Final Could, I wrote an article for Bitcoin Journal predicting that Layer 2 (L2) metaprotocol options would resolve the Ordinals controversy. Now that two of essentially the most highly-anticipated Layer 2 options, Taproot Property (TA) and RGB, are both obtainable or imminent, it’s time to revisit this topic. Certainly, it might be previous time judging by latest price spikes pushed by a resurgence of curiosity in BRC-20 tokens…Following my view that the worth, price, and adaptability benefits supplied by L2 metaprotocol options over on-chain Ordinals will in the end show decisive, I’ve targeted my energies on advancing such options. Over the previous couple of months, I’ve been deeply concerned in each TA and RGB tasks. In early September, I established a gaggle through which the builders of L2 metaprotocol wallets, exchanges, and tasks – in addition to every other events – can collaborate. I traded the primary tokens on the brand new “Tiramisu” and “NostrAssets” TA exchanges and named the now-abandoned “Spank” TapAss (get it?) change. Most not too long ago, I based what would be the first 10,000 piece profile image (PFP) artwork assortment on RGB, Single-Use-Seal (named for the cryptographic primitive invented by Peter Todd in 2016 which varieties the idea of RGB).

Provided that creating the art work for Seals, advertising the venture and interacting with its (distinctive) group constitutes essentially the most important funding of my time into L2 metaprotocol tasks, it follows that I imagine RGB has larger potential than TA. Nonetheless, not like RGB which is presently present process a code audit by Blockstream earlier than the gates are thrown vast to person funding, TA is offered as a useful various to Ordinals proper now. From private expertise, I can testify that TA tokens and NFTs are working and buying and selling extraordinarily effectively, with Lightning help as commonplace… So why, within the present high- price setting, is the Ordinals battle nonetheless raging, as proven by the latest battle over OCEAN mining pool filtering Ordinals transactions?

Picture Inscriptions – Right here to Keep?

