Be part of Our Telegram channel to remain updated on breaking information protection

Solana is poised for “an epic end-of-year run” as potential Solana ETF launches and a $1.65 billion company treasury dedication present the firepower for a rally.

That’s based on Bitwise’s Chief Funding Officer (CIO) Matt Hougan, who mentioned in a Sept. 9 memo to traders that “Solana season” may echo the dynamics that drove Bitcoin and Ethereum to a number of new all-time highs.

“When demand exceeds provide, costs usually go up,” he wrote.

A number of main issuers, together with Grayscale, VanEck, Constancy, and Franklin Templeton, have filed for spot Solana ETFs, with the Securities and Change Fee (SEC) rulings due by October 10.

On the identical time, Galaxy Digital, Leap Crypto, and Multicoin Capital have pledged $1.65 billion to Ahead Industries, a brand new publicly traded Solana treasury firm that can purchase and stake SOL at scale.

Ahead Industries has additionally named Multicoin co-founder Kyle Samani as chairman, positioning him to champion SOL publicly as one in all its “most articulate and constant promoters,” much like what Michael Saylor has carried out for Bitcoin and Tom Lee for Ethereum, Hougan mentioned.

With Solana’s $121 billion market cap a fraction of BTC’s $2.2 trillion and Ethereum’s $529 billion, even modest inflows may transfer the needle on SOL in outsized vogue, he instructed.

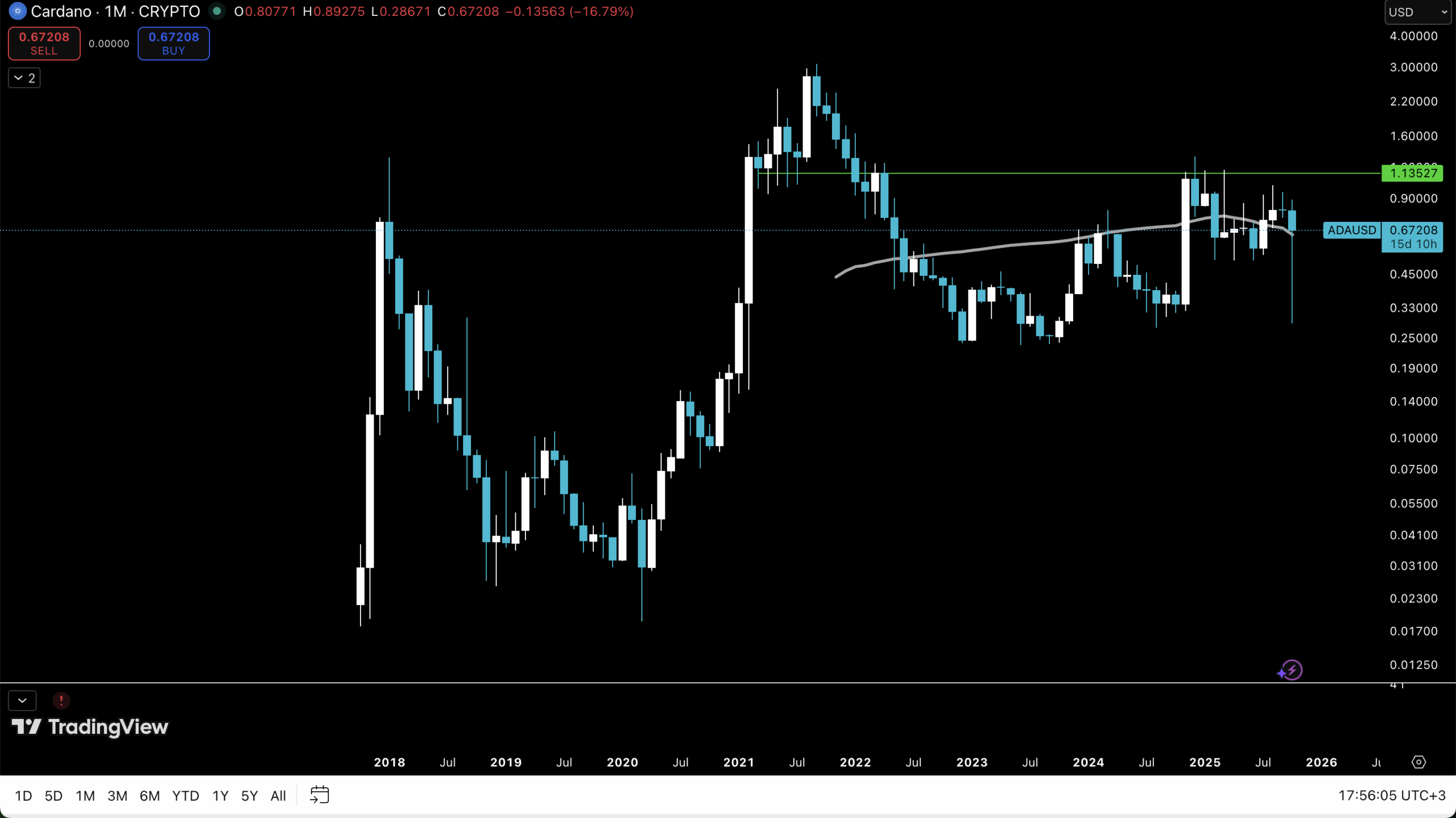

Largest cryptos by market cap (Supply: CoinMarketCap)

He estimated that Ahead Industries’ deliberate $1.65 billion SOL purchase would have the identical impact as shopping for $33 billion price of Bitcoin.

“My suggestion? Preserve your eye on Solana within the coming months,” he mentioned.

The Recipe That Propelled BTC And ETH

Bitcoin soared from round $40K in January 2024, when spot Bitcoin ETFs have been launched, to a brand new all-time excessive of virtually $125K, he mentioned, earlier than including that the ETH value additionally virtually tripled between April and August this 12 months underneath the identical circumstances.

There was a surge in demand throughout that interval as properly. In these months, the Bitcoin community produced 322,681 BTC, whereas ETPs (exchange-traded merchandise) purchased over 1.1 million BTC.

In the meantime, the Ethereum community produced 388,568 ETH, whereas ETPs and companies acquired 7.4 million ETH, the Bitwise CIO famous.

“It’s no shock that the recipe works,” he mentioned. “It’s basic provide and demand.”

🏛️ Sector Strikes:

🔹 Ahead Industries raises $1.65B in file Solana treasury deal (shares +128%)🔹 SOL Methods accredited for @NasdaqExchange itemizing (ticker: STKE)🔹 Galaxy Digital tokenizes SEC-registered shares on Solana🔹 @Gemini rolls out Solana staking + USDC…

— CoinMarketCap (@CoinMarketCap) September 10, 2025

However Solana Could Want A Catalyst To Match Bitcoin And Ethereum

Hougan warned although that company SOL purchases and potential ETF launches alone received’t be sufficient to propel the altcoin’s value to new all-time highs.

“There needs to be a basic motive for traders to be occupied with these autos,” he wrote.

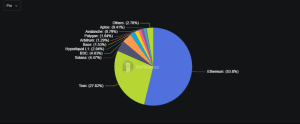

Hougan mentioned Ethereum solely took off when it grew to become clear that its community could be the primary beneficiary of the stablecoin growth.

Stablecoin market share by chain (Supply: DeFiLlama)

For Solana, Hougan believes the foremost draw will probably be its a lot increased speeds and considerably decrease charges in comparison with each Bitcoin and Ethereum.

He known as the Solana blockchain a programmable community constructed for stablecoins, tokenized belongings, and decentralized finance (DeFi).

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection