You’ll have felt a slight sense of unease if you happen to checked your portfolio in current weeks. I’m with you as a result of even unrealised losses damage. Whether or not you’ve been investing for 12 months or 12 years, seeing your portfolio within the pink feels the identical. Investing entails ups and downs, and whereas we are able to’t management the market, we may help you navigate by it. If historical past tells us something, it’s that Trump loves shaking issues up, and his newest tariffs aren’t any exception. Briefly, tariff threats have became a tariff battle and have now develop into a significant supply of market threat, injecting volatility into the world financial system and preserving traders on edge. So, i’ll enable you to break it down, reduce by the panic, and work out what this all actually means on your portfolio.

New commerce tariffs are hitting main US buying and selling companions, elevating issues over financial development, company earnings, and inflation dangers.

Throughout a market sell-off, it’s essential to remain calm, focus in your long-term monetary objectives, and keep away from making impulsive selections pushed by worry. Market corrections have occurred all through centuries of investing.

It’s essential to zoom out and have a look at the larger image. Earlier commerce wars brought about sharp pullbacks however markets recovered. The S&P 500 continues to be up greater than 16% within the final 12 months and has rallied greater than 23% in 2023.

Trump and his tariffs

He’s solely been within the White Home for a few months, however President Trump is already inflicting a stir in international markets. His greatest transfer up to now has been tariffs and on the 4th March, Trump made good on his guarantees, slapping 25% tariffs on imports from Canada and Mexico whereas doubling tariffs on Chinese language items from 10% to twenty%.

These measures goal the US three largest buying and selling companions, which collectively accounted for over 40% of U.S. imports in 2024. Canada and China retaliated with tariffs on US items, escalating tensions and fueling fears of a broader commerce battle. For Trump, tariffs are a cornerstone of his financial technique. He argues they’ll shield American manufacturing, create jobs, increase tax income, and rebalance commerce deficits.

What on earth are tariffs, Josh?

I’m glad you requested. Primarily, tariffs are taxes paid by corporations importing items, on this case, into the US. They’re calculated as a proportion of the product’s worth and are designed to guard home industries by making overseas items dearer.

For instance, the 20% tariffs on China imply a $10 Chinese language-made merchandise prices $2 extra. The main focus then turns to the importers. Do they take the hit to their revenue margins or cross it on to shoppers by larger costs? Both manner, the ripple results are larger prices for companies, potential worth hikes for customers, and a scramble to adapt provide chains.

So why are we seeing the inventory market fall?

Trump’s tariffs may spark a full-blown commerce battle, creating uncertainty about their true financial affect. Markets typically ‘entrance run’ potential outcomes, however traders stay cautious of how these commerce tensions may have an effect on company earnings, financial development, and general market volatility.

Industries like automotive manufacturing, the place elements crisscross the US, Mexican, and Canadian borders a number of occasions earlier than a car is completed, are particularly susceptible. Uncertainty is the important thing driver. Buyers don’t know the way corporations will adapt, whether or not they’ll eat the prices, increase costs, or shift manufacturing. We additionally don’t know the way retaliatory tariffs from Canada, China, and doubtlessly others will hit US exporters.

Goldman Sachs estimates that each 5% enhance in U.S. tariff charges may shave 1-2% off S&P 500 earnings per share. Worldwide gross sales make up 30% of S&P 500 firm revenues and that issues, as a result of in This autumn corporations with larger worldwide income noticed stronger earnings development than these with larger US income. Based on FactSet, for corporations that generate greater than 50% of gross sales contained in the US, the blended earnings development fee is 14.4%. For corporations that generate greater than 50% of gross sales exterior the US, the blended earnings development fee is 20.8%.

Tech shares that have been already priced to perfection, thrown in with some AI issues, have taken the brunt of the sell-off. Nvidia, a darling of the AI increase, has fallen over 20% from its highs as traders fret over provide chain disruptions and shrinking revenue margins. Extra broadly, the Nasdaq has fallen 4% this 12 months.

One other concern is that these tariffs will reignite inflation. Capital Economics predicts US inflation may climb from 2.9% to as excessive as 4% if tensions proceed to escalate. That has the Federal Reserve on watch and means the view of no fee cuts this 12 months is an actual chance.

Volatility and pullbacks are merely the value of entry into investing

Lengthy-term retail traders must preserve a degree head throughout turbulent occasions. The hot button is to not panic, which may be straightforward after checking your portfolio.

