains to be intact.

Diminishing Returns?

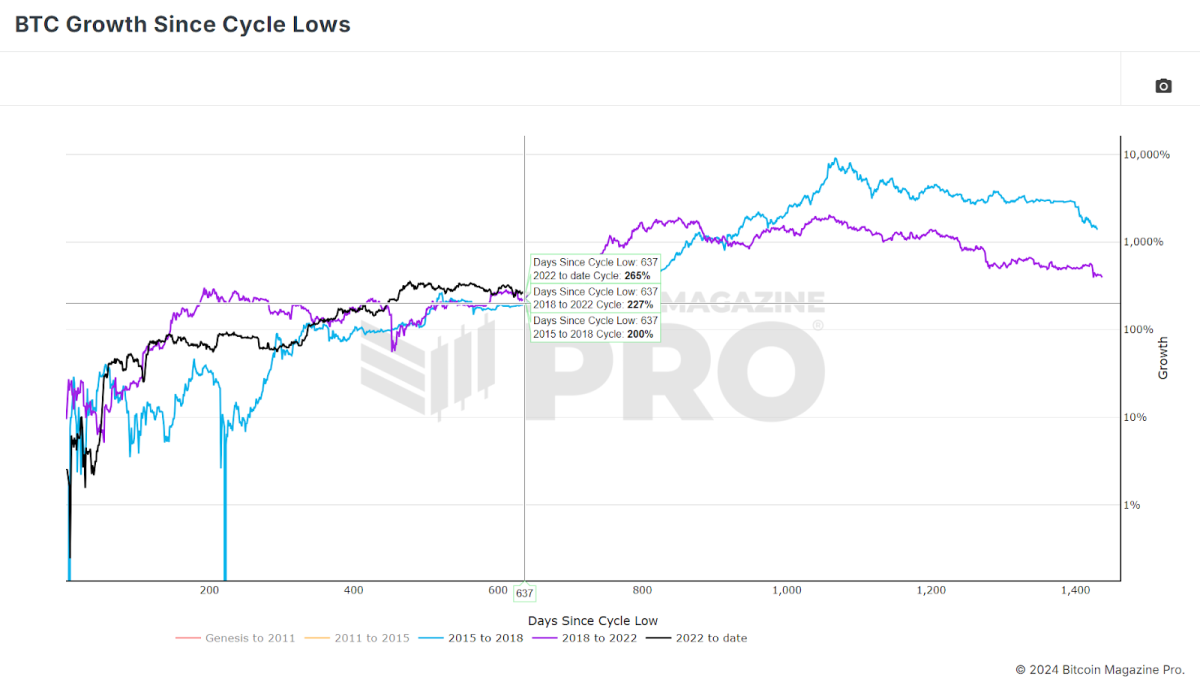

There is a principle that every Bitcoin cycle has diminishing returns, with decrease proportion positive factors than the earlier cycle. If we examine the present cycle to earlier ones, it is clear that Bitcoin has already outperformed each the 2015-2018 and 2018-2022 cycles concerning proportion positive factors. This outperformance may recommend that Bitcoin has gotten forward of itself, necessitating a cooling-off interval.

Nonetheless, it is also vital to keep in mind that this cooling-off interval does not imply the tip of the bull market. Traditionally, Bitcoin has skilled comparable pauses earlier than resuming its upward trajectory. Thus, whereas we’d see extra sideways and even downward worth motion within the brief time period, this does not essentially point out that the bull market is over.

The Hash Ribbons Purchase Sign

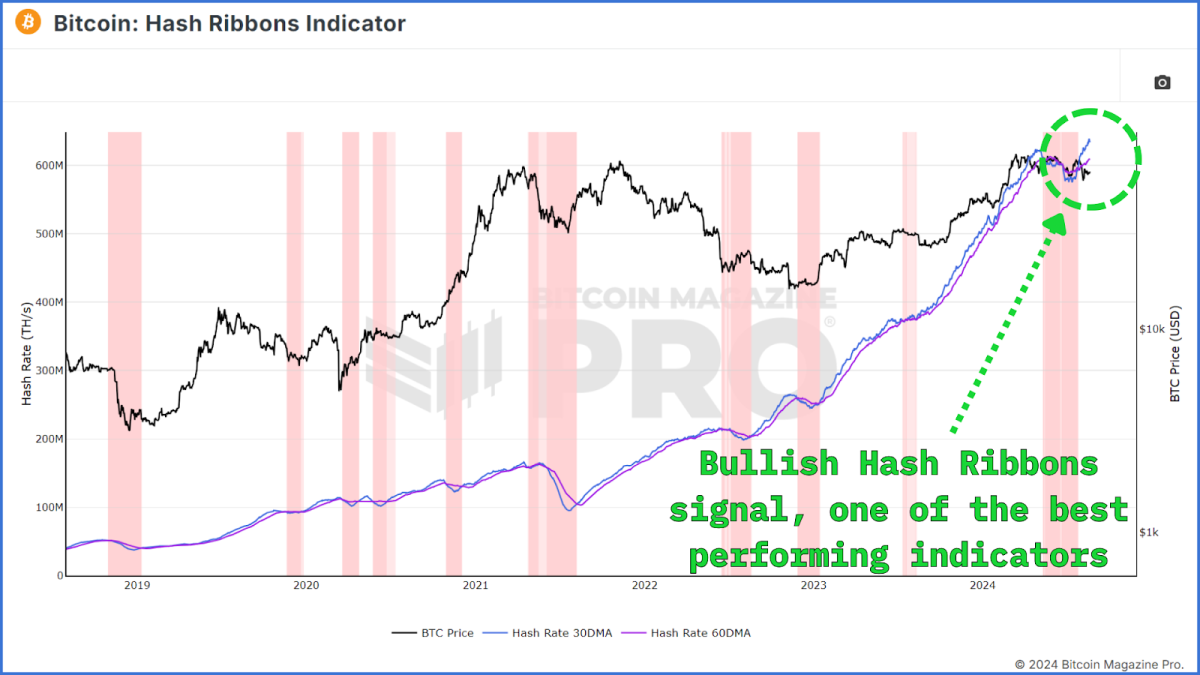

One of the vital promising indicators for Bitcoin’s future worth motion is the Hash Ribbons Purchase Sign. This sign happens when the 30-day shifting common of Bitcoin’s hash price crosses above the 60-day shifting common, indicating that miners are recovering after a interval of capitulation. The Hash Ribbons Purchase Sign has traditionally been a dependable indicator of bullish worth motion within the months that observe.

Not too long ago, Bitcoin has proven this purchase sign for the primary time because the halving occasion earlier this yr, suggesting that Bitcoin may see optimistic worth motion within the coming weeks and months.

Conclusion

In abstract, whereas there are indicators of weak point within the Bitcoin market, such because the dip within the MVRV Z-Rating and the STH Realized Worth, these metrics have proven comparable habits in earlier bull cycles with out signaling the tip of the market. The shortage of widespread capitulation, as indicated by the SOPR and the current Hash Ribbons Purchase Sign, offers additional confidence that the bull cycle remains to be intact.

For a extra in-depth look into this matter, take a look at a current YouTube video right here: