Maximizing Bitcoin Positive aspects with ETF Knowledge

Because the introduction of Bitcoin Trade Traded Funds (ETFs) in early 2024, Bitcoin has reached new all-time highs, with a number of months of double-digit positive aspects. Nonetheless, as spectacular as this efficiency is, there is a option to considerably outperform Bitcoin’s returns by using ETF knowledge to information your buying and selling selections.

Bitcoin ETFs and Their Affect

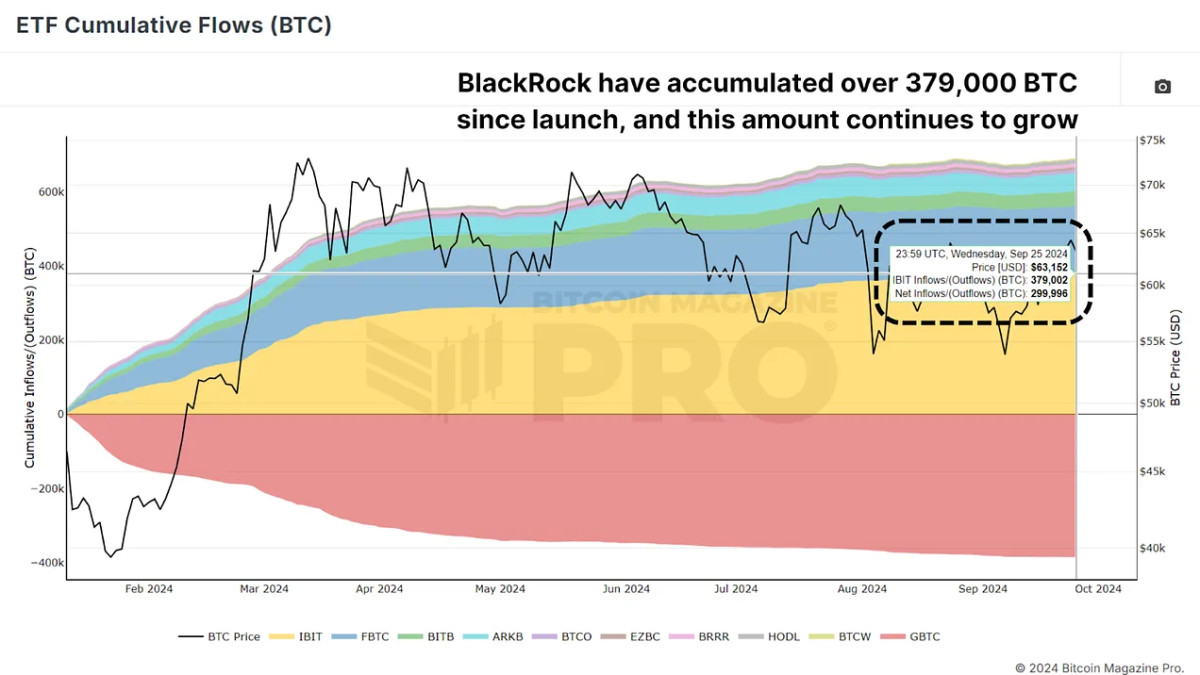

Bitcoin ETFs, launched in January 2024, have shortly amassed massive quantities of Bitcoin. These ETFs, tracked by varied funds, enable institutional and retail buyers to realize publicity to Bitcoin with out instantly proudly owning it. These ETFs have accrued billions of USD price of BTC, and monitoring this cumulative circulate is crucial for monitoring institutional exercise in Bitcoin markets, serving to us gauge whether or not institutional gamers are shopping for or promoting.

ETF every day inflows denominated in BTC point out that large-scale buyers are accumulating Bitcoin, whereas every day outflows recommend they’re exiting positions throughout that buying and selling interval. For these seeking to outperform Bitcoin’s already sturdy 2024 efficiency, this ETF knowledge provides a strategic entry and exit level for Bitcoin trades.

A Easy Technique Primarily based on ETF Knowledge

The technique is comparatively simple: purchase Bitcoin when ETF inflows are constructive (inexperienced bars) and promote when outflows happen (pink bars). Surprisingly, this technique permits you to outperform even throughout Bitcoin’s bullish durations.

This technique, whereas easy, has constantly outperformed the broader Bitcoin market by capturing worth momentum on the proper moments and avoiding potential downturns by following institutional tendencies.

