Fast Take

In a latest evaluation shared by Kelly Greer, an analyst at Galaxy, knowledge from NYDIG reveals a big shift within the habits of publicly traded Bitcoin miners over the previous two years. The chart illustrates a notable decline within the quantity of Bitcoin these miners promote, indicating a transition from internet sellers to internet consumers. In line with Greer:

“Public BTC miners flipped from internet sellers to internet consumers in July,” highlighting a vital development within the business.

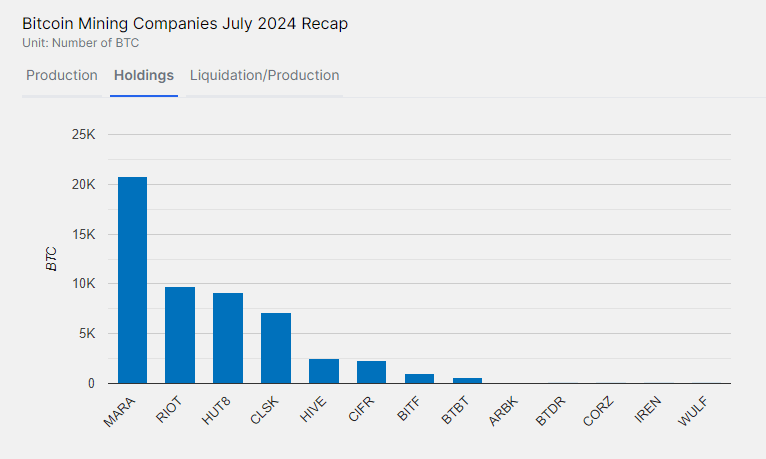

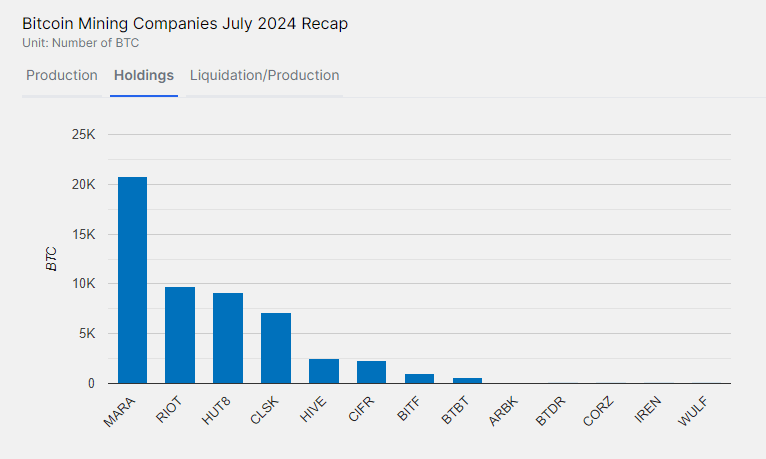

Firms like Marathon Digital Holdings (MARA) have notably elevated their Bitcoin holdings, surpassing 20,000 BTC, in accordance with the minermag.

Though public miners as a gaggle could not but be vital internet consumers, the discount in promote strain is a optimistic growth for the market. Publicly traded miners now management a considerable portion of the Bitcoin community’s hash fee, a development anticipated to proceed as bigger gamers consolidate their dominance.

The potential for these miners to shift methods suggests they need to think about retaining extra of their mined Bitcoin on their steadiness sheets, akin to IREN. Such a transfer would additional cut back market promote strain, probably supporting Bitcoin’s worth stability in the long run.