Technique’s co-founder, Michael Saylor, has once more displayed his firm’s Bitcoin portfolio tracker, highlighting the present worth of its BTC holdings. This comes amid plans to lift as much as $2.5 billion by way of a inventory providing for extra BTC purchases.

Michael Saylor Showcases Technique’s Bitcoin Holdings

In an X submit, Michael Saylor shared a picture of the corporate’s Bitcoin portfolio tracker, which confirmed that its 607,770 BTC holdings have been at the moment value round $71.8 billion. Saylor captioned the submit, saying, “All of it started with 1 / 4 billion in bitcoin.” This refers back to the quantity the corporate initially invested to provoke this Bitcoin Technique.

Michael Saylor’s Technique started shopping for Bitcoin in August 2020, once they first purchased 21,454 BTC value $250 million. Since then, the corporate has continued to make large purchases, bringing its complete holdings to 607,770 BTC, which it acquired for a complete of $43.61 billion at a median value of $71,756 per BTC. Its newest buy got here between July 14 and 20, when it purchased 6,220 BTC.

Because of the Bitcoin value appreciation since Technique started shopping for BTC, the corporate now boasts an unrealized acquire of round $30 billion on its holdings. It’s also value noting that Michael Saylor’s firm is the biggest BTC treasury firm. The corporate is properly forward of the opposite BTC treasury firms, with second-place MARA Holdings holding 50,000 BTC.

In the meantime, Michael Saylor’s submit once more hints that the corporate doubtless made one other buy within the week ending July 27. A BTC buy announcement has most occasions adopted his posts on the portfolio tracker. As such, there may be the chance that the corporate will announce one other Bitcoin buy right now, which it made between July 21 and 27.

Technique To Increase $2.5 Billion To Purchase Extra BTC

Michael Saylor’s Technique has additionally introduced plans to lift as much as $2.5 billion for extra Bitcoin purchases. In a press launch, the corporate revealed that it has upsized its STRC IPO from $500 million to $2.5 billion. The corporate plans to supply 28,011,111 shares of Variable Charge Sequence A Perpetual Stretch Most well-liked Inventory at a public providing value of $90 per share.

Technique plans to concern and promote these STRC shares by July 29. As such, it’s unlikely that the most recent BTC buy was made with proceeds from the providing. The corporate estimates that the web proceeds from the providing can be round $2.474 billion. It additionally confirmed that the web proceeds can be used for the acquisition of BTC. It’s value noting that Michael Saylor and his firm have bought primarily MSTR shares to fund their final two Bitcoin purchases.

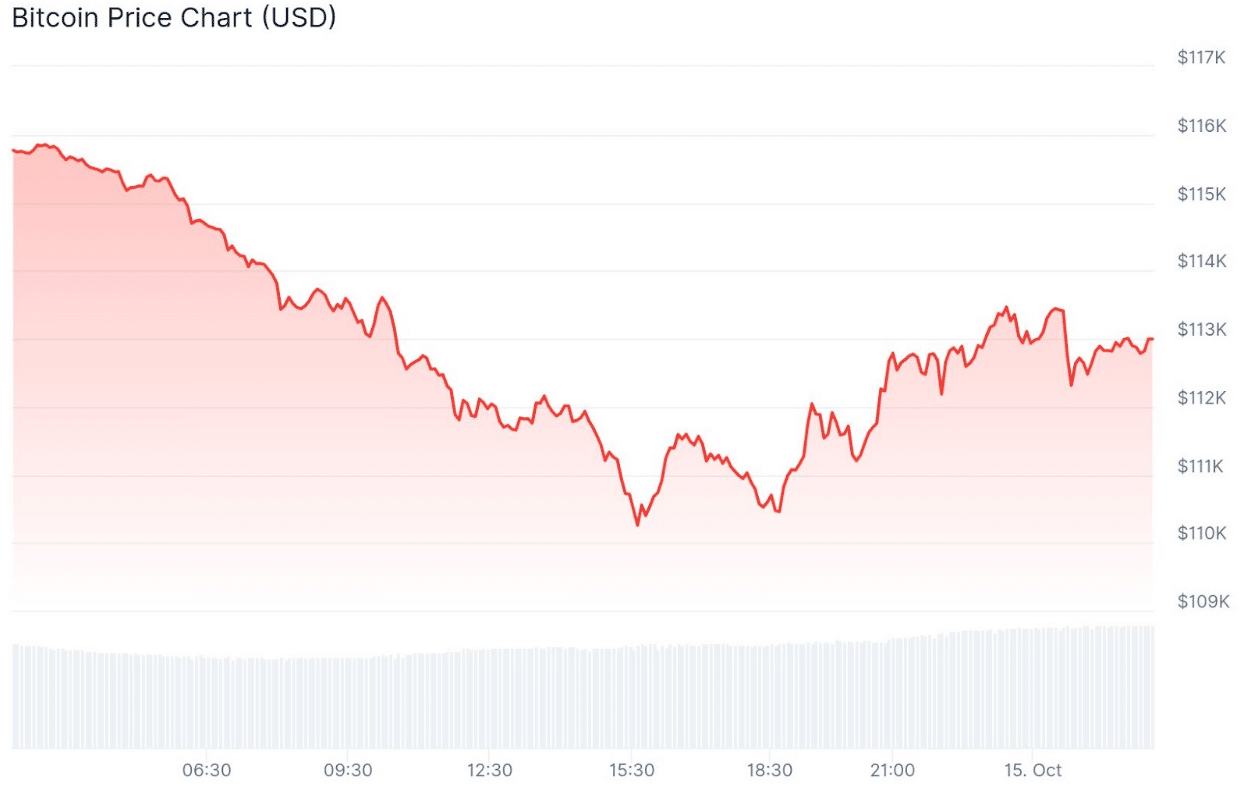

On the time of writing, the Bitcoin value is buying and selling at round $119,500, up within the final 24 hours, based on information from CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.