It’s essential to keep in mind that pullbacks are regular, and volatility is normal. Since 1974, the S&P 500 has averaged three pullbacks of 5% or extra per 12 months, whereas the common intra-year pullback is roughly 14%. We’ve seen 5 corrections (10% declines from peak to trough) within the final 9 years, and since 1974, the S&P 500 has returned over 24% on common following a correction.

Throughout the final 12 months, together with this present pullback, we’ve seen three pullbacks of greater than 5%. Proper now, the S&P 500 is down simply 5% from its highs, so we’re effectively throughout the vary of regular—this isn’t new for markets. The sell-off can, in fact, deepen, however from July to August final 12 months, the S&P 500 fell 8.5% earlier than rallying as a lot as 17% from its lows.

For some extra context, this isn’t the primary time we’ve been right here. Throughout his earlier tenure, Trump additionally provoked a commerce battle. In 2018, Trump launched tariffs on China, and the ‘commerce battle’ lingered all year long. The S&P 500 fell 10% at the beginning of the 12 months, however the market finally clawed again. Nonetheless, as tensions escalated, the S&P 500 had sunk 19.8% beneath its late-September peak by Christmas Eve 2018. By the ultimate months of 2019, the worst of the commerce battle market volatility started to subside, with the S&P 500 ending the 12 months up 29% earlier than rallying 16% the next 12 months and 26.8% the 12 months after.

In hindsight, the commerce battle’s main market affect got here in waves. Every escalation triggered a pointy sell-off and surge in volatility, and every truce or commerce deal sparked reduction rallies. All through Trump’s first time period, commerce coverage grew to become a key driver of market volatility, inflicting a number of vital pullbacks. These have been all short-lived, and markets in the end bounced again. Though previous efficiency just isn’t a assure of future outcomes, it’s an awesome reminder to not be short-sighted when investing.

Alternatively, the VIX, Wall Avenue’s “worry gauge” continues to be nowhere close to the highs we’ve seen beforehand. In July final 12 months, it hit a excessive of 65.73. Going again to 1990, that was the second-highest one-day rally within the VIX, trailing solely the acquire it noticed on February 5, 2018—funnily sufficient, when Trump’s commerce battle beforehand began. So, though volatility hasn’t reached these ranges but, it has the potential to, and beneath are some tips about tips on how to navigate that volatility.

Keep Centered

In case you have a long-term investing plan, keep it up. A plan helps traders persist with the nice concepts they got here up with throughout calmer occasions. Those that constantly add to their long-term inventory publicity are likely to do effectively over time.

Promoting investments in a panic can lock in losses. Traditionally, markets rebound, and those that keep invested typically profit from the restoration. Lacking one of the best market days can considerably affect long-term returns. A JPMorgan examine discovered that lacking the ten finest market days between 2004 and 2024 would halve your funding returns. Seven of these finest days occurred inside 15 days of the ten worst days.

