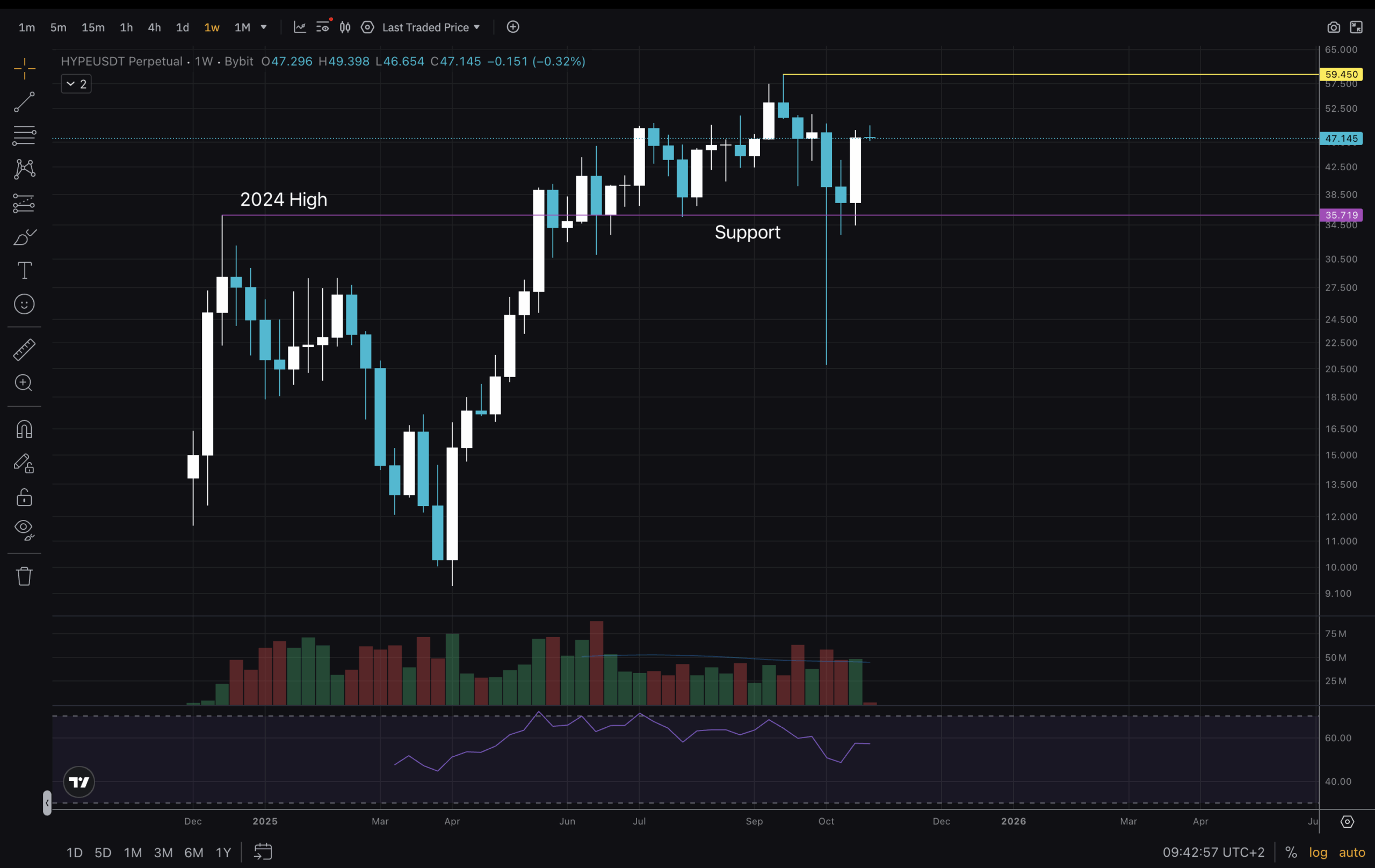

PEPE’s current value motion is elevating considerations amongst merchants, as bullish momentum seems to be fading. After trying to rebound, the token confronted robust resistance on the $0.00000963 mark, signaling a possible shift in market sentiment.

With bulls struggling to take care of management and promoting strain mounting, the door is now open for additional draw back motion, leaving buyers to query whether or not PEPE can recuperate or if extra losses are on the horizon.

The aim of this text is to look at the token’s lack of bullish momentum after failing to interrupt previous the $0.00000963 resistance. By analyzing present market traits and technical indicators, the goal is to spotlight the rising draw back dangers and discover whether or not the meme coin is about for added declines or a potential reversal shortly.

Bulls Lose Steam: PEPE Set For Additional Decline

PEPE has lately entered bearish territory on the 4-hour chart, dipping just under the 100-day Easy Transferring Common (SMA) and approaching the essential $0.00000766 assist degree. This drop under the 100-day SMA signifies weakening energy, and with sellers taking management, the cryptocurrency faces the potential of extra losses.

An evaluation of the 4-hour Relative Power Index (RSI) signifies that the sign line has dropped to 43%, following a short rise to the 50% threshold suggesting that shopping for strain is weakening, because the RSI strikes deeper into bearish territory. Sometimes, an RSI studying under 50% implies that sellers are gaining management, which might result in additional downward strain on the value.

Additionally, the meme coin is demonstrating notable unfavourable momentum on the each day chart, having encountered resistance at $0.00000963, as evidenced by a bearish candlestick formation. With sellers gaining the higher hand, the meme coin is on the verge of breaking under the 100-day SMA, an important assist degree that, if breached, might intensify promoting strain probably setting the stage for extra losses.

A more in-depth have a look at the RSI formation on the 1-day chart reveals that the RSI sign line has decreased to 53%, beforehand reaching 55% suggesting that purchasing strain is starting to wane. Notably, the RSI remaining above the 50% threshold signifies that the asset continues to be in a comparatively robust place, however the downward motion might sign an impending lack of bullish energy.

Worth Motion Breakdown: Can The Meme Coin Discover Help?

After dealing with resistance at $0.00000963, PEPE’s value has begun to point out weak point, dropping under the 100-day SMA and transferring towards the $0.00000766 assist degree. A break under this threshold might unleash heightened promoting strain, probably leading to an prolonged decline towards the $0.00000589 assist degree and past.

In the meantime, a restoration above the $0.00000963 threshold might reignite bullish momentum, which might spark a value surge towards the $0.00001152 resistance degree. Efficiently breaking by way of this degree might pave the best way for additional value development and enhance merchants’ optimism, indicating a extra sustained upward development.

Featured picture from Shutterstock, chart from Tradingview.com