Metaversal is a Bankless e-newsletter for weekly level-ups on NFTs, digital worlds, & extra!

Expensive Bankless Nation,

It’s RWA this, RWA that recently in numerous circles of crypto.

Simply catching up right here? Properly, RWA stands for “real-world belongings.”

They’re created when “offchain” issues — something from U.S. T-bonds to Pokémon playing cards — are tokenized on a blockchain like Ethereum to unlock borderless liquidity, 24/7 markets, non-custodial possession, and many others.

After all, NFTs are suited to symbolize non-fungible belongings onchain, pointing to a future the place widespread RWA adoption means widespread NFT adoption.

Let’s stroll by means of the fundamentals right here for at the moment’s publish!

-WMP

🙏 Sponsor: Kraken — Kraken NFT is constructed for safe NFT buying and selling ✨

Broadly talking, there are two forms of RWAs: ones that symbolize monetary devices (bonds, actual property, shares, and many others.) and ones that symbolize cultural objects (baseball playing cards, Pokémon playing cards, and many others.).

In both case, extra individuals and teams have been going by means of the method of “onchaining” the “offchain” to make the most of the distinctive issues {that a} community like Ethereum can supply. Assume non-custodial borrowing energy in DeFi, or open and international public sale infra by means of NFTs, proper. Essentially making the illiquid extra liquid.

RWAs aren’t new in crypto, although. For example, Maker, the primary DeFi protocol to achieve appreciable adoption, has been more and more underpinning its Dai stablecoin with RWAs like T-bonds since April 2021. Different DeFi initiatives like Canto, Frax, Maple, and Polygon have additionally lately made deeper advances into the RWA area.

🏹 Settle, Hunt, Declare, Repeat.

Be extra bankless and develop into a Bankless Citizen at the moment!

But should you zoom in right here, the dominant method on the DeFi aspect of issues up to now has been like Maker’s, i.e. tokenizing RWAs through swimming pools of fungible ERC-20 tokens. It’s labored nicely, at the least to date, as evidenced by how RWAs at the moment are the majority of the backing behind the Dai.

Conversely, on the cultural aspect of issues NFTs have develop into the tokenization software of selection since they’re suited to being mapped 1:1 to distinct collectibles, for instance a 1st-edition “mint situation” Charizard card that isn’t interchangeable with a 2nd-edition “nice situation” Charizard, and many others.

