Rocket Corporations has introduced its second acquisition in as many weeks. The Michigan-based firm is shopping for Mr. Cooper, one of many largest non-bank mortgage servicers and mortgage lenders within the US. The deal is anticipated to shut in an all-stock transaction of $9.4 billion in fairness worth, primarily based on an 11.0x change ratio.

Mr. Cooper, which demoed its cellular app at FinovateSpring 2018, was based in 1994 to problem the standard mortgage expertise to deliver debtors a greater, extra easy dwelling shopping for course of. With 9,000 workers, the Texas-based firm serves greater than six million owners with its refinancing and mortgage merchandise.

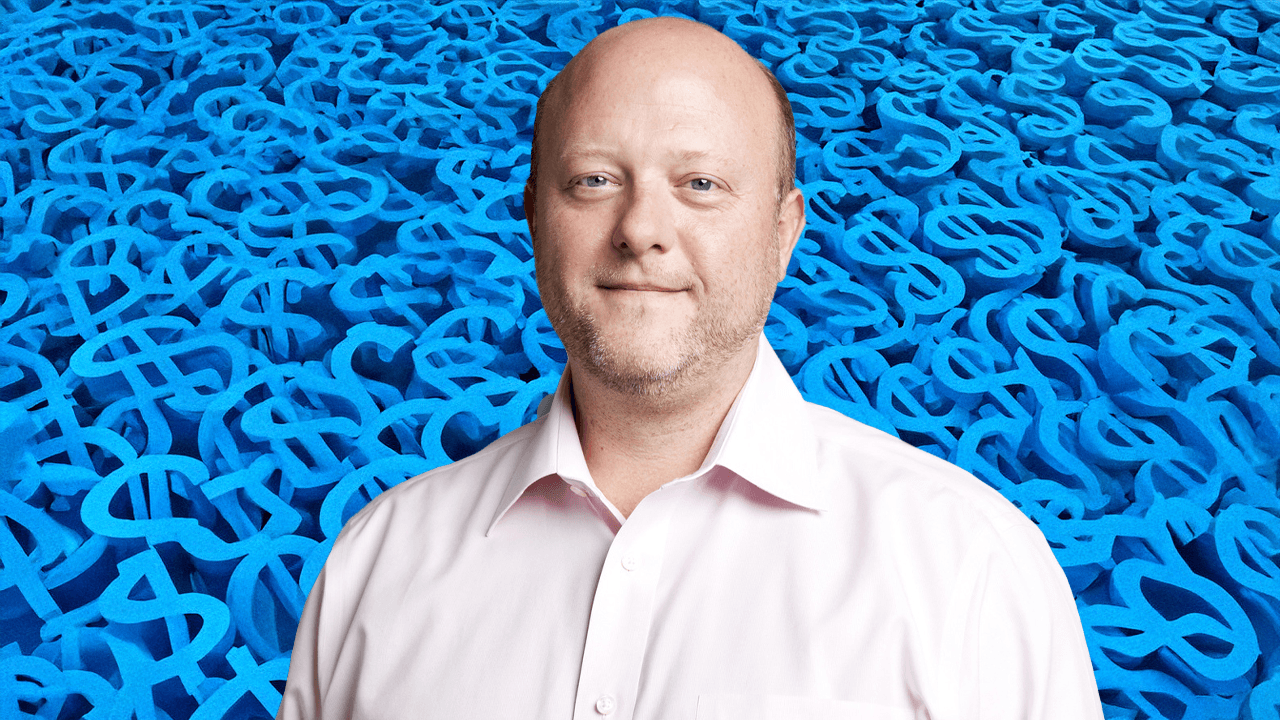

“Mr. Cooper has been on a journey to remodel the homeownership expertise, and we have now constructed essentially the most superior servicing platform within the mortgage business,” mentioned Mr. Cooper Group Chairman and CEO Jay Bray. “By combining Mr. Cooper and Rocket, we’ll kind the strongest mortgage firm within the business, providing an end-to-end homeownership expertise backed by main expertise and grounded in buyer care. I’m deeply grateful for the dedication of the Mr. Cooper workforce and stay up for our continued work as we lead our business into the way forward for homeownership.”

As soon as finalized, Rocket Corporations and Mr. Cooper will serve a mixed 10 million purchasers with a servicing guide of $2.1 trillion, which represents one in six mortgages in America. Rocket will leverage the acquisition to deliver its mortgage recapture capabilities to this new, enlarged shopper base. This may assist produce increased mortgage quantity, drive long-term shopper relationships, and supply higher recurring income whereas decreasing shopper acquisition prices.

Holding a considerably bigger servicing portfolio will assist Rocket maintain its retention and 83% recapture price. And by attaching Rocket’s title, closing, and appraisal companies to Mr. Cooper’s current originations, Rocket anticipates it is going to generate $100 million in further pre-tax income, in addition to an additional $400 million in financial savings from streamlining operations, expense, and expertise investments.

When the deal is full, Mr. Cooper Group’s Chairman and CEO Jay Bray will grow to be President and CEO of Rocket Mortgage, whereas Dan Gilbert will stay Chairman of Rocket Corporations. The corporate’s board will encompass 11 members, 9 from Rocket’s board and two from Mr. Cooper’s.

“Servicing is a essential pillar of homeownership—alongside dwelling search and mortgage origination,” mentioned Rocket CEO Varun Krishna. “With the correct information and AI infrastructure we’ll ship the correct merchandise on the proper time. That’s how we construct lifelong relationships, by proactively unlocking advantages and assembly wants earlier than they come up. We stay up for welcoming Mr. Cooper’s almost 7 million purchasers.”

Right now’s announcement comes simply two weeks after Rocket unveiled plans to accumulate actual property brokerage web site Redfin for $1.75 billion. Collectively, the 2 offers gas Rocket’s imaginative and prescient of proudly owning all the homeownership journey—from search to shut and past.

With Redfin, Rocket features a house search platform and a community of actual property brokers; with Mr. Cooper, it secures a big servicing portfolio and deep operational infrastructure. By consolidating core items of actual property and lending processes below one roof, Rocket is positioning itself not simply as a mortgage lender, however as a full-stack digital homeownership platform with the potential to recreate how Individuals purchase, finance, and handle their properties.

Views: 27