In keeping with the newest report from blockchain safety agency Immunefi, the cryptocurrency sector will face persistent challenges with hacks and scams in 2024.

The report highlights that though exploit losses have decreased month-to-month, the trade has seen greater than $1.4 billion misplaced to 179 hacks and scams this yr.

In October alone, losses amounted to $55.1 million, a major discount from the $126.9 million misplaced in September, marking a 56.6% drop. However, Immunefi’s information highlights the continued vulnerability of the trade, because the cumulative losses stay substantial.

The October losses are notably notable resulting from their focus throughout a number of incidents. Seven particular exploits contributed to the month’s losses, with two main DeFi protocol hacks — Radiant Capital, which misplaced $50 million, and Tapioca DAO, which misplaced $4.4 million — accounting for many of the monetary harm.

Crypto Sees Shifts In Safety Methods

Immunefi’s Head of Safety, Gonçalo Magalhães, commented on the evolving safety within the trade, observing that “initiatives are more and more adopting strong safety measures,” which embrace “extra in depth audits, improved sensible contract design, and the introduction of bug bounty packages.”

He famous a noticeable enchancment within the maturity of safety practices within the trade in comparison with two or three years in the past. These measures above seem like serving to to cut back exploit dangers, although hackers proceed to use weak factors the place potential.

The BNB Chain emerged as probably the most focused community in October, accounting for 50% of assaults. In the meantime, Ethereum and Arbitrum collectively accounted for the remaining 50%, with every chain seeing 25% of the month’s incidents.

This distribution of hacks throughout these chains highlights how sure networks proceed to draw greater focusing on frequencies, with Ethereum-based ecosystems typically on the forefront.

This persistent focusing on means that though safety measures have improved, high-value belongings and DeFi ecosystems stay enticing to malicious actors.

Outlook For 2024: A Sector on Guard

Because the yr progresses, the crypto trade’s response to hacking makes an attempt and fraud exhibits a combined but hopeful pattern. Immunefi’s report notes that total losses in 2024 now present a slight 1% lower in comparison with the earlier yr, indicating a gradual enchancment.

This pattern and decreased month-to-month exploit ranges recommend heightened safety measures are taking impact. Along with adopting extra “strong” safety methods, initiatives more and more deal with complete audits and deploying decentralized insurance coverage mechanisms to offset dangers.

Nonetheless, large-scale incidents like these affecting Radiant Capital and Tapioca DAO reveal substantial vulnerabilities. As an illustration, whereas centralized finance (CeFi) was freed from incidents in October, DeFi stays a major goal.

Nonetheless, the absence of CeFi losses this month could point out attackers’ elevated deal with decentralized protocols, leveraging their typically speedy tactic improvement cycles.

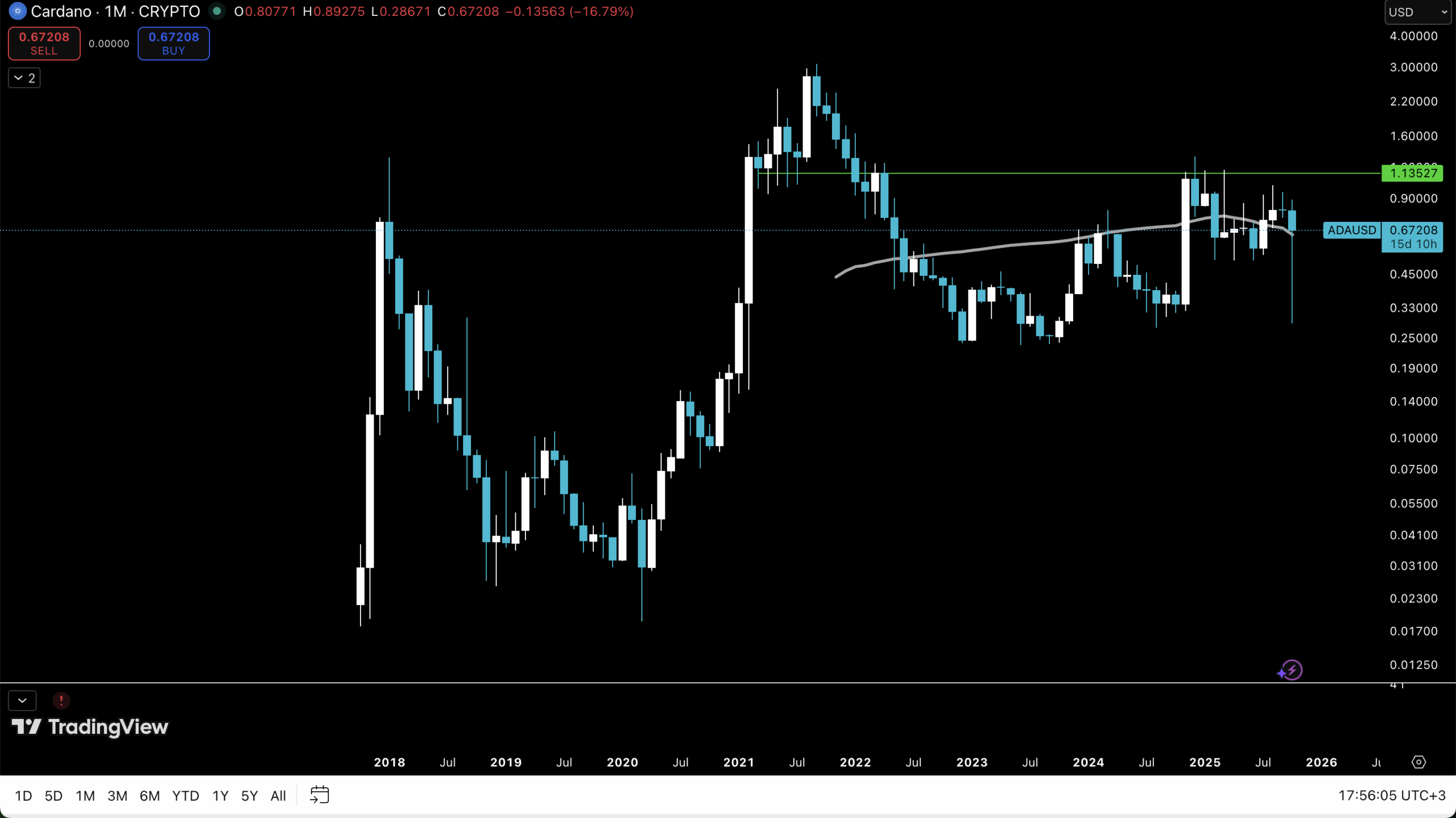

Featured picture created with DALL-E, Chart from TradingView