The Each day Breakdown takes a better have a look at the Magnificent 7 to gauge which shares have been leaders and which of them have been laggards.

Earlier than we dive in, let’s be sure to’re set to obtain The Each day Breakdown every morning. To maintain getting our day by day insights, all it is advisable to do is log in to your eToro account.

Tuesday’s TLDR

Magazine 7 has been blended this 12 months

BTC tries to guide crypto push

GM falls as tariffs hit earnings

What’s Taking place?

Monday’s cup of espresso hadn’t kicked in but once I wrote in yesterday’s observe that Tesla and Alphabet report earnings on Tuesday afternoon — they each report on Wednesday afternoon.

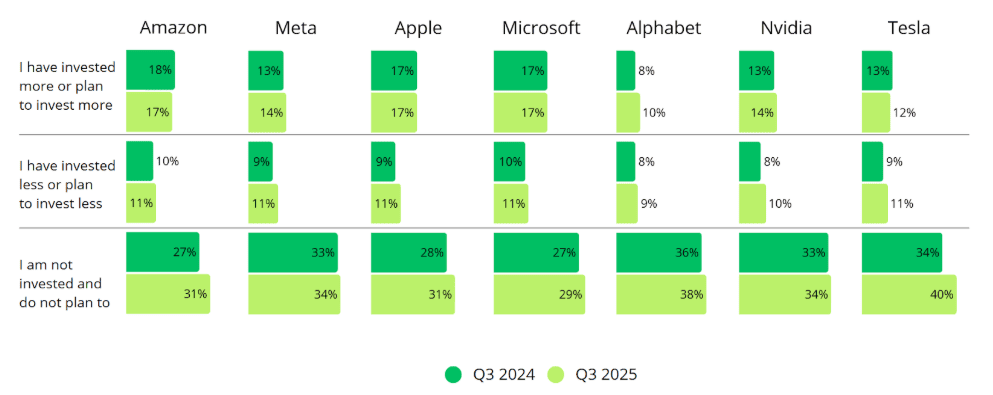

We’re somewhat over midway by means of the 12 months, and the Magnificent 7 has been blended. On the one hand, a number of parts have executed nice. Meta, Microsoft, and Nvidia all hit report highs in Q2 and are every up no less than 20% or extra to this point this 12 months.

Then there are the laggards, as shares like Apple and Tesla are down 15.2% and 18.7% to this point this 12 months, respectively.

The shares that don’t slot in both class — Alphabet and Amazon — are doing higher now, with GOOGL up about 0.5% in 2025 and Amazon up 4.5%. Nonetheless, that’s solely after each shares rallied greater than 25% over the past three months.

The Backside Line: I simply bombarded you with a variety of efficiency numbers, however it’s to emphasise that whereas these shares are all lumped into one group, they’re not all created equal. They ebb and stream when it comes to which of them are in demand and which of them aren’t. We’ll see if that adjustments with earnings season, with Alphabet and Tesla due up this week and 4 of the remaining 5 reporting subsequent week.

Wish to obtain these insights straight to your inbox?

Enroll right here

The Setup — Lockheed Martin

Shares of Lockheed Martin are tumbling this morning, down about 7% in pre-market buying and selling after the agency reported disappointing quarterly outcomes. Lockheed’s Q2 earnings outcomes badly missed analysts’ expectations after the corporate took an sudden pre-tax loss.

The inventory — which was already down about 25% from its report excessive in October — isn’t reacting effectively to the information. However will patrons present up within the low $400s?

As of yesterday’s shut, LMT commanded a market cap of ~$108 billion and paid a dividend yield of virtually 3%. At as we speak’s open, the previous shall be smaller and the latter will enhance. Both approach, bulls shall be questioning whether or not help comes into mess around $420, simply because it has for the reason that starting of 2024.

If it does, bulls have a stable help space to measure their threat in opposition to, as they hope for a state of affairs the place the worst is now within the rearview mirror and a bigger rebound takes maintain in LMT.

Nonetheless, purchaser beware: Some of these dips are sometimes called “making an attempt to catch a falling knife” — a saying not made for simple buying and selling conditions. Needless to say if help doesn’t materialize on this space, extra promoting stress may ensue

What Wall Road Is Watching

GM

Common Motors inventory is dipping this morning regardless of adjusted earnings per share of $2.53 beating analysts’ expectations of $2.33 a share. Nonetheless, $1.1 billion in tariffs weighed on the corporate’s outcomes, whereas earnings slipped from $3.03 a 12 months in the past. Take a look at GM’s fundamentals.

BTC

Bitcoin has sat out of the current crypto rally over the previous few days, however to this point, it’s up properly on Tuesday morning whereas many different cryptoassets take a breather. Presently sitting simply above $119K, bulls are questioning if BTC can clear $120K and problem the report excessive simply above $123K. View the charts for Bitcoin.

Disclaimer:

Please observe that as a consequence of market volatility, among the costs might have already been reached and eventualities performed out.