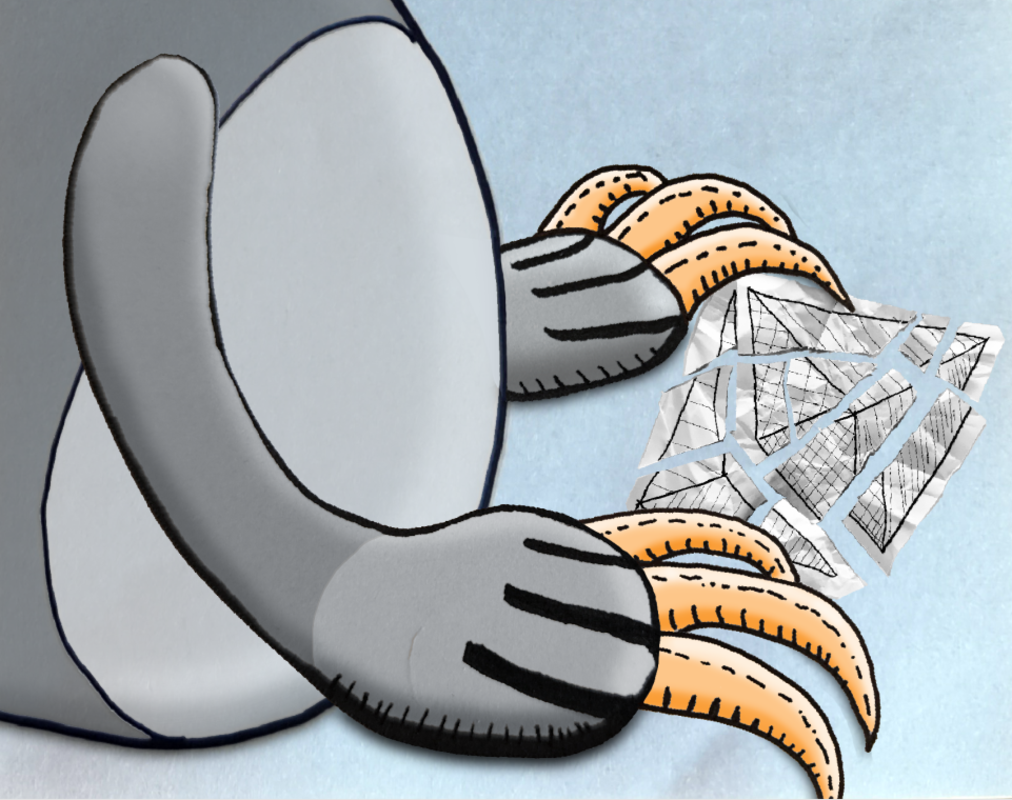

As an artist (or, extra precisely, novice cartoonist), I effectively perceive that limitations typically spur creativity. A clean web page could be intimidating in its countless risk, whereas restrictions counsel construction and typically current a place to begin. The dimensions limitations of Inscriptions have clearly not stopped an explosion of creativity, from charming low-res and pixel artwork to improved technical efficiencies, like recursive inscriptions. Nonetheless, the tight restrictions on file dimension imposed by the on-chain format does exclude sure potentialities.

For instance, Single-Use-Seals explores the human artist’s function in a tradition more and more fabricated by AI. To realize “Proof-of-Artwork” verification throughout the PFP assortment and to filter AI-generated entries from our varied group contests, Seals depends on high-res pictures of handmade artwork. At a decision of 3072 by 3072 pixels, it’s doable to conduct a CSI-style enhancement of a Seal, enough to substantiate the irregular pen strokes, imperfections of the paper, and shifting photographic tones as human made:

For a ten,000 piece assortment, attaining this stage of constancy is cost-prohibitive inside Inscriptions – if not technically unimaginable, given that every Seal picture is roughly double the utmost dimension of a Bitcoin block. The identical limitations apply much more so to high-quality audio and video content material. However, the excessive value of scarce blocksize is as a lot a characteristic as a bug. Placement throughout the world’s first, costliest, and most safe blockchain confers an plain status. These with suitably-small artwork or deep pockets will subsequently proceed to boost the perceived worth of their work by direct affiliation with Bitcoin. It will inevitably result in a scenario the place data-heavy artwork (or that produced by the archetypal ravenous artist) finds its pure place on Layer 2 metaprotocols. Thus I nonetheless foresee a fee-determined bifurcation of Bitcoin-based artwork between layers.

BRC-20s – Time to Go!

Whereas picture Inscriptions have their place, in my opinion BRC-20s (and associated on-chain tokens) at the moment are out of date. There are some important and elementary drawbacks to those tokens:

