Be part of Our Telegram channel to remain updated on breaking information protection

European Central Financial institution president Christine Lagarde is warning that stablecoins pose critical liquidity dangers except policymakers shut loopholes that permit international issuers skirt EU guidelines.

“We all know the risks,” she stated in ready remarks for the European Systemic Threat Board convention. “And we don’t want to attend for a disaster to forestall them.”

Lagarde highlighted issues over “multi-issuance schemes,” the place stablecoins are collectively issued by entities inside and outdoors the EU.

She stated such schemes may depart European buyers uncovered in a run, since non-EU issuers aren’t certain by the bloc’s Markets in Crypto Property (MiCA) framework, which mandates safeguards like prohibiting redemption charges.

“In a disaster, buyers would naturally desire to redeem within the jurisdiction with the strongest safeguards,” she stated. “However the reserves held within the EU might not be adequate to satisfy such concentrated demand.”

She in contrast the chance to previous banking mismanagement, emphasizing that liquidity shortfalls might be prevented with correct planning.

“The chance of liquidity mismanagement throughout jurisdictions is one we have now seen earlier than,” she stated.

Worldwide Cooperation ”Indispensable”

Lagarde stated ”worldwide cooperation is indispensable” and urged policymakers to not permit multi-issuance schemes to function within the EU except they’re “supported by strong equivalence regimes in different jurisdictions.”

Along with the attainable liquidity dangers, ECB officers have already warned that Europe’s monetary stability and autonomy may be in danger given the US Administration’s push to advertise crypto property and dollar-backed stablecoins.

Stablecoins are reshaping the way forward for cash. How will tech, information, and new values redefine finance and its dangers? The brand new difficulty of F&D journal offers in-depth evaluation.

Obtain and skim right here: https://t.co/c87mPk2WPj pic.twitter.com/rcnclCMnbT

— IMF (@IMFNews) September 3, 2025

“The measures taken by the brand new US Administration to advertise crypto-assets and US dollar-backed stablecoins elevate issues for Europe’s monetary stability and strategic autonomy,” stated Piero Cipollone, an govt board member on the ECB, in April.

“They might probably outcome not simply in additional losses of charges and information, but in addition in euro deposits being moved to america and in an additional strengthening of the position of the greenback in cross-border funds,” Cipollone added.

The ECB govt board member additionally famous that companies “are more and more open to accepting stablecoins for buyer funds,” which “may have far-reaching implications for financial sovereignty.”

Stablecoin Market Booms After GENIUS Act Signing

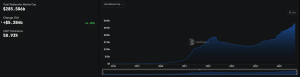

The stablecoin market has grown by over $80 billion because the begin of the yr, with the sector’s capitalization climbing from round $204 billion in January to $285 billion as of Sept. 4, in line with information from DefiLlama.

Stablecoin market overview (Supply: DefiLlama)

That’s after US President Donald Trump signed the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act into legislation on July 18. That is the primary complete US federal regulatory framework for stablecoins, bringing some readability to a beforehand unsure authorized space.

Much like the MiCA framework, the GENIUS Act additionally establishes reserve necessities for issuers within the US, and likewise requires them to have anti-money laundering (AML) and counter-terrorism insurance policies in place. It protects customers as effectively, whereas nonetheless selling innovation.

EU, US And China Kick Off Stablecoin Race

Whereas the EU tries to deal with gaps in stablecoin rules and the US progresses with establishing guidelines for issuers, China might also be exploring the launch of a yuan-backed stablecoin.

Studies final month advised that the Chinese language authorities was additionally contemplating a stablecoin backed by its renminbi foreign money due to the sluggish rollout of a digital yuan.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection