When Michael Saylor, the founding father of MicroStrategy, now Technique, began shopping for Bitcoin and constructing a Bitcoin Treasury from scratch, the primary for a public firm buying and selling on the Nasdaq, many individuals thought he was going loopy. But, over 5 years after his first Bitcoin purchase, not solely is Technique dominating Bitcoin information, however the public agency is neck-deep in cash. Whereas BTC USDT costs fell final week, the typical value for every Bitcoin crypto underneath Technique’s maintain is $74,000.

In fact, so long as the Bitcoin value stays above $74,000 and ideally $100,000, Technique will proceed floating in earnings. In accordance with Coingecko, every BTC in circulation is at the moment buying and selling above $111,000, a refreshing bounce contemplating final week’s capitulation and fears. In some unspecified time in the future, BTC USDT fell to as shut as $102,000, simply inches away from the mega assist at $100,000.

(Supply: BTC USDT, TradingView)

Even so, the Bitcoin value is now agency, and sentiment is bettering. Will Technique proceed to build up and construct up its BTC stash?

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Bitcoin Information: Saylor and Michael Technique Owns 2.5% of Bitcoin Provide

In accordance with BitcoinTreasuries, Technique controls over 640,000 BTC, or roughly 2.5% of the entire provide. It stays the world’s largest holder of Bitcoin, controlling over 2.5X the quantity held by Satoshi Nakamoto.

(Supply: Bitcoin Treasuries)

It’s assumed that a good portion of the 21M Bitcoin ever minted is misplaced. Some estimates place it at round +4%, whereas others suppose it’s even bigger. This loss successfully reduces the entire provide to round 20.16M BTC.

JUST IN: 2.3M – 3.7M Bitcoin is completely misplaced, in response to Ledger. This implies at the least 11% of the entire provide is gone ceaselessly.

pic.twitter.com/OtnUKwWwTa

— Altcoin Day by day (@AltcoinDaily) September 6, 2025

As of October 20, miners had acquired over 19.9M BTC, and a tiny share of the entire provide stays. Miners will proceed to scramble for these priceless gems for the subsequent 100 years or so, till 2134.

Technique is satisfied that Bitcoin, being naturally deflationary, is an ideal hedge towards fiat inflation and can proceed to scoop up extra cash. Underneath its 42/42 plan, the general public firm is elevating cash from traders, shopping for Bitcoin, and incomes what it says is an honest Bitcoin yield averaging over +20%.

MicroStrategy pronounces $42 billion capital plan together with $21 billion ATM fairness providing and a goal of elevating $21 billion in fixed-income securities. Be a part of us at 5pm ET as we focus on our quarterly outcomes and #Bitcoin Treasury Firm plans. $MSTR https://t.co/eXYELbN1Dm