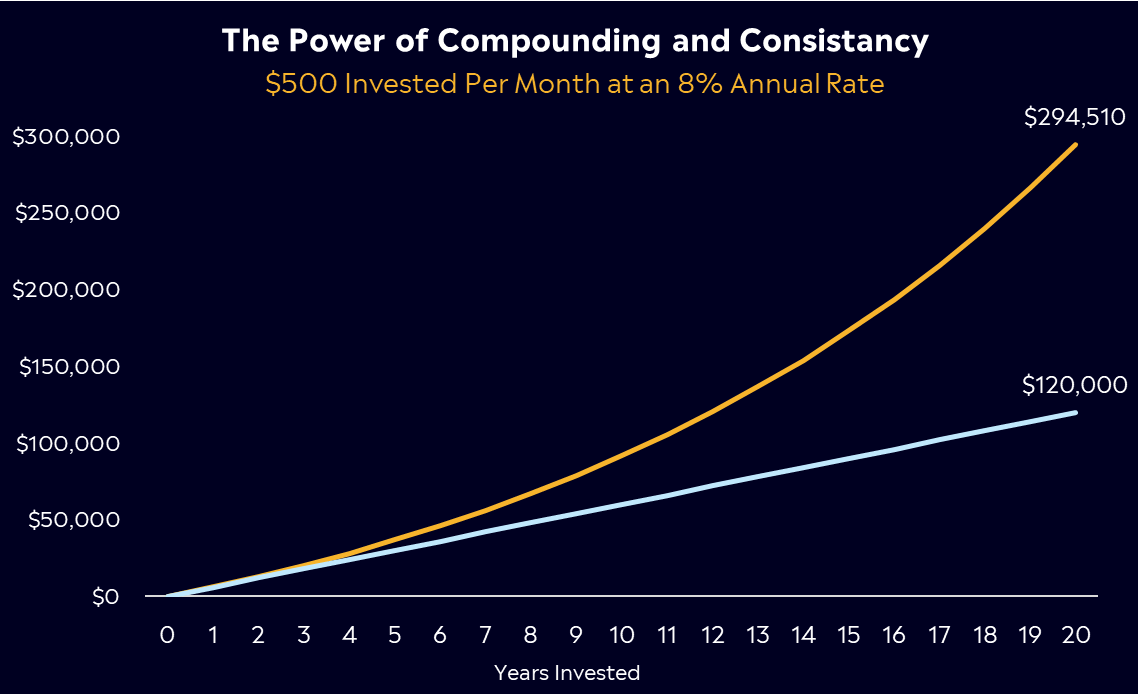

We’re emphasising that timing the market is way tougher than it appears, and getting it fallacious can have vital penalties. A easy technique like dollar-cost averaging may be extremely efficient. It rewards consistency over timing, permitting you to guard towards the unpredictable nature of markets by spreading out your investments over time, sometimes in even increments.

Rebalance as Wanted: If volatility skews your asset allocation, take into account rebalancing to keep up your long-term technique.

Use Greenback-Price Averaging: Investing a hard and fast quantity at common intervals may help easy out volatility.

Concentrate on Fundamentals: Quick-term noise shouldn’t dictate long-term selections. The hot button is to spend money on high quality corporations with robust fundamentals.

The significance of diversification

The present volatility highlights the significance of diversification in an funding portfolio. By spreading investments throughout quite a lot of property, diversification reduces the affect of any single asset’s poor efficiency. In occasions of market turbulence, not all sectors or particular person shares react the identical manner; some could even see positive factors, which may help offset losses in different areas. This technique smooths out the volatility in a portfolio, offering a steadier return over time and main to higher risk-adjusted returns.

Let’s take an S&P500 ETF for example, this may be SPY, VOO, or IVV. The sort of ETF invests within the 500 largest publicly traded corporations within the US, providing broad market publicity. The S&P500 consists of a variety of industries comparable to know-how, healthcare, finance, and shopper items, which implies that the ETF is inherently diversified throughout a number of sectors. Throughout the S&P500, totally different sectors carry out in a different way primarily based on varied financial situations. As an illustration, throughout a pullback within the know-how sector, different sectors like utilities or shopper staples could carry out higher, thereby cushioning the general affect on the ETF.

