Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

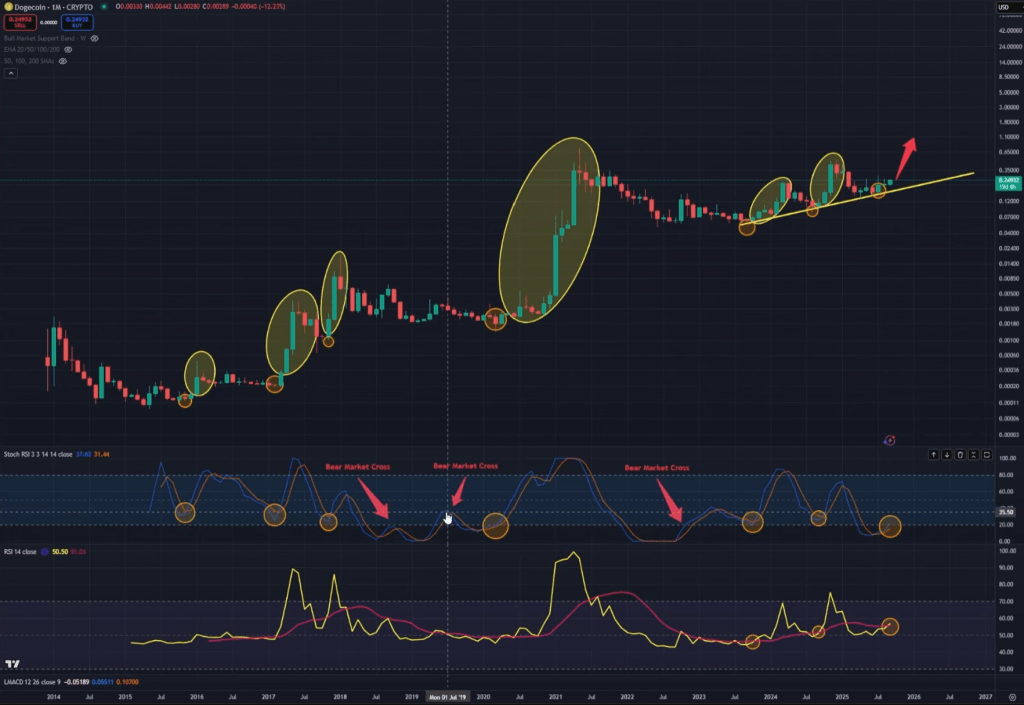

Dogecoin is approaching a well-recognized inflection on the month-to-month chart that beforehand preceded its most explosive advances, in keeping with a brand new high-timeframe evaluation from Kevin (Kev Capital TA) printed on September 11. The analyst argues {that a} recent stochastic RSI (stoch RSI) cross to the upside on the month-to-month timeframe—now forming however not but above the 20 threshold—echoes the technical regime that fueled Dogecoin’s prior cycle blow-offs.

Dogecoin Explosion Imminent?

“Again in February 2017, Dogecoin received a V-shaped inventory RSI cross above the 20 degree and it went on one other rally… 1,852%,” he mentioned, including {that a} subsequent month-to-month cross “produced a really good 1,751% acquire” earlier than the market in the end topped. The setup, he contends, is once more coalescing into This fall.

The framework is intentionally easy: pair the month-to-month stoch RSI with the month-to-month RSI and an anchored development construction. Within the 2015–2017 cycle, sustained stoch RSI crosses above 20 had been the dividing line between failed bear-market feints and true bull-cycle advances. Against this, a 2019 impulse rally pale as a result of “the inventory RSI by no means actually received a sturdy cross to the upside,” occurring amid a still-dominant bear regime, he famous. Within the 2020–2021 cycle, a brand new stoch RSI bull cross above 20 “goes on its main bull market rally, which was the most important rally Dogecoin has ever been on.”

Associated Studying

Kevin says the current cycle has adopted a cleaner sequence than prior ones. After a confirmed month-to-month stoch RSI bull cross earlier within the cycle, Dogecoin delivered an preliminary advance “roughly 280%,” then, following a corrective part, one other month-to-month cross powered a “November-December rally” of about “497%.” The market then reset once more.