— Michael Saylor (@saylor) October 30, 2024

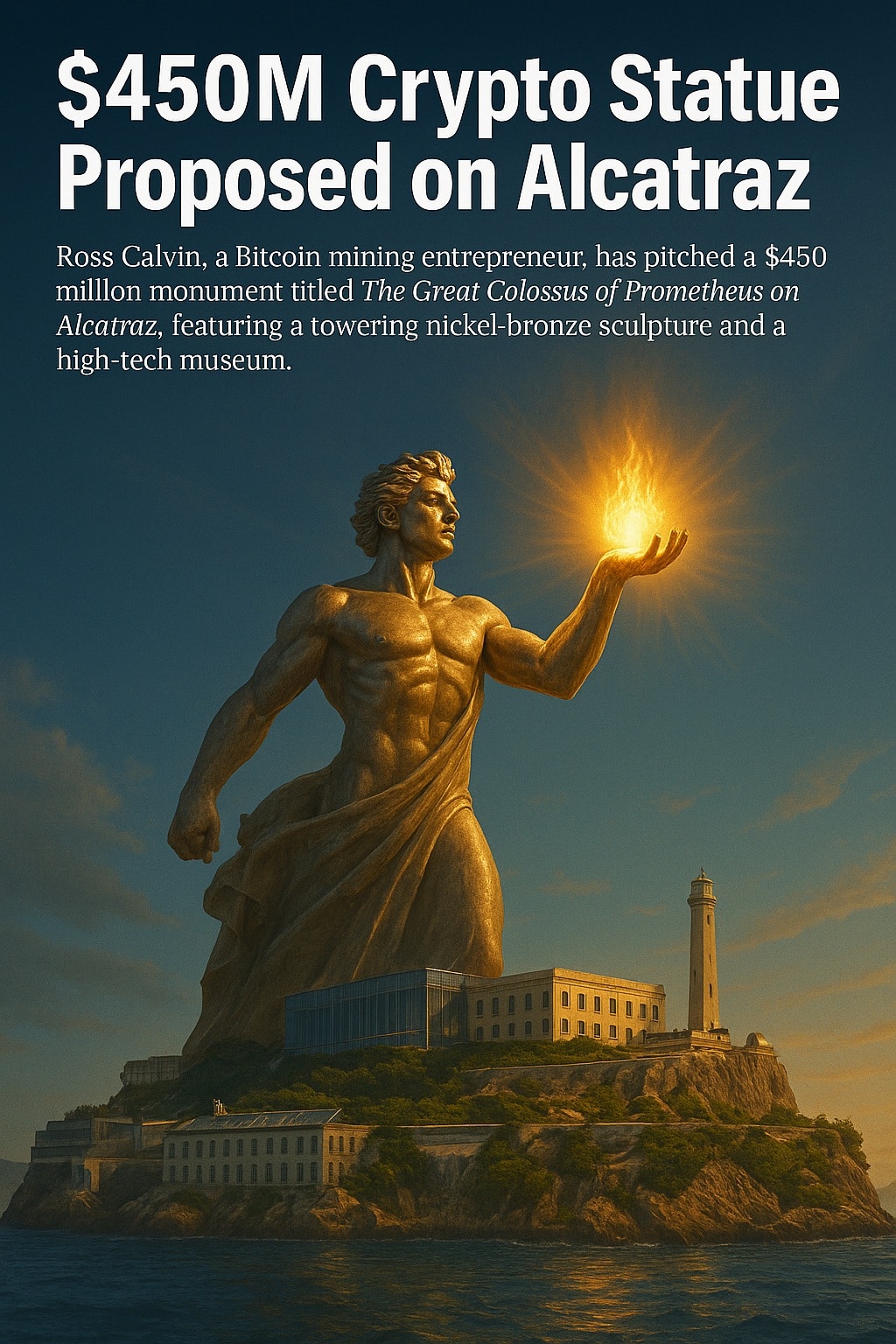

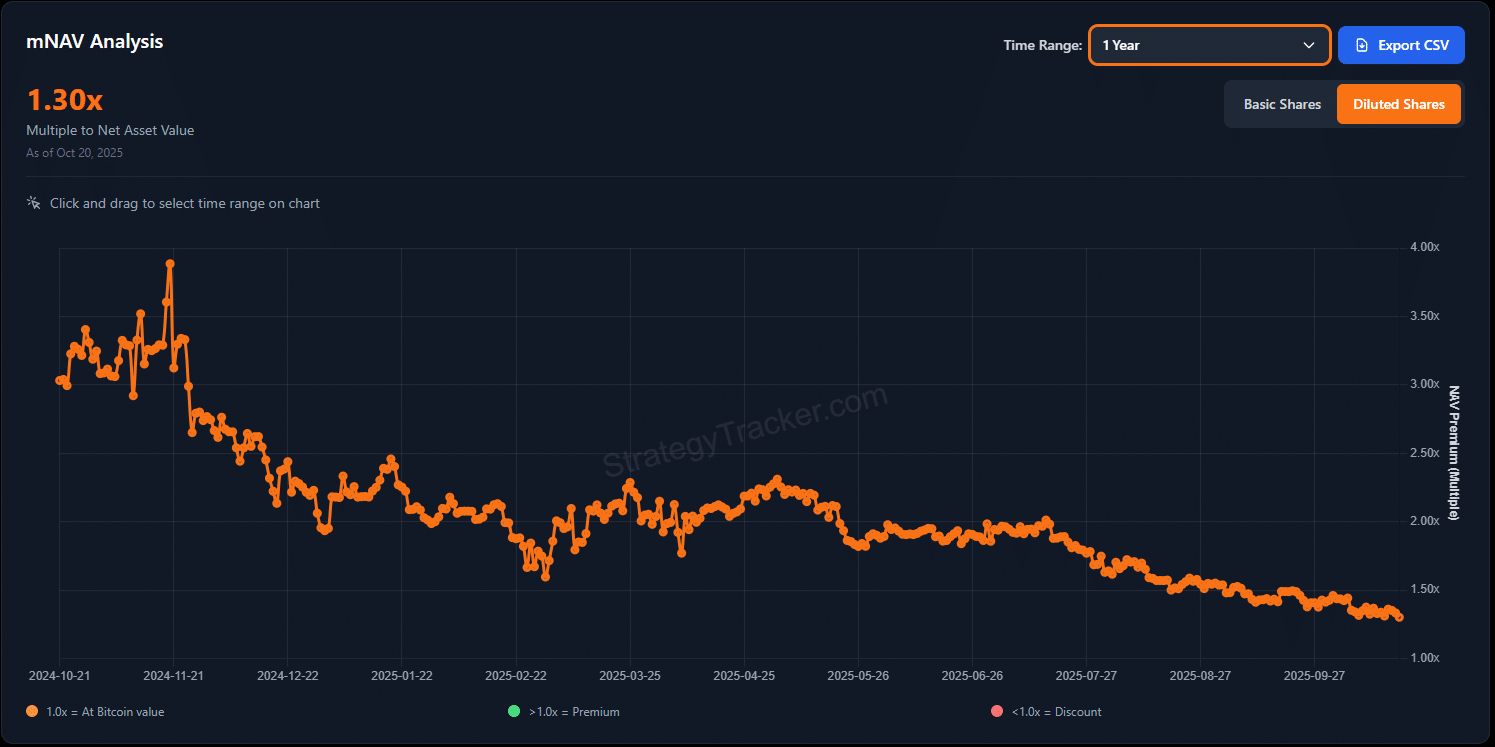

The issue is that there are doubts about whether or not this plan will work out. Reflecting on this pessimism is Microstrategy’s falling web asset worth (NAV). MicroStrategy’s inventory to Bitcoin NAV fell to 1.3X as of October 20, that means the corporate’s shares are, traditionally, buying and selling at a slight low cost to its big Bitcoin stash.

(Supply: SaylorTracker)

For years and months, particularly when Bitcoin and a few of the high Solana meme cash are trending larger, MicroStrategy’s shares are inclined to commerce at a premium, typically over 2X of the Bitcoin NAV. A number of components might clarify this drop.

One is the contraction of Bitcoin and costs of a few of the greatest cryptos to purchase, and waning institutional optimism, probably due to market saturation and availability of different crypto treasuries, together with corporations holding cash that may be staked for a passive yield on high of capital positive aspects.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Bitcoin Worth Above $111,000: Will The Rally Proceed?

Nevertheless, if Bitcoin costs tick larger, surging above $115,000 as losses of October 10 are reversed, MicroStrategy’s NAV might float above one and start buying and selling at a premium.

Analysts are assured that the BTC USDT value will shake off weak point and break above $130,000. Others suppose there’s room for a breakout to new all-time highs of over $200,000, although the percentages stay slim.

7d

30d

1y

All Time

The native assist is at the moment at $103,700, but when the Bitcoin value breaks $118,000, there might be extra room for progress.

Earlier, Cathie Wooden of Ark Make investments stated BTC USD might attain $1.5M by 2030, a greater than 10X from spot charges.

DISCOVER: 9+ Greatest Excessive-Threat, Excessive-Reward Crypto to Purchase in 2025

Bitcoin Information: Saylor Holds 2.5% of All BTC, BTC USD Above $111,000

Bitcoin information: MicroStrategy controls over 2.5% of all BTC in provide

Saylor and staff personal over 640,000 BTC

MicroStrategy’s NAV is falling

Will BTC USD soar to over $1.5M by 2030?

The publish Saylor Now Controls 2.5% Of BTC Provide: Newest Bitcoin Information as BTC USD Worth Surges For $110K Retest appeared first on 99Bitcoins.