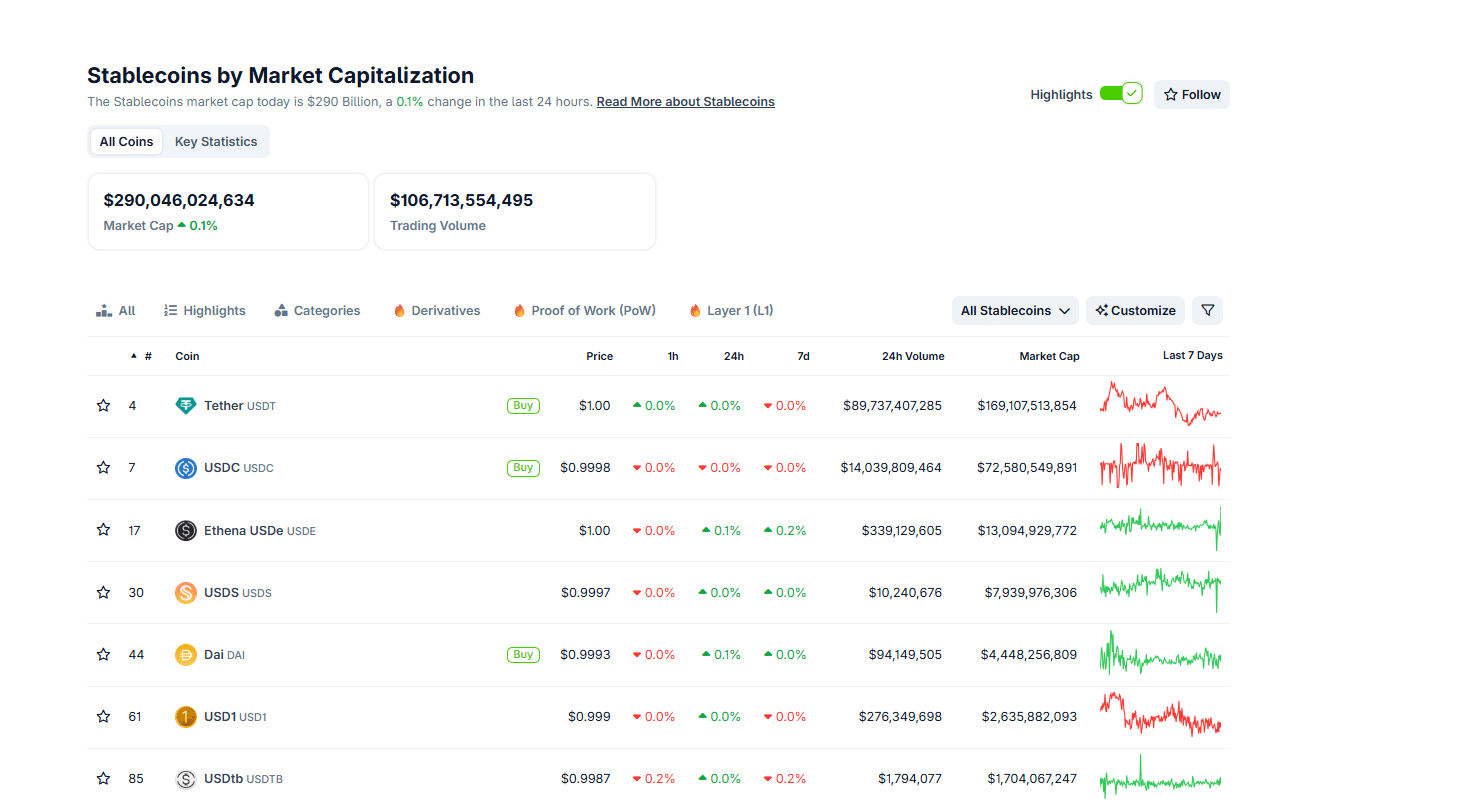

BRC-20s are minted on a first-come-first-served-no-refunds (FCFS/FU) foundation. In case your transaction arrives in spite of everything provide has been claimed then your funds are wasted and also you get nothing. This results in the bursts of intense price competitors that are so disruptive to the Bitcoin community – and trigger a lot Ordinals backlash. BRC-20s depend on centralized indexers, run primarily by exchanges, to maintain the ledger of who-owns-what straight. The potential for desynchronization and fraud is excessive. BRC-20 transfers and actions require on-chain Bitcoin transactions. That is costly and comparatively gradual in comparison with tokens on competing chains. BRC-20 tokens are restricted of their software. To my data, the fundamental features anticipated of tokens on different chains, equivalent to any type of decentralized monetary functions, have but to materialize. Definitely nothing like a BRC-20 stablecoin of any reputation exists right now – Stably just isn’t one thing I’d advocate even to a central banker. BRC-20s are restricted to 4 character tickers – and all of the juiciest 4-letter phrases have lengthy since been taken.

Additional to level 1… New BRC-20s deployments are beneath fixed risk by “The Sophon,” a slightly aggressive little bit of now-public code, developed by Rijndael to stifle new on-chain tokens. Named for the single-proton supercomputers deployed by aliens to dam scientific progress on Earth (at the least in Cixin Liu’s glorious sci-fi trilogy, “Remembrance of Earth’s Previous”), Bitcoin Sophons scan the mempool for any new BRC-20 exercise. Upon detection, Sophons pay for a high-fee transaction meant to front-run the unique BRC-20 deployment transaction and set its whole provide to 1. This successfully occupies the BRC-20’s meant ticker and invalidates any mint transactions from customers, by the way losing any of their en-route transactions.

Suffice to say, I’m certainly one of many Bitcoiners who believes that BRC-20s, in a phrase, suck. Nonetheless, slightly than attempting to neutralize them by way of costly Sophon transactions or censor them on the miner stage, my most well-liked resolution is to publicize the superior alternate options. To that finish:

AdamCoin (AC) is the primary token deployed on the Tiramisu TA pockets and change. AC enjoys a bullish and lively market and, like all tokens on Tiramisu, could be traded by each Liquidity Pool and Order Ebook. Many different tokens and NFTs can be found for buying and selling on Tiramisu and the method of making new ones is reasonable and dependable (sans menacing multi-dimensional micro-computers). As an added bonus in these attempting excessive price occasions, Tiramisu deposits and withdrawals could be made by way of Lightning.

