Steakhouse, a decentralized autonomous group (DAO)-focused monetary advisory agency, in collaboration with Phoenix Labs, a analysis and growth firm, has put forth a proposal urging the MakerDAO neighborhood to think about allocating as much as $100 million from its reserves for funding in tokenized US Treasury Invoice (T-Invoice) merchandise.

The proposal, presently within the dialogue section, goals to discover new avenues for monetary innovation inside the decentralized finance (DeFi) ecosystem.

Unlocking Liquidity Effectivity for MakerDAO?

MakerDAO, famend because the issuer of the DAI decentralized stablecoin, has already made vital investments in US Treasuries via off-chain constructions since 2022, amounting to over a billion {dollars}.

By venturing into tokenized T-Payments, MakerDAO seeks to bolster its steadiness sheet by gaining publicity to low-risk, liquid conventional belongings. This transfer aligns with their long-term technique of strengthening the steadiness and sustainability of the protocol.

Tokenized T-Payments supply a number of potential advantages to MakerDAO and its neighborhood. Firstly, they supply increased transparency than off-chain constructions, simplifying the auditing course of and decreasing the necessity for inside assets.

With tokenized T-Payments, every day attestations will be streamlined, offering real-time visibility on funding efficiency.

Moreover, tokenized merchandise allow less complicated accounting procedures by leveraging every day value feeds, eliminating handbook revenue returns related to off-chain investments.

Moreover, tokenized T-Payments supply the potential for elevated automation. Asset-liability administration, a handbook and gradual course of for MakerDAO, will be automated via tokenized merchandise.

This automation would enhance effectivity and scale back operational overhead, enabling MakerDAO to give attention to different strategic initiatives.

By way of liquidity, tokenized T-Payments current benefits over conventional off-chain investments. Redeeming stablecoins via on-chain tokenized merchandise will be quicker than promoting off-chain and changing them again into stablecoins. This may present MakerDAO with larger flexibility and responsiveness to market dynamics.

Maximizing Returns?

Regardless of the potential advantages, the adoption of tokenized T-Payments introduces sure concerns. One such consideration is the publicity to increased counterparty danger. Nevertheless, a aggressive market is anticipated to favor the safer choices, mitigating this danger to a sure extent.

Tokenized T-Payments additionally supply numerous liquidity and yield profiles, offering alternatives for MakerDAO to diversify its funding technique.

Merchandise vary from tremendous liquid non-volatile choices, which act extra like lending protocols with collateralized T-Payments, to frictionless merchandise that provide higher charges however require longer subscription and redemption processes.

In keeping with the announcement, these choices permit MakerDAO to leverage totally different trade-offs with out reinventing the wheel and cater to various wants inside the DeFi ecosystem.

Steakhouse, Phoenix Labs, and BlockAnalitica will contribute their experience in authorized, monetary, technical, and danger evaluation domains to maneuver ahead with the proposal.

Total, the proposed allocation of as much as $100 million for creating and experimenting with tokenized T-Invoice merchandise displays MakerDAO’s dedication to steady innovation and exploring new prospects inside the DeFi panorama.

Because the discussions progress, the neighborhood’s collective knowledge and insights will form the long run roadmap of MakerDAO’s funding technique and contribute to the evolution of decentralized finance.

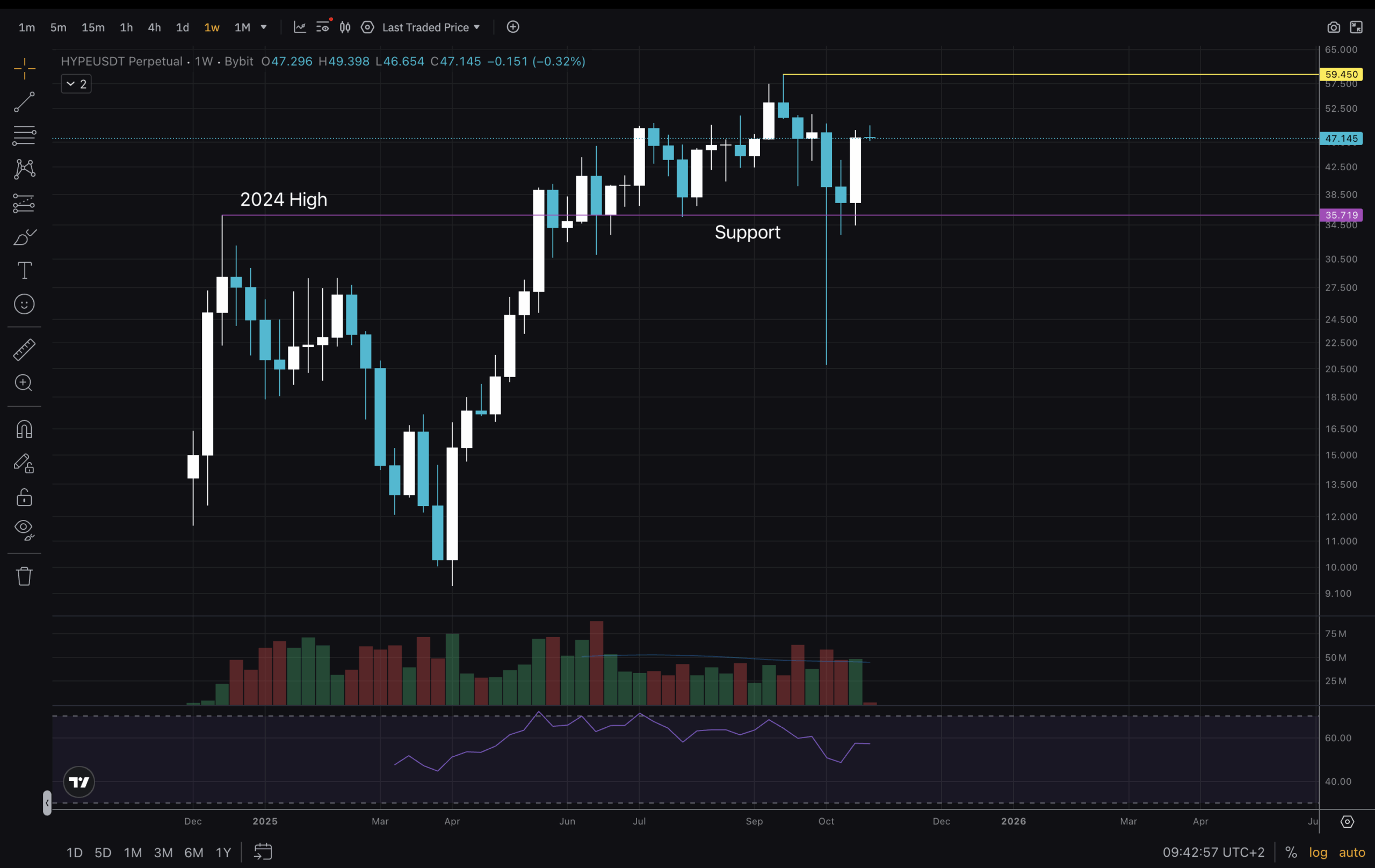

As of the time of writing, the native token of MakerDAO, MKR, is presently buying and selling at $1,113, reflecting a lower of 0.7% over the previous 24 hours.

Nevertheless, over the previous seven and fourteen days, the token has demonstrated substantial efficiency, surpassing most cryptocurrency markets with positive factors of two.5% and over 12%, respectively.

Featured picture from iStock, chart from TradingView.com