The market efficiency of the spot Bitcoin ETFs (exchange-traded funds) in america has been spectacular over the previous couple of weeks. Persevering with their glorious streak, the crypto funding merchandise closed the earlier buying and selling week with their greatest single-day efficiency in virtually 4 months.

The constructive investor sentiment surrounding the spot ETFs appears to have additionally bubbled into the Bitcoin and the overall crypto market, which has recovered nicely from an early value droop in September.

US Bitcoin ETFs Put up Practically $500 Million In A Single Day

On Friday, September 27, the US spot Bitcoin ETF market registered a complete web influx of $494.27 million, the best worth because the $886 million capital inflow on June 4. This was one other robust each day efficiency by the crypto-based merchandise, which posted over $365 million in web inflows barely 24 hours earlier than.

In line with information from SoSoValue, Ark Make investments and 21Shares’ ARKB led the day with an influx of $203 million, whereas Constancy’s FBTC adopted in second place with a $124 million inflow. In a seeming resurgence, BlackRock’s IBIT got here in third with a web influx of over $110 million.

Supply: SoSoValue

In the meantime, Grayscale Bitcoin Belief (GBTC) recorded a uncommon constructive day, with $26.15 million flowing into the product. Unsurprisingly, this worth represents the fund’s highest capital inflow since mid-Could, reflecting the extent of redemption it has skilled because the spot Bitcoin ETFs launched.

Because of Friday’s efficiency, the entire weekly web inflows for the BTC exchange-traded funds rose to a outstanding $1.11 billion. This billion-dollar displaying makes it the third consecutive week through which the US-based spot Bitcoin ETFs has recorded a cumulative weekly web influx.

Spot Ethereum ETFs File Second Constructive Week Ever

The excellent efficiency of the Spot Bitcoin ETFs appears to have impressed its Ethereum counterpart, because the ETH funds posted their second constructive buying and selling week since launch. The Ethereum ETFs registered a cumulative web influx of greater than $84.51 million prior to now week.

On Friday, the entire web influx of spot Ethereum ETFs stood round $58.6 million. Information from SoSoValue exhibits that Constancy’s FETH led with a capital inflow of $42.5 million, with BlackRock’s ETHA in second with $11.46 million.

iShares Ethereum ETF eclipses $1bil in property…

Now in high 20% of all 3,700+ ETFs.

Did that is 2 months. pic.twitter.com/iRWaxkjZxl

— Nate Geraci (@NateGeraci) September 28, 2024

In a publish on X, ETF skilled Nate Geraci talked about that the BlackRock Ethereum ETF has surpassed the $1 billion mark when it comes to property. Whereas acknowledging that this feat was achieved in two months, Geraci revealed that ETHA is now within the high 20% of over 3,700 ETFs in america.

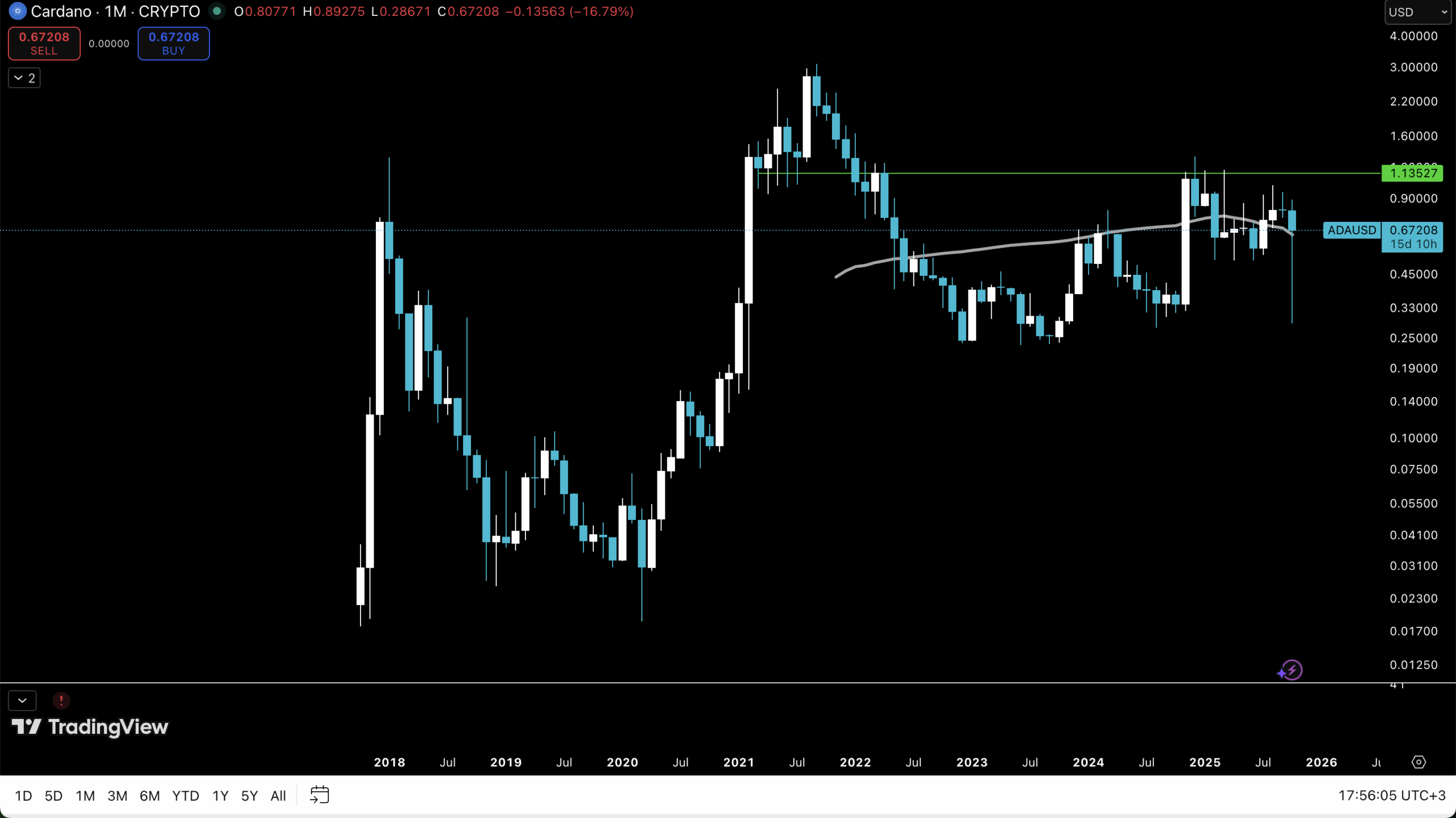

The value of Bitcoin fails to carry above the $66,000 mark on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by Dall.E, chart from TradingView