The Each day Breakdown takes a have a look at the large rally on Wall Avenue and the current breakout in Bitcoin. Can BTC proceed to run?

Wednesday’s TLDR

Shares set for extra beneficial properties

Tesla jumps on earnings

Bitcoin clears key technical space

What’s Occurring?

Earlier than we dive in, let’s be sure you’re set to obtain The Each day Breakdown every morning. To maintain getting our each day insights, all you should do is log in to your eToro account.

I used to be going to make use of this part to speak about Tesla’s earnings response. However with the S&P 500, Nasdaq 100 and different key indices boasting highly effective beneficial properties yesterday and this morning, the narrative have to be expanded (we’ll contact on Tesla’