In opposition to all expectations, September 2025 proved surprisingly sort to crypto. Whereas BTC USD ticked larger within the first few weeks of the month, the sharp plunge within the closing week did not erase these positive factors. As an alternative, a mixture of bullish Bitcoin information and resilient patrons offered robust help, establishing a strong basis for BTC USDT to push above $125,000 in This fall 2025.

Presently, the Bitcoin worth is regular above $116,000. The digital gold has efficiently reversed its losses from September 25. That stated, this leg up is on comparatively low buying and selling quantity however has nonetheless pumped a number of the finest cryptos to purchase. From a technical standpoint, a detailed above $118,000 might ignite an enlargement towards all-time highs.

(Supply: BTC USDT, TradingView)

On Coinglass, dealer sentiment leans optimistic general. The lengthy/brief ratio for prime dealer positions stands at 1.5, although most prime accounts stay closely shorted, with a ratio of simply 0.98. This bearish tilt is clear throughout platforms like OKX and within the majority of accounts. In the meantime, inflows to identify exchanges are combined, however notable purchases have emerged within the final eight hours.

(Supply: Coinglass)

Will BTC USDT Rally in This fall 2025 After a Uncommon Inexperienced September?

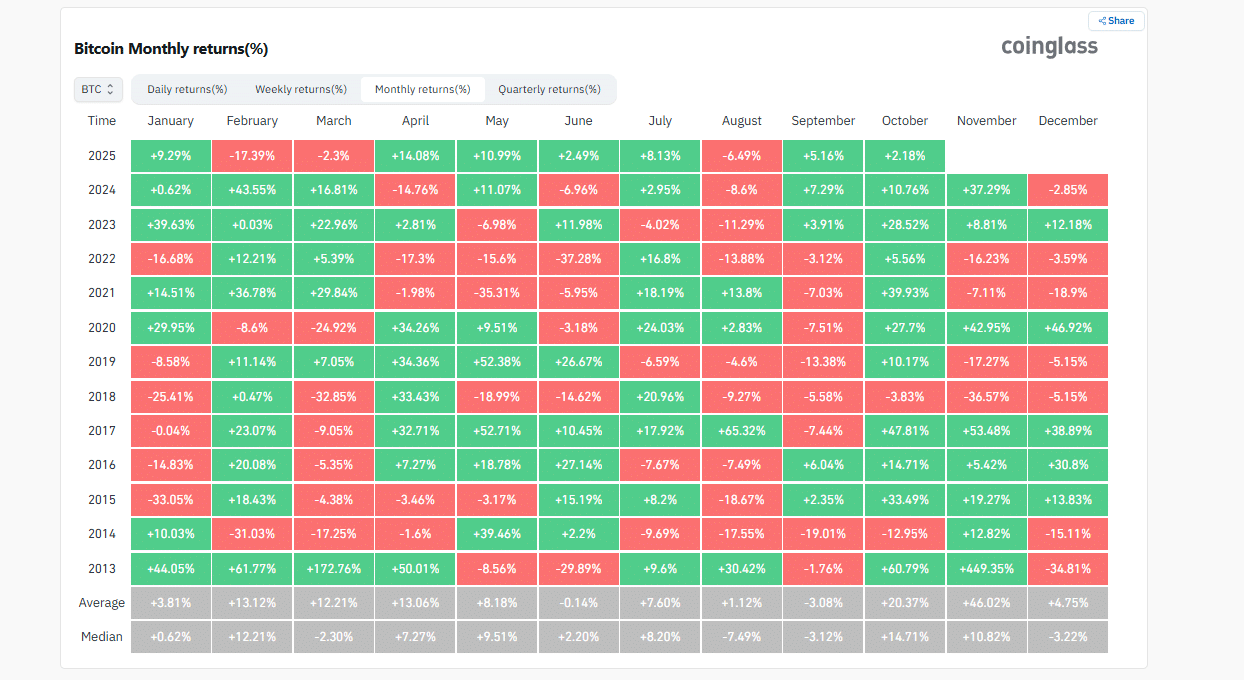

September’s positive factors might sign a bullish highway forward for crypto and Bitcoin merchants. Traditionally, Bitcoin has hardly ever ended the month in optimistic territory. In a lot of this decade, it has closed in crimson, dragging prime Solana meme cash with it.

