MARA Holdings loans 7,377 BTC to 3rd events in a daring yield technique geared toward offsetting operational prices. Study concerning the dangers and implications for the crypto mining sector.

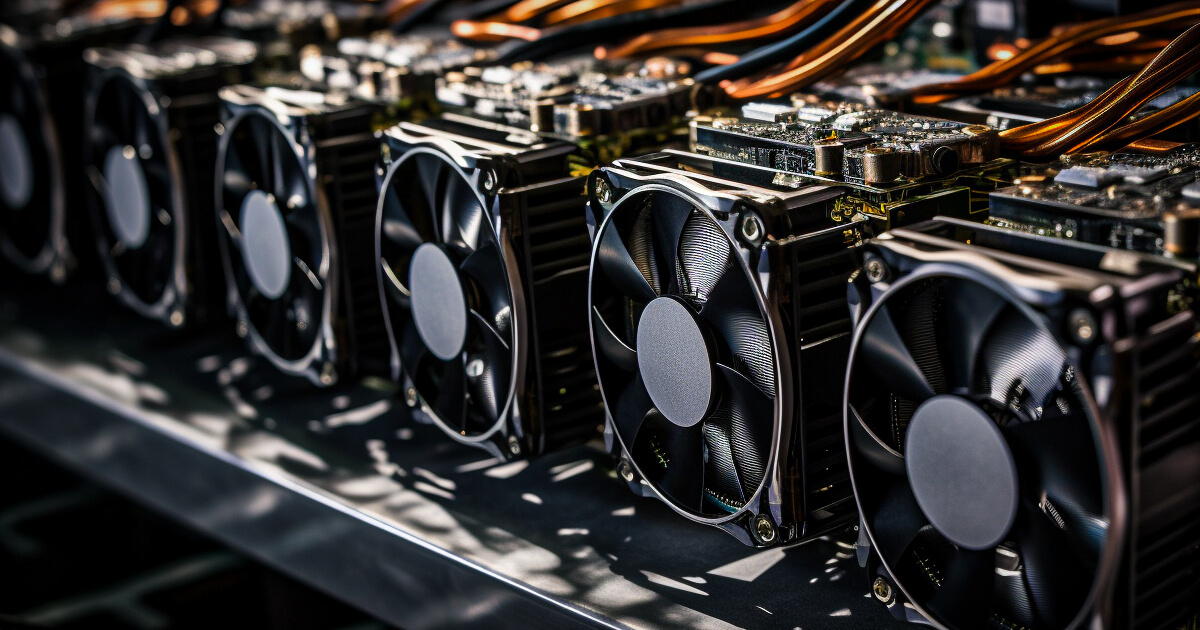

MARA Holdings Bitcoin Lending Technique and Key Updates

MARA Holdings (Nasdaq: MARA), a number one bitcoin mining firm, not too long ago revealed it has loaned 7,377 BTC to 3rd events, valued at over $722 million at present trade charges. This transfer goals to generate a modest single-digit yield as a part of a broader technique to offset working bills. The disclosure was a part of the corporate’s newest operations and manufacturing replace, which additionally famous a 15% improve in its hashrate to 53.2 EH/s and an increase in bitcoin reserves to 44,893 BTC.

Robert Samuels, MARA’s vice chairman of investor relations, clarified the initiative on X, previously Twitter, stating the lending program focuses on short-term preparations with established third events. Samuels emphasised the technique’s long-term aim of producing sustainable yields to help operational prices.

Business Issues Over Bitcoin Lending Dangers

Whereas this system highlights MARA‘s progressive monetary method, it has sparked concern amongst trade watchers. Recollections of mining firm bankruptcies in 2022, attributed to lending fraud and monetary mismanagement, linger within the crypto group. Critics have questioned the dangers concerned, significantly relating to the counterparty choice and publicity length.

One commenter on Samuels’ X publish expressed unease, urging better transparency concerning the counterparties and the phrases of the agreements.

This makes me nervous, having been caught up within the bankruptcies of 2022 because of lending fraud, they remarked.

Others urged that the 7,377 BTC must be excluded from MARA’s HODL (Maintain On for Pricey Life) stack to mitigate threat.

Balancing Innovation with Danger Administration

MARA Holdings’ technique underscores a rising pattern amongst bitcoin miners to diversify income streams amid fluctuating market circumstances. By leveraging its vital BTC reserves, the corporate seeks to reinforce monetary stability. Nevertheless, the transfer additionally underscores the fragile stability between innovation and the potential dangers inherent within the unstable cryptocurrency panorama.

The follow of lending bitcoin, significantly at a time when regulatory scrutiny and market instability persist, brings each alternatives and challenges. MARA’s emphasis on short-term lending agreements with respected third events seeks to mitigate these dangers, however questions stay about this system’s long-term viability.

What This Means for the Business

MARA Holdings’ method may set a precedent for different mining companies exploring yield-generation methods. If profitable, it would encourage related initiatives, selling new monetary fashions within the sector. Conversely, any misstep may reignite fears of instability, significantly because the crypto trade continues to get well from previous setbacks.

Keep knowledgeable concerning the newest developments in cryptocurrency and bitcoin mining methods. Observe our updates for in-depth evaluation and trade insights.