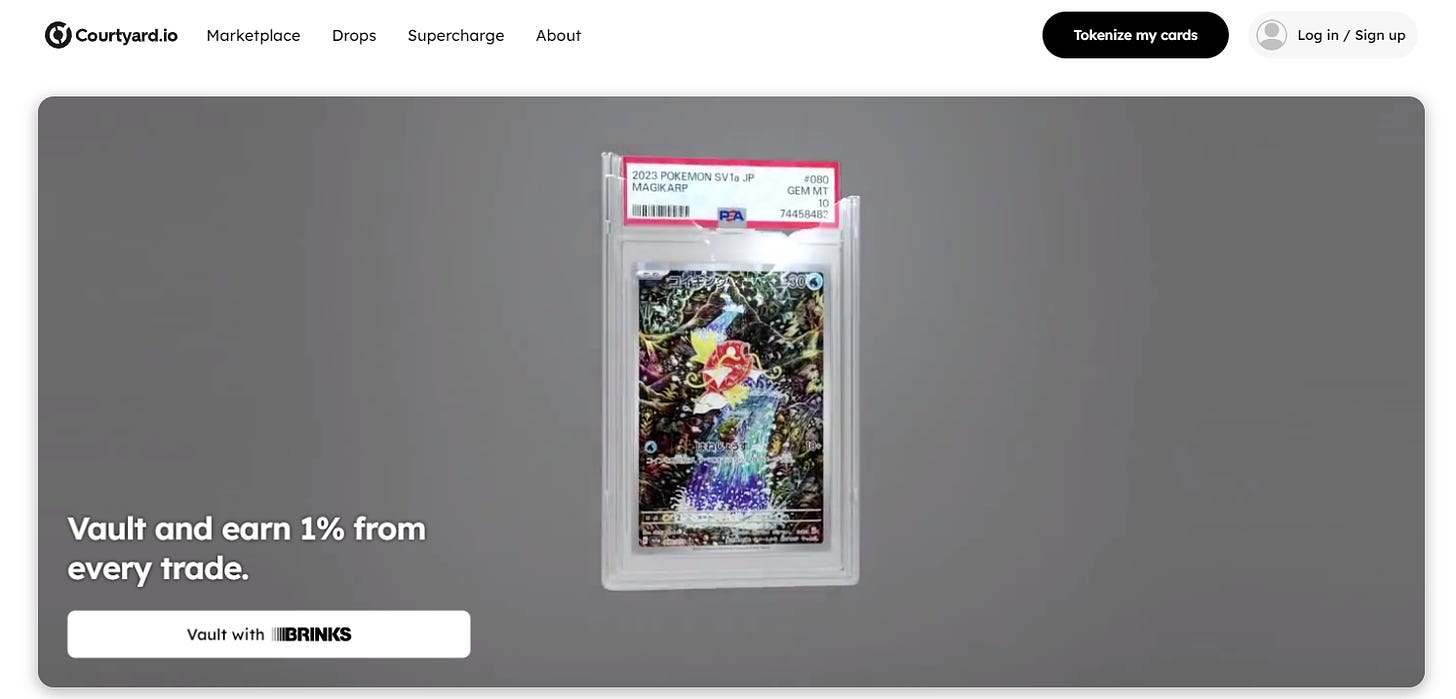

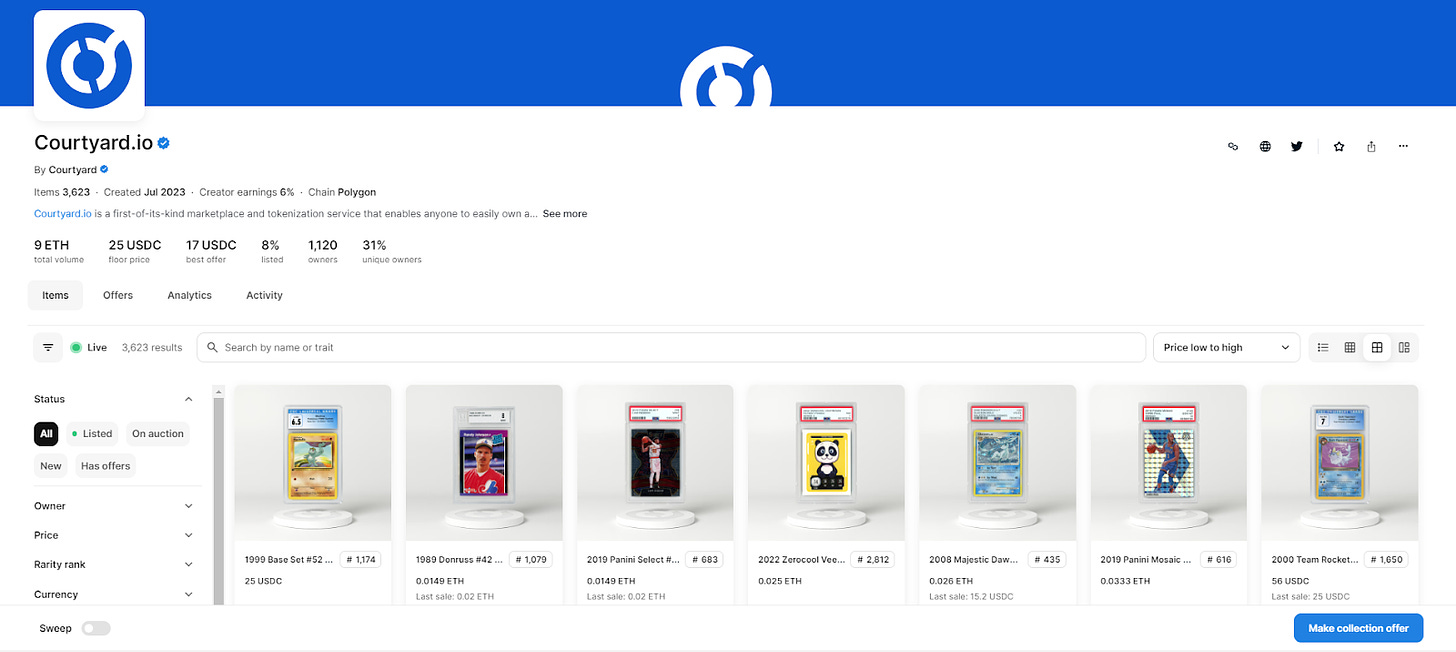

One of many largest initiatives to concentrate to right here proper now’s Courtyard.io, which has been making waves recently because of its latest Pokémon card drops on Polygon.

Each a tokenization service and a market, Courtyard lets collectors vault and tokenize their very own graded buying and selling playing cards or purchase and promote playing cards already put onchain by others. Its pack drops, some as little as $5 every, have been minting out in seconds, and one pack opener lately received a mint situation “Mario Pikachu” card price ~$6k USD!

All playing cards on the platform are authenticated after which custodied in an insured vault at Brink’s, the property administration big, to make sure the integrity and redeemability of the related NFTs always.

But it’s not simply all enjoyable and video games on the NFT x RWA crossroads, as we’ve seen some finance-centric use circumstances begin to achieve some preliminary traction as nicely.