What’s extra? Out of roughly 15 Septembers since Bitcoin buying and selling went mainstream, solely 4 have closed inexperienced: in 2013, 2017, 2019, and 2023. Every was a uncommon occasion, usually fueled by distinctive catalysts, just like the early adoption increase of 2017 or the ETF hype of 2024.

(Supply: Coinglass)

That’s why September is usually dubbed “Rektember.” But, with Bitcoin posting a good +5% achieve final month, this optimistic shut may foreshadow even stronger efficiency to return.

At any time when September favors Bitcoin, although, the coin tends to roar by This fall. Traditionally, BTC USD has rallied greater than +50% within the quarter following a inexperienced September. October alone typically delivers not less than +25% positive factors, with November and December piling on extra momentum.

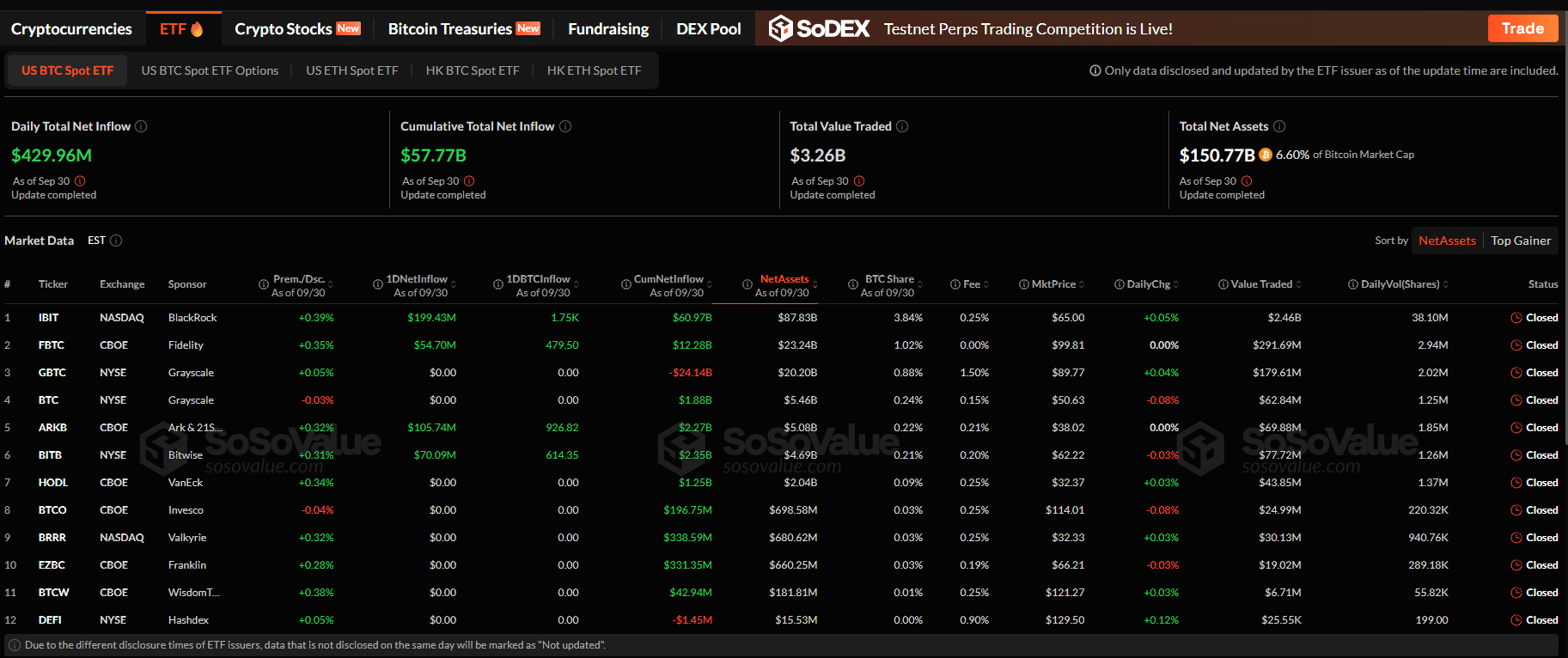

A number of key indicators counsel this sample might repeat. Up to now, as an example, from 2020 by 2022, the shortage of clear rules and the SEC’s refusal to approve spot Bitcoin ETFs have been main roadblocks. That shifted dramatically in 2024, when the company greenlit the primary batch of spot Bitcoin ETFs.