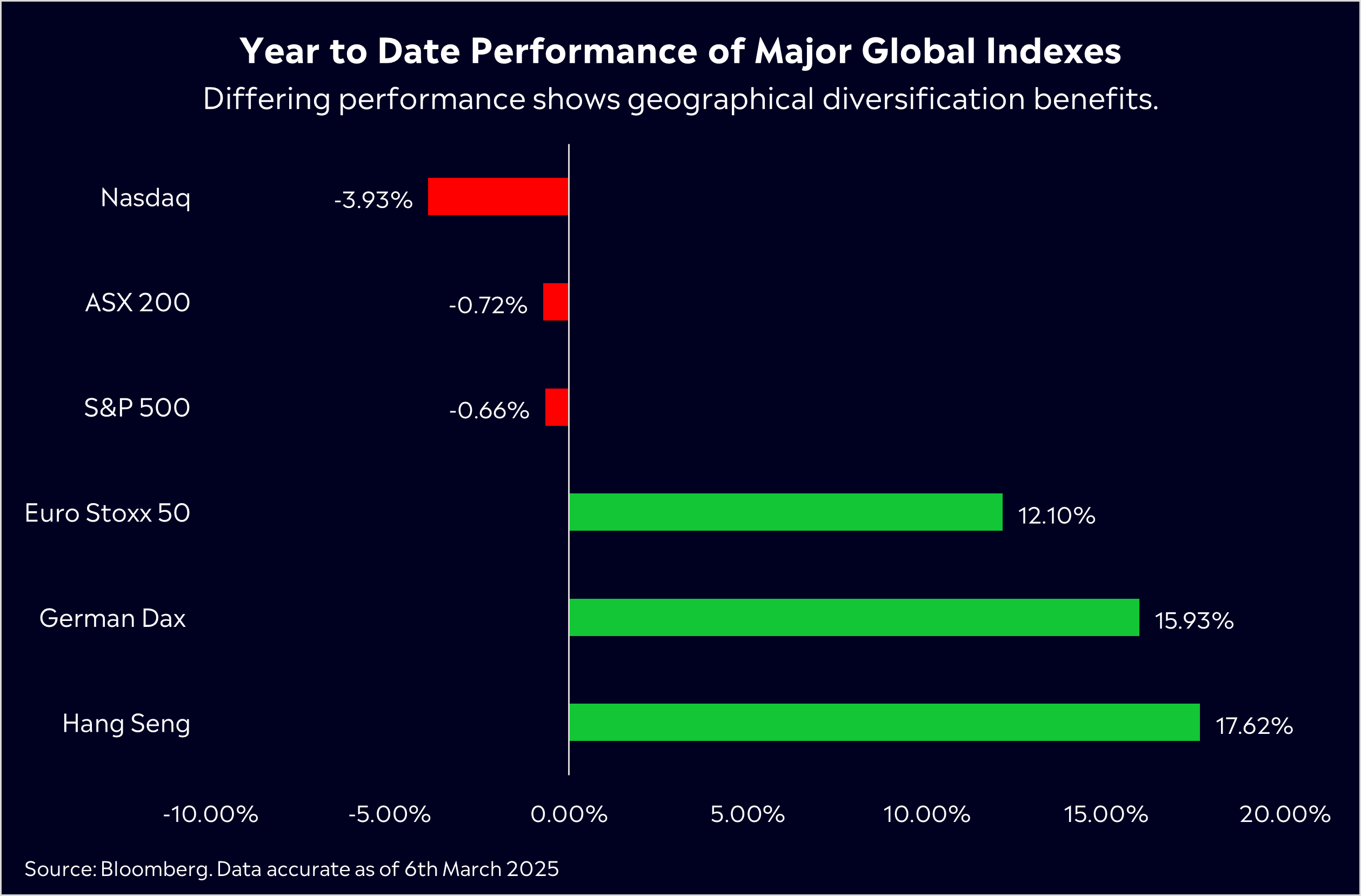

One other nice instance is geographical diversification. European inventory markets have been on a powerful run this 12 months, whilst international markets have pulled again. Yr to this point, the Euro Stoxx 50 has gained 12%, considerably outperforming the S&P 500, which has misplaced -0.66%. European earnings have performed a key function in sustaining market momentum. The This autumn earnings season exceeded expectations, reviving EPS development after a interval of stagnation. With valuations nonetheless enticing (the ahead price-to-earnings ratio for the Euro Stoxx 50 stands at 15.4x, considerably decrease than the S&P 500’s 21.5x) and a shifting macroeconomic panorama, European shares present a powerful case for diversification. Examples of European ETFs embrace: FEZ, VGK and EZU.

So, what’s subsequent for you as an investor?

As I’ve mentioned above, volatility may enhance additional, and the sell-off could deepen, but it surely’s nonetheless not a motive to run for the hills. When you’re a long-term investor, chances are you’ll discover alternatives to personal high quality corporations at much more enticing costs, but it surely’s about being astute. Consider market sell-offs as a Black Friday sale occasion. They solely seem every now and then. It’s irritating once you already personal the discounted merchandise (shares), but it surely’s an thrilling alternative when on the lookout for new shares as a result of they’re on sale. From a psychological perspective, the inventory market is the one place on this planet the place individuals run from decrease costs.

However, there’s additionally nothing fallacious with simply driving out the volatility and preserving that portfolio closed for some time. Both manner, right here’s what I’d be watching:

Preserve a detailed eye on commerce negotiations and tariff bulletins. Additional escalation of commerce tensions – comparable to new tariffs or breakdowns in talks – may spur extra market volatility and draw back for trade-sensitive shares. Sectors like autos, aerospace, know-how {hardware}, attire, and agriculture are particularly delicate: tariffs can both increase their prices or make their merchandise much less aggressive overseas. Against this, extra insulated sectors (utilities, finance, healthcare, actual property) may see much less direct affect. This might see a rotation from mega-cap tech shares into these specific sectors.

Conversely, any easing of tensions, rollbacks, or commerce offers could elevate the cloud of uncertainty and spark reduction rallies. We noticed this over the last commerce battle of 2018/19, so it might be on the horizon.

On the finish of February, the S&P 500 was buying and selling at 26x ahead earnings. As I mentioned earlier, it was priced to perfection. That meant little room for disappointment, however we received precisely that. The Magnificent Seven, alternatively, have seen valuations drop considerably, buying and selling as excessive as 36x ahead earnings at the beginning of the 12 months to 27x now.

Backside line? Whereas this pullback could also be robust for traders, notably these with heavy publicity to the Magnificent Seven, it’s a wholesome correction for the market general and traders shouldn’t panic when the market dips.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.