Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin dipped marginally after reaching a brand new peak above $97,000 on Could 2. It retreated to only under $94,000, a 3% to 4% decline from its current excessive. Though short-term value actions are retaining merchants nervous, longer-term on-chain knowledge is starting to exhibit indicators that will affect what occurs subsequent.

Associated Studying

Index Studying Signifies A Potential Early Bull Market

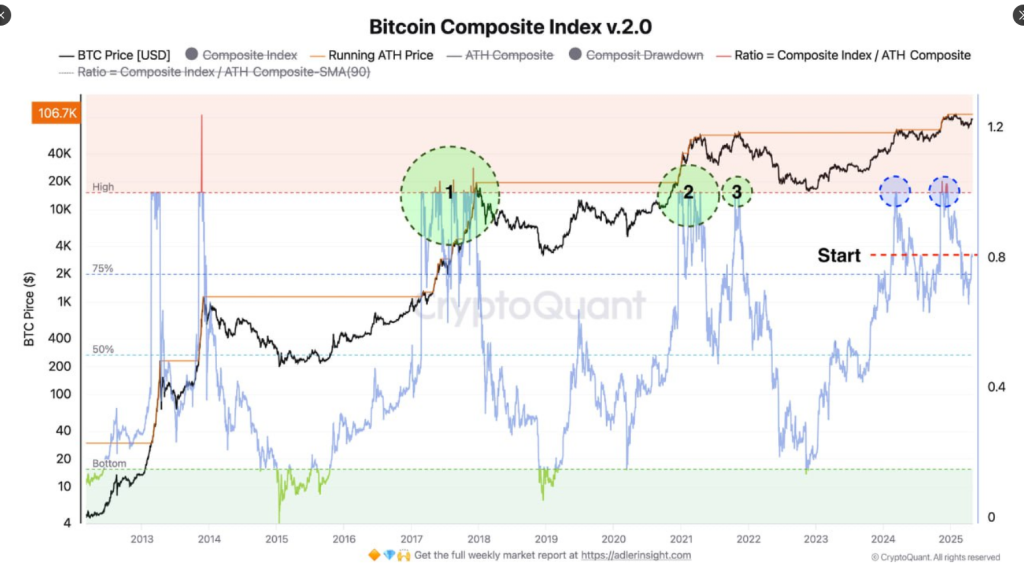

One gauge, which is known as the Bitcoin Composite Index v2.0, is now standing at a studying of 0.8. The index mixes value motion with blockchain exercise and makes an attempt to weigh the place Bitcoin could possibly be going. For analyst Constantin Kogan, a studying on this scale has beforehand appeared forward of some large value rallies, reminiscent of in 2017 and 2021.

Kogan described how if this quantity rises to 1.0 and holds, Bitcoin could start to speed up considerably sooner. The index isn’t fairly there now—nevertheless it’s not off course. One of the vital vital elements of the index, the “Working ATH Worth,” has begun trending upward too. This means that further patrons are getting into the market and religion could also be on the rise.

📈 The upward momentum in Bitcoin is simply beginning to construct, with on-chain metrics just like the Bitcoin Composite Index signaling the start of a bull market. The index has already reached 0.8 (80%). Listed below are three doable situations:

🚀 Bullish: BTC may surge to… pic.twitter.com/8bZ4vmr2CH

— Constantin Kogan (@constkogan) Could 4, 2025

Worth Goal Could Hit $175K If Momentum Continues

If Bitcoin maintains its momentum and drives the Composite Index to greater than 1.0, analysts predict the value to rise sharply. The goal vary given is between $150,000 and $175,000. That’s if bullish momentum accelerates and previous tendencies are repeated.

But when the index stays wedged between 0.8 and 1.0, Bitcoin could stall for a bit. Meaning a range-bound market, starting from $90,000 to $110,000. Kogan additionally highlighted a 3rd, much less possible route—if the index falls under 0.75. Then Bitcoin could appropriate again to $70,000 to $85,000.

Provide Information Exhibits The place Consumers Stepped In

The second a part of the puzzle is from the UTXO Realized Worth Distribution chart, additionally known as the URPD chart. Supplied by analyst Checkmate, it plots the place the holders of Bitcoin final transferred their cash. This supplies a way of who bought when—and at what value.

An enormous section of patrons seems to have entered between $93,000 and $98,000. That area is at present behaving as an important provide zone. It’s the area the place traders have simply purchased Bitcoin and should maintain on or promote primarily based on what follows.

Associated Studying

Market Awaits Clear Transfer From Present Zone

Bitcoin is squarely in the course of that vary at about $94,000. As Checkmate factors out, the following transfer will rely on whether or not value breaks out strongly or will get rejected. A robust breakout, evidenced by a strong day by day candle, may flip current provide into revenue and propel costs larger. But when the value can’t rise via this space, it may create a decrease excessive and appeal to further promoting strain.

For the second, Bitcoin sits in wait mode. Merchants and analysts are monitoring each the Composite Index and provide figures to find out whether or not the present lull turns into the following leg up—or an extra step down.

Featured picture from Gemini Imagen, chart from TradingView