TRICK and TREAT are twin TA tokens buying and selling on the open-source NostrAssets platform. With a Telegram channel of 13,000+ members, buying and selling is brisk certainly and has the added bonus of integration with the Nostr protocol (regardless of Fiatjaf’s heated objections). Presently NostrAsset’s solely actual disadvantage is that it doesn’t permit the minting of latest tokens or NFTs.

PePe-RGB is an RGB-based venture within the last levels of launch preparations. PePe has already attracted an enormous Twitter following of 28,500+ individuals and enthusiasm runs excessive for the PePe’s preliminary stage; the discharge of the world’s first standard RGB-20 token. There’s much more in PePe’s plan nevertheless, already there’s a fully-3D animated avatar, the grandson of the ever-present memetic frog, forged because the protagonist in a story set to play out throughout a cyberpunk metropolis. It’s even rumored {that a} sure Seal could visitor star… and even launch his personal token with utility for a verified-human-art market in future!

So, with such wonderful L2 tokens obtainable, the query is why anybody nonetheless bothers with BRC-20s? As even essentially the most scorchingly laser-eyed Bitcoin Maxi should admit, shitcoins ON Bitcoin are a rattling web site higher than shitcoins IN Bitcoin!

Stealthy Stablecoins within the Vibrant Darkish

Talking of tokens, it is comprehensible that many Bitcoiners have little curiosity in them. Nonetheless, stablecoins are – prefer it or not – main gamers in our house. The third largest coin by market cap, Tether, is especially noteworthy for repeatedly having the very best day by day buying and selling volumes throughout the market. Plainly fiat and BRC-20 get pleasure from a equally persistent demand, regardless of the existence of vastly superior alternate options… And whereas a cryptocurrency sure to fiat could also be removed from the cypherpunk best, that does not imply it could actually’t be improved. For instance, a digital Greenback invisible to chainanalysts and regulators alike (24:30) presents some attention-grabbing new potentialities in a world of accelerating financial sanctions and surveillance. Maybe with such potentialities in thoughts, Tether’s CEO and Bifinex’s CTO, Paolo Ardoino, has named RGB because the rightful successor to the stablecoin’s unique platform, and the very best alternative for issuing stablecoins on BTC.

Certainly, whereas nothing prevents the issuance of stablecoins on TA, RGB has some technical benefits which make it an excellent platform. Firstly, TA has the constraint of its universe mannequin, through which every asset issuer creates their very own distinctive and separate universe through which their belongings function. Whereas it is doable to bridge universes, this requires permission from the unique issuer. For belongings meant to commerce freely throughout the online – and stablecoins are absolutely most helpful when simply transferable between varied exchanges, wallets, and so on. – this construction presents some apparent difficulties and centralization points. RGB has no such constraints. Any two events utilizing the RGB system can freely change any quantity of belongings. Moreover, because of RGB’s client-side validation mannequin, solely these events would bear in mind that any such change occurred… May we be “gaining a brand new territory of freedom for a number of years,” about 15 years after Satoshi’s unique assertion?

The RGB rabbit gap goes quite a bit deeper, to the intense future prospect of Prime, whereby Bitcoin itself rebases from its blockchain to a client-side validation mannequin – all achievable on a voluntary foundation with none comfortable or hardfork required. Such a prospect is effectively past the scope of this text, so let’s confine ourselves to a different thrilling characteristic of RGB – complicated good contracts working on Bitcoin. This opens the door to all of the alternatives (and dangers) of the DeFi house however hopefully, carried out privately and in a low-cost, scalable method atop Bitcoin. Whereas some can have their objections, the prospect of rendering Ethereum and different on-chain good contract platforms out of date holds plain attraction…

Conclusion: Layer 2 is Bullish for Bitcoin

As the following Bitcoin bull market will get underway, Bitcoiners have the chance to make Layer 2 metaprotocol options a part of the narrative. By failing to take action, extra consideration will stream to acquainted, flawed choices like BRC-20s, which can exacerbate the price pressures typical to scorching Bitcoin markets. Even for Bitcoiners with none curiosity within the potentialities and prospects of L2 metaprotocol belongings, understanding and selling them is an effective option to help Bitcoin’s subsequent progress section.

It is a visitor put up by Steven Hay. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.