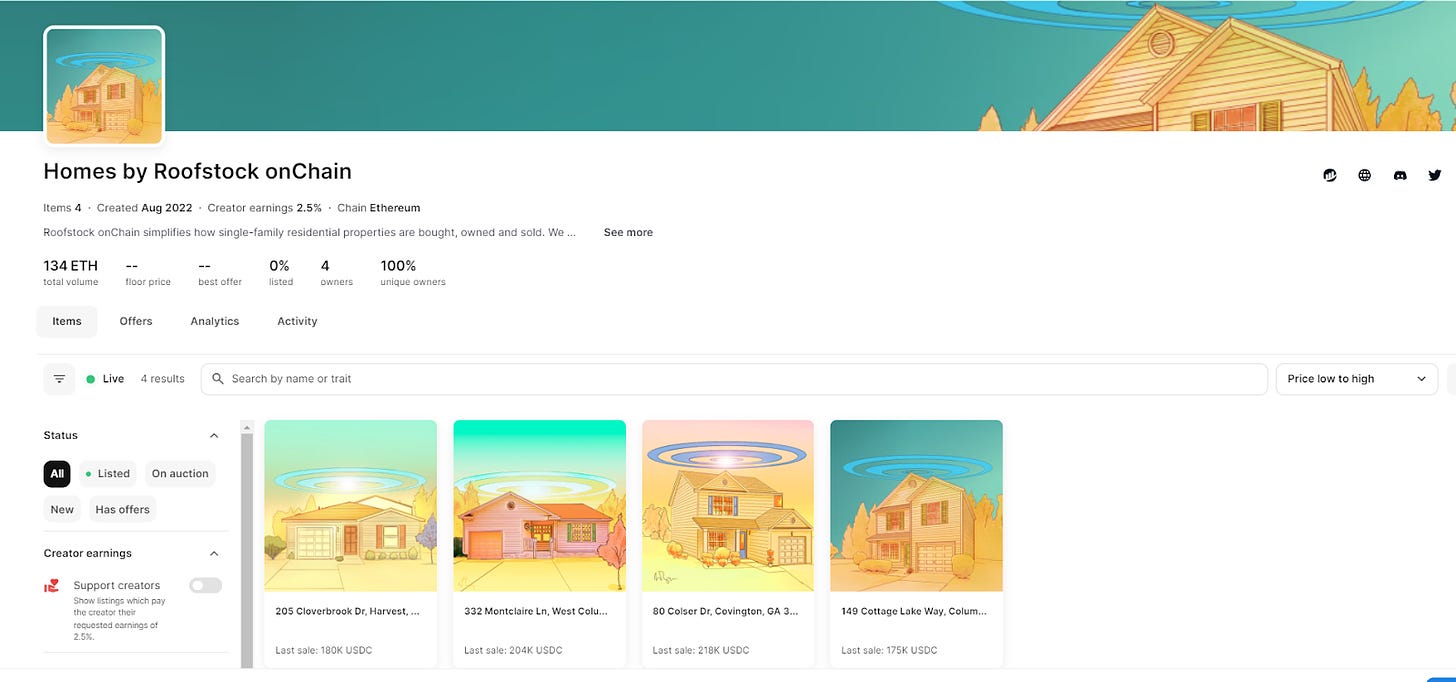

For instance, Roofstock onChain has already resold a handful of homes in the true world through NFTs on OpenSea, with the best sale to date being for 218k USDC.

Over time, I predict we’re going to see an rising variety of DeFi initiatives embrace the NFT method to tokenization as extra discrete monetary belongings are introduced onchain and as extra improvements preserve changing into out there round NFTs.

Certainly, for each the cultural and monetary sides of issues right here, we’ve reached new potentialities round issues like containability and composability — e.g. now you’ll be able to put different tokens inside your RWA NFTs through ERC-6551, like a “fuel move” setup, or put your RWA NFTs inside different onchain issues like onchain sport engines.

That sort of stuff could sound far-fetched at present, however it’s precisely the ability of RWAs and why they’re compelling going ahead, i.e. they pave the best way to doing issues onchain that you could’t do elsewhere, and that’s the magic.

For now, although, the RWA scene stays a reasonably experimental and pioneering area because the frontier is being constructed out right here. Many challenges stay to make certain, like the present lack of regulatory readability round crypto normally that’s conserving corporations and main monetary establishments on standby.

As we get extra readability over time, there could ultimately come a day the place all monetary devices and lots of cultural objects shall be issued onchain, so my grand level then? If that future transpires, NFTs are poised to play a large function in making all of it doable!

A Bankless Citizen ⚑ turned $264 into $6,077 final yr. A 22x ROI 🚀 in a bear market!

Kraken NFT is among the most safe, easy-to-use and dynamic marketplaces out there. Lively and new collectors alike profit from zero fuel charges, multi-chain entry, cost flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Study extra at Kraken.com/nft

👉 Go to Kraken.com to be taught extra and open an account at the moment.

Not monetary or tax recommendation. This text is strictly instructional and isn’t funding recommendation or a solicitation to purchase or promote any belongings or to make any monetary selections. This text will not be tax recommendation. Discuss to your accountant. Do your individual analysis.

Disclosure. From time-to-time I’ll add hyperlinks on this e-newsletter to merchandise I take advantage of. I’ll obtain fee should you make a purchase order by means of one in all these hyperlinks. Moreover, the Bankless writers maintain crypto belongings. See our funding disclosures right here.