As we speak, he sees that course of restarting: “We’re getting a month-to-month inventory RSI cross once more. Nevertheless, we’ve got not but crossed the 20 degree. So that is the very starting levels of a possible rally for Dogecoin.” He emphasizes that traditionally, “you don’t even get your most bullish worth motion till the inventory RSIs are above the 80 degree,” calling the present second the “first or second inning.”

Past momentum, the analyst highlights a three-part structural confluence he considers important on the month-to-month chart. First, the RSI itself has repeatedly crossed again above its transferring common at inflection factors; second, every of these RSI/MA recaptures “has coincided with a inventory RSI cross to the upside”; third, worth has defended a long-running development line on a sequence of upper lows.

Associated Studying

After a quick deviation under, “we’re now breaking again above the development line and the [RSI] MA on the identical time after holding the 50 degree,” which he describes as a textbook double-bottom response. He stresses that month-to-month closes nonetheless matter—“we nonetheless have… greater than half a month to go… this isn’t assured”—however the multi-indicator alignment is undamaged. In his phrases, “we’re speaking a few mixture of indicators and technicals which have by no means failed earlier than,” supplied the macro backdrop doesn’t flip opposed.

Macro Circumstances Want To Align

Macro is the caveat and, doubtlessly, the accelerator. Kevin frames US financial coverage because the decisive driver of the crypto threat cycle: “Financial coverage… that’s the earnings report for the crypto market.” He argues that inflation has been range-bound on a year-long view whereas labor knowledge “continues to melt,” a combination he believes anchors expectations for price cuts “this month… and… in November and December.”

If that path holds and the Federal Reserve’s tone is dovish on the upcoming FOMC, he expects Bitcoin dominance to float decrease and for “alt season” dynamics to reassert, with Dogecoin positioned to “outperform over Bitcoin.” Conversely, a hawkish flip or a renewed inflation drift greater could be a “main hiccup” for the setup.

Seasonality and timing additionally determine in his threat administration steering. September stays “seasonally weak,” and with the FOMC roughly every week away from his recording date, he anticipates choppier, indecisive worth motion within the close to time period whereas markets “sit again and watch for the tone of Powell.”

The upper-timeframe roadmap, nevertheless, stays his anchor: month-to-month uptrend construction, RSI reclaim over its MA, stoch RSI in early-stage flip, and the historic tendency for main Dogecoin expansions to ignite solely after these momentum gauges push effectively into overdrive. “These charts are telling us proper in our faces that Dogecoin is making ready for a much bigger transfer greater… the pathway is laid,” he mentioned.

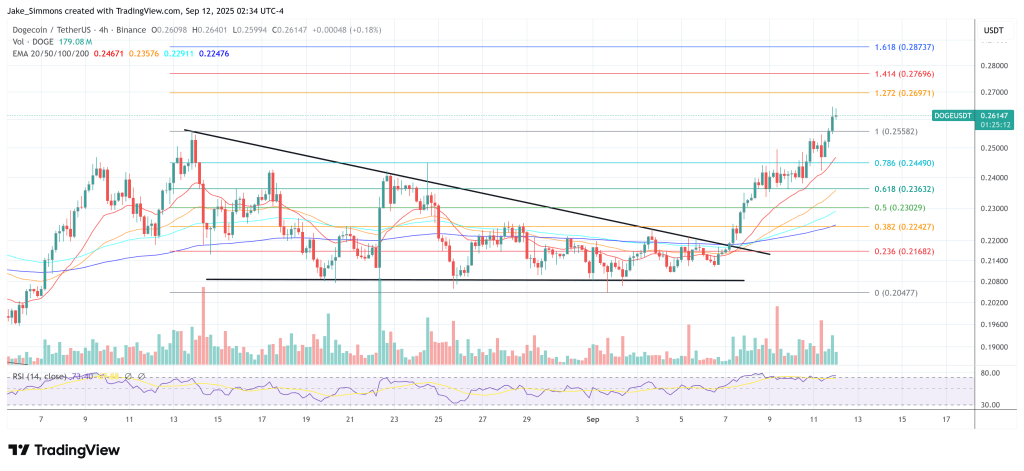

At press time, DOGE traded at $0.261.

Featured picture created with DALL.E, chart from TradingView.com