Decoding the 2025 Outlook

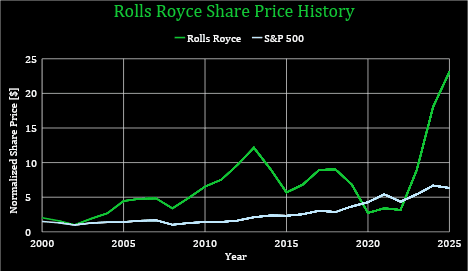

Rolls-Royce ($RR.L), a reputation synonymous with engineering excellence, has not too long ago ignited investor enthusiasm. The appointment of CEO Tufan Erginbilgic in 2023 marked a pivotal second, along with his transformation initiatives delivering a outstanding 15% inventory value surge in 2024 alone. However is that this a fleeting rally, or the beginning of a sustained ascent? Allow us to delve into the important thing drivers behind Rolls-Royce’s resurgence and assess its long-term potential.

A Transformation Taking Off

Erginbilgic’s strategic overhaul has delivered tangible outcomes, streamlined operations, and boosted effectivity at a formidable tempo. The group’s working revenue and margin improved from £0.65B and 5.1% in 2022 to £2.5B and 13.8percentin 2024. Free money elevated from £0.5B in 2022 to £2.4B in 2024.

Key initiatives geared toward value discount and operational optimization are set to gasoline continued efficiency enhancements within the coming years. Moreover, vital contract wins within the vitality, protection or marine sectors are poised to bolster top-line development and drive additional economies of scale.

A Diversified Powerhouse

Rolls-Royce’s income streams are various, spanning:

Civil Aerospace

Manufacturing and servicing aero engines for industrial plane, a phase pushed by rising air journey demand and engine service necessities. This division contributes roughly 50% of the corporate’s income and revenue. Within the pipeline there are backorders and orders from Airbus and Boeing.

Protection

Offering engines for army plane and vessels, together with the UK’s nuclear submarine fleet. The Aukus partnership and elevated international army spending present a powerful tailwind. RR not too long ago gained a contract to provide $11.1B nuclear reactors for U.Okay. submarines.

Energy Methods

Providing energy era, marine, and industrial options, together with a strategic give attention to small modular reactors (SMRs) and knowledge heart energy options. In partnership with ČEZ RR will deploy as much as six SMRs within the Czech Republic.

Future Development

The corporate’s deliberate re-entry into the narrowbody plane engine market within the subsequent decade presents a big long-term alternative.

Clients: Powering World Industries

Rolls-Royce caters primarily to industrial airways and army forces, delivering high-performance engines and energy methods that prioritize reliability, refined know-how, and premium customer support, solidifying its management in industries requiring cutting-edge options.

Navigating a Tight Market

4 key gamers dominate the aero engine market: Rolls-Royce ($RR.L), Pratt & Whitney, CFM Worldwide (JV between GE Aerospace and Safran Plane Engines), and Common Electrical ($GE). Different key opponents embody Siemens (energy methods), Honeywell, and MTU Aero Engines.

GE offers energy and propulsion options and is a powerful competitor for its progressive options and international presence. Siemens competes with RR within the built-in energy methods market. Honeywell’s choices overlap with RR’s merchandise. MTU Aero Engines competes within the aviation sector. Pratt and Whitney is a formidable competitor for its progressive know-how and engineering experience.

Rolls-Royce distinguishes itself via:

Complete engine design and system integration capabilities.

In depth R&D investments and technological innovation.

A world presence and a powerful model status.

Custom-made options and eco-friendly applied sciences.

Funding Thesis

Monetary Well being: Rolls-Royce has achieved investment-grade credit score rankings and demonstrated monetary energy via a GBP 1 billion share buyback and the resumption of dividends. The Complete Money Value/Gross Margin (TCC/GM) ratio highlights the success of the transformation efforts.