In keeping with SoSoValue, U.S. establishments have snapped up over $150Bn in spot Bitcoin ETF shares. On September 30 alone, they bought $429M, reigniting demand and bolstering the coin’s legitimacy.

(Supply: SosoValue)

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Bitcoin Information: Tether Buys $1Bn in BTC Throughout Q3 2025

Past establishments, main corporations are additionally stacking sats.

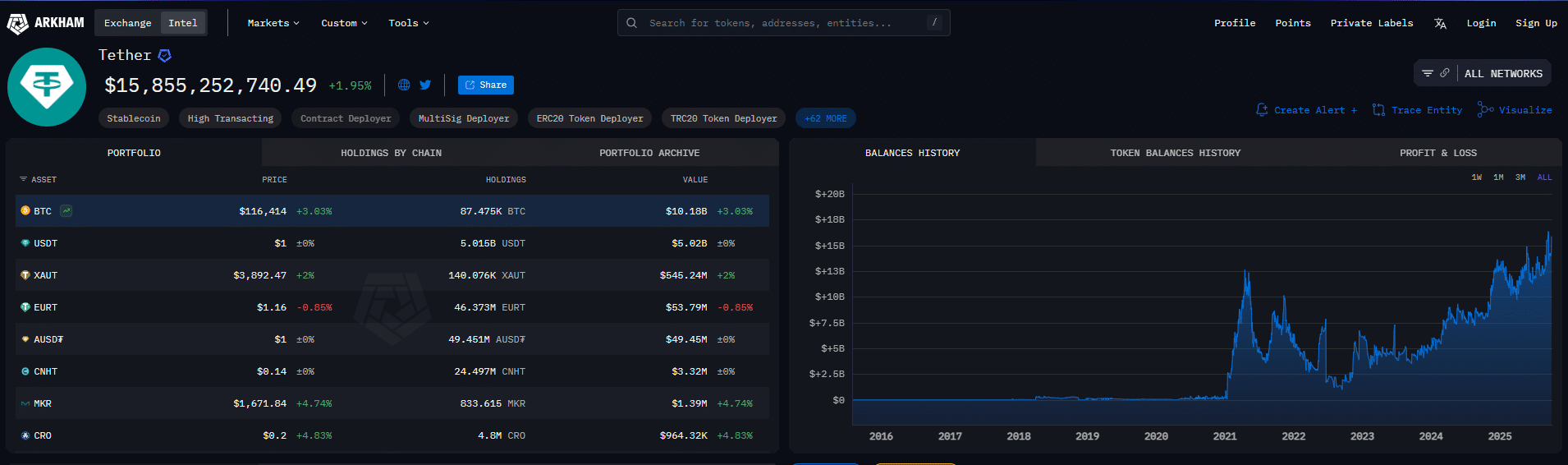

In Q3 2025, Tether revealed it acquired 8,888 BTC at a mean worth of $112,500, for a complete of $1Bn. The USDT issuer, tied to the viral Plasma blockchain, marked this as its newest treasury addition.

TETHER JUST BOUGHT $1 BILLION USD OF BITCOIN

TETHER IS BULLISH ON $BTC pic.twitter.com/JourxhhHXo

— Arkham (@arkham) September 30, 2025

That is Tether’s second main Bitcoin buy; in Q1 2025, the USDT issuer purchased one other $1Bn price. In keeping with Arkham, the corporate now holds over 87,000 BTC.

(Supply: Arkham)

The buildup technique is deliberate. In 2023, Tether up to date its coverage to allocate as much as +15% of quarterly income to BTC, viewing it as a perfect inflation hedge. On the similar time, the agency is diversifying its reserves, mixing Bitcoin with property like gold and actual property.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Bitcoin Information: Tether Buys BTC, Will BTC USDT Pump In This fall 2025?

Bitcoin worth agency above $116,000

September 2025 closed within the inexperienced

Octobers are normally bullish for Bitcoin and crypto

Bitcoin information: Tether buys $1Bn of BTC

The submit Rarest September in Crypto Historical past and Newest Bitcoin Information as Tether Strikes Billions in BTC appeared first on 99Bitcoins.