Coinbase CEO Brian Armstrong believes US crypto laws lastly has a shot at passing. After a number of days of assembly with lawmakers in Washington, Armstrong mentioned the Digital Asset Market Readability Act has “a great probability of getting finished.”

In recent times, Coinbase is the place BlackRock shops its BTC whereas different US exchanges like Gemini or Kraken are a literal who.

The invoice seeks to make clear how digital property are regulated, splitting oversight between the SEC, CFTC, and different businesses. It focuses significantly on non-stablecoins like tokenized equities.

“That is how we make sure the crypto business might be constructed right here in America, driving innovation and defending shoppers, and ensuring we by no means have one other Gary Gensler making an attempt to take your rights.” – Brian Armstrong, Coinbase CEO

Coinbase And Stand With Crypto: Is Regulation About to Ship Bitcoin to $150k?

(Supply: TradingView)Armstrong additionally urged retail traders to affix the Stand With Crypto initiative, a grassroots platform that alerts customers when to contact representatives. He framed it as a community-driven push, not only a company effort.

ICYMI: SWC Neighborhood Director @512mace lately spoke with @PunchbowlNews on the true weight of the crypto voter. pic.twitter.com/iTDu7FrtAh

— Stand With Crypto (@standwithcrypto) September 8, 2025

He mentioned energetic participation would sign to lawmakers that constituents, not simply firms, desire a clear regulatory framework. Amen to that! Armstrong argued that this can be a pivotal second for the crypto business that would stop one other wave of “hostile enforcement” or unregulated rip-off chains like Terra Luna.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Banking Foyer Pushback Over Stablecoin Yields: Ought to You Be Apprehensive?

One of many sharpest battles might contain stablecoins. Armstrong claimed that US banking teams tried to insert language into the GENIUS Act earlier this yr that will have banned yield-bearing stablecoins outright. That try failed, however banking lobbies are nonetheless urgent lawmakers to curb interest-based stablecoin merchandise.

Crypto wasn’t simply on Coinbase’s agenda. Lawmakers additionally met with 18 Bitcoin executives, together with Michael Saylor of Technique (previously MicroStrategy), to debate the BITCOIN Act sponsored by Sen. Cynthia Lummis.

The proposal envisions the US buying a million Bitcoin over 5 years utilizing “budget-neutral methods” like revaluing Treasury gold certificates and reallocating tariff revenues.

“This has a great probability of getting finished… it’s a freight practice leaving the station.” – Brian Armstrong

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Bullish Market Knowledge And Why Regulation Might Be the Spark

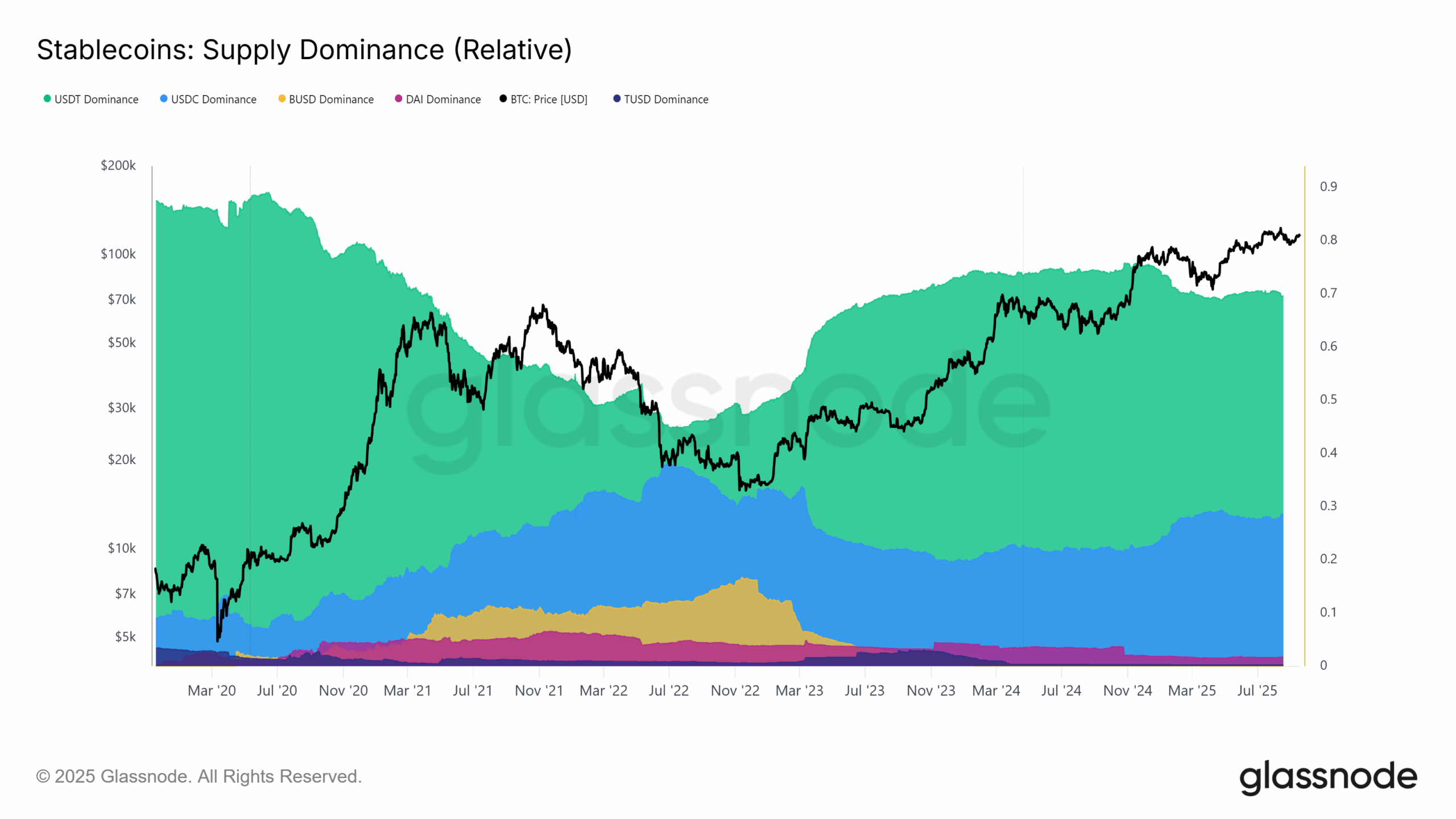

Institutional knowledge reveals why this laws issues. In line with CoinGlass, open curiosity in crypto futures has climbed steadily into September, whereas DeFiLlama studies over $290 Bn in stablecoin liquidity sitting on the sidelines.

For Armstrong, the stakes are excessive: seizing bipartisan momentum and enacting guidelines that steadiness shopper safety and innovation.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Coinbase CEO Brian Armstrong believes US crypto laws and Readability Act lastly has a shot at passing.

For Armstrong, the stakes are to grab bipartisan momentum and lock down guidelines that steadiness shopper safety and innovation.

The put up New Crypto Invoice: Coinbase CEO Brian Armstrong Heads to Washington DC appeared first on 99Bitcoins.