Knowledge supply: 2024 Full Yr Outcomes Presentation

One of the best-in-class TCC/GM (complete money value/gross margin) ratio and a internet money place contribute to the elevated resilience to EFH (engine flying hours) volatility.

Strategic Initiatives: Ongoing initiatives embody renegotiated contracts, margin enhancements, and investments in R&D, such because the UltraFan engine and next-generation energy methods. The UltraFan is a jet engine demonstrator that improves gasoline effectivity and reduces emissions. It’s the world’s largest aero engine. Capability expansions in key amenities will help elevated manufacturing and repair calls for.

UltraFan and SMR alternatives.

Development in energy methods via decrease carbon options and battery vitality storage.

Robust protection sector demand.

Increasing civil aerospace market share and improved engine time-on-wing.

The corporate is main the SMR market with the most important Megawatt electrical (MWe) out there and has achieved vital regulatory milestones forward of the competitors.

Administration: CEO Erginbilgic’s strategic management and restructuring efforts have yielded spectacular outcomes.

Valuation

Present valuations counsel a possible upside of 20%. Given the wholesome base and measurable strategic initiatives, it’s our view that the chance for unfavorable returns is low.

Development

LT-growth

WACC

Truthful worth

Vs present

Excessive

18.5%

4.0%

9.5%

£ 880.94

20%

Medium

15.0%

4.0%

9.5%

£ 790.05

8%

Low

11.5%

4.0%

9.5%

£ 706.81

-4%

Common

£ 792.60

8%

E book worth

£ -0.10

Present

£ 732.80

Rolls-Royce’s price-to-earnings (PE) ratio, a measure of its share value relative to its earnings, is under the trade common, suggesting potential undervaluation. Rolls-Royce’s unfavorable e-book worth is primarily attributable to losses incurred through the COVID-19 pandemic, which considerably impacted the aviation trade.

Aerospace and Protection Opponents

Inventory Value [$]

Mkt Cap [$Billion]

PB

PE

Dividend Yield

GE Aerospace

192.12

208.06

10.67

31.86

0.74%

Pratt & Whitney

128.52

171.20

2.84

36.20

1.96%

Airbus SE ADR

44.20

147.19

7.00

32.50

1.02%

Boeing Co

148.15

111.47

(30.40)

–

0.00%

Lockheed Martin Corp

479.17

112.79

17.60

21.46

2.75%

TransDIGM Group Inc

1336.02

74.93

9.20

47.18

0.00%

Common Dynamics Corp

271.94

73.51

3.33

19.97

2.21%

Northrop Grumman Corp

495.45

71.72

4.61

17.48

1.66%

Honeywell Worldwide

213.82

139.42

7.49

24.58

2.11%

MTU Aero Engines

163.96

19.08

5.86

21.28

0.60%

BAE Methods PLC ADR

82.76

69.02

4.16

25.00

2.02%

Rolls-Royce

732.80

87.76

(0.10)

26.25

0.77%

Common (excl. Boeing)

6.61

27.61

1.44%

Navigating Turbulent Skies

Key challenges for RR in a aggressive panorama are:

Sustaining a aggressive edge via steady innovation.

Navigating advanced regulatory necessities.

Addressing ongoing provide chain disruptions, that are anticipated to proceed for roughly 18 months.

RR manages these dangers via funding in R&D, compliance buildings and packages to make sure compliance and is in ongoing negotiations with gamers within the provide chain to handle supply of elements. Potential tariffs would have a restricted influence on RR, given a better publicity to Europe and Asia than the U.S.

A Promising Trajectory

Rolls-Royce’s monetary well being, strategic initiatives, and market positioning counsel a promising development trajectory. The corporate is well-positioned to capitalize on alternatives in civil aerospace, protection, and energy methods. Whereas challenges stay, the potential for sustained development and shareholder returns makes Rolls-Royce a compelling funding consideration.

Knowledge supply: https://finance.yahoo.com/

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.