The Energy of Compounding

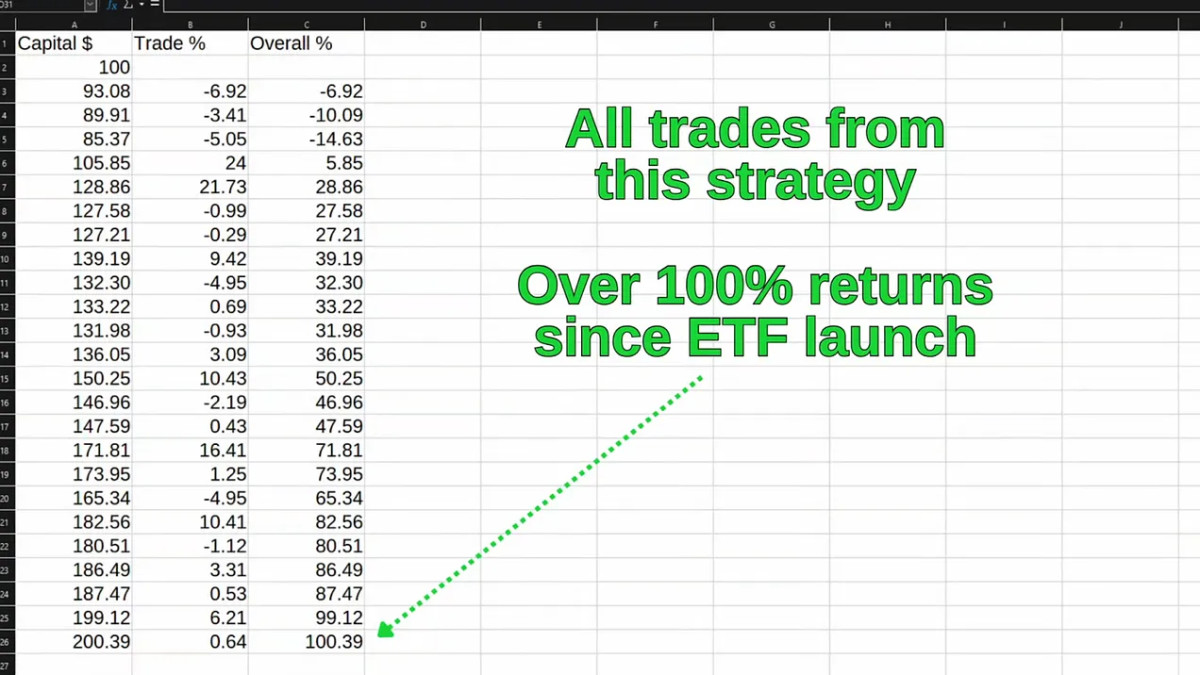

The actual secret to this technique lies in compounding. Compounding positive aspects over time considerably boosts your returns, even in periods of consolidation or minor volatility. Think about beginning with $100 in capital. In case your first commerce yields a ten% return, you now have $110. On the subsequent commerce, one other 10% acquire on $110 brings your whole to $121. Compounding these positive aspects over time, even modest wins, accumulate into important income. Losses are inevitable, however compounding wins far outweigh the occasional dip.

Because the launch of the Bitcoin ETFs, this technique has offered over 100% returns throughout a interval by which simply holding BTC has returned roughly 37%, and even in comparison with shopping for Bitcoin on the ETF launch day and promoting on the actual all-time excessive, which might have returned roughly 59%.

Can Additional Upside Be Anticipated?

Just lately, we’ve begun to see a sustained development of constructive ETF inflows, suggesting that establishments are as soon as once more closely accumulating Bitcoin. Since September nineteenth, day by day has seen constructive inflows, which, as we are able to see, have usually preceded worth rallies. BlackRock and their IBIT ETF alone have accrued over 379,000 BTC since inception.

Conclusion

Market circumstances can change, and there’ll inevitably be durations of volatility. Nonetheless, the constant historic correlation between ETF inflows and Bitcoin worth will increase makes this a useful instrument for these seeking to maximize their Bitcoin positive aspects. When you’re searching for a low-effort, set-it-and-forget-it strategy, buy-and-hold should still be appropriate. Nonetheless, if you wish to attempt to actively improve your returns by leveraging institutional knowledge, monitoring Bitcoin ETF inflows and outflows could possibly be a game-changer.

For a extra in-depth look into this subject, try a current YouTube video right here: Utilizing ETF Knowledge to Outperform Bitcoin [Must Watch]