By Elad Lavi, Government Vice President Company Improvement & Technique

For too lengthy retail traders have been dismissed as unsophisticated, emotional, or just silly and impulsive. We had hoped this outdated narrative had reached a peak with the meme inventory frenzy of 2021, but myths take time to bust. So we’ve been busy crunching the info to assist paint an image of what the retail investor was doing in 2024 and what meaning for the retail investing panorama going ahead.

Why does the retail investor matter?

Know-how is driving innovation and opening up entry to capital markets. As the worldwide capital markets proceed to broaden and evolve, retail traders are not passive bystanders. They account for a rising proportion of every day buying and selling volumes which implies that their shopping for choices matter.

On a worldwide foundation, retail traders accounted for 52% of worldwide belongings beneath administration in 2021, which is predicted to develop to over 61% by 2030. They’re beginning to make investments at a youthful age. On common, Gen Z started investing at age 19, in comparison with age 32 for Gen X and age 35 for Child Boomers. An important wealth switch can be unfolding. Based on UBS International Wealth Report 2024, an estimated $83.5 trillion in belongings are anticipated to be transferred to youthful generations inside the subsequent 20 to 25 years.

We all know People make investments, however what about elsewhere?

We imagine the development of accelerating retail participation extends to non-U.S. markets the place there has traditionally been much less retail participation. The latest Federal Reserve Survey of Client Funds states that 58% of U.S. households had some kind of publicity to the inventory market in 2022, the best stage ever recorded. Comparatively, the E.U. had 7% publicity in 2023, as reported by Oliver Wyman, and the U.Ok. had 20% publicity, as reported by a survey performed by the Division of Work and Pension.

But, Oliver Wyman forecasts that Europe will add 22 million new brokerage accounts by 2028 which suggests penetration within the grownup inhabitants will enhance by 72% from 6.8% in 2023 to 11.7% in 2028.

However retail traders lose cash…

Know-how has levelled the taking part in subject and in the present day’s retail investor have entry to the instruments and information they should succeed. Exercise on the eToro platform exhibits that customers usually are not simply studying about investing, they’re making use of that information to efficiently meet their long run monetary objectives.

We analyzed the info for eToro customers in 2024. The outcomes present that 74% of eToro customers had been worthwhile, rising to 80% for eToro Membership members. However what does a 12 months present? Rather a lot, however let’s add 2023 into the combination too. We additionally probed the info for eToro customers in 2023 and 79% of customers and 85% of Membership members had been worthwhile, .

So what are retail traders shopping for?

The listing of most generally held shares on the eToro platform was majorly disrupted in 2024. Nvidia jumped from seventh to first place, taking Tesla’s crown and bumping them to second place. There was additionally a brand new entry to the highest ten as chipmaker Superior Micro Gadgets rose from sixteenth to tenth place.

eToro customers are additionally more and more on the lookout for international publicity inside their portfolios. The highest ten most held shares exterior of the US embrace main names like ASML Holding, LVMH, and Rolls-Royce, spanning industries from semiconductors and luxurious items to aerospace. The recognition of ASML and ASM Worldwide displays retail traders perception in AI and their understanding of the significance of semiconductors to the worth chain.

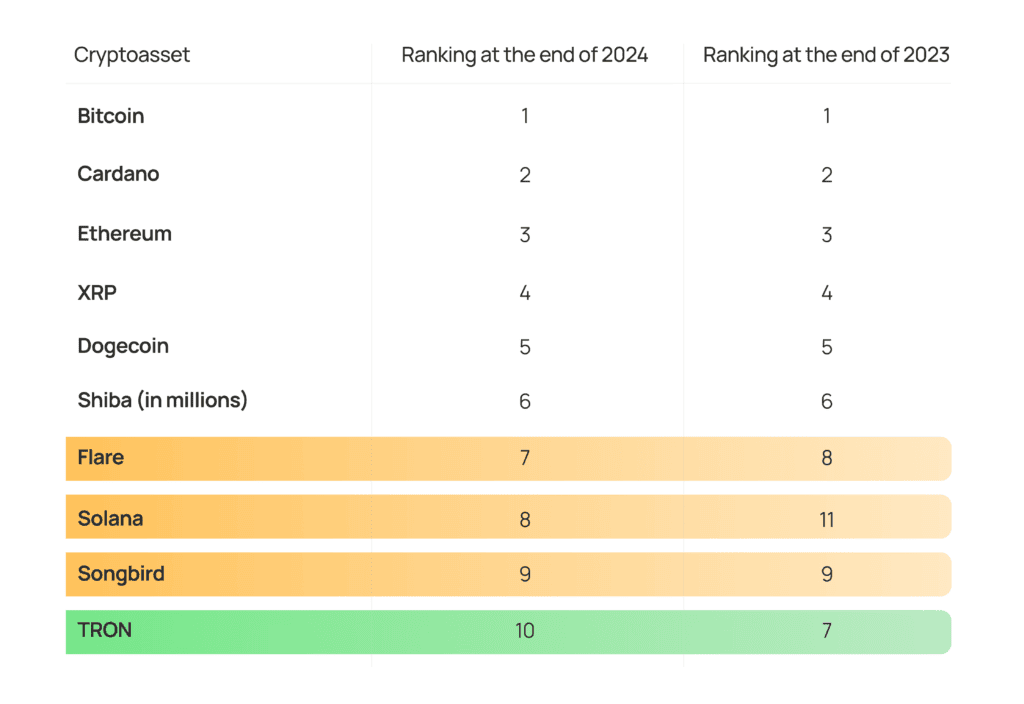

Whereas we noticed many altcoins rise in reputation in 2024, there was little change when it comes to our high ten most held cryptoassets on eToro because of the purchase and maintain mentality of our customers. Our customers are HODLERs and we see cryptoasset holdings stay comparatively steady even during times of crypto winter.

Trying forward

The rise of the retail investor is difficult outdated fashions of market behaviour. Markets now mirror not simply fundamentals, but additionally collective perception. Retail traders play an more and more massive half in that perception system. Understanding the behaviour of retail traders is now very important to understanding how markets transfer.

The concept of ‘dumb’ retail cash: a lone, newbie investor making in poor health knowledgeable choices is outdated. The retail investor of 2025 is knowledgeable and linked. They characterize the way forward for capital markets: a extra inclusive, extra engaged and extremely interactive ecosystem.

Disclaimers:

eToro is a multi-asset funding platform. The worth of your investments might go up or down. Your capital is in danger.

eToro is authorised and controlled by the Monetary Conduct Authority within the UK, in Cyprus by the Cyprus Securities and Trade Fee, by the Australian Securities and Investments Fee in Australia and licensed by the Monetary Providers Authority within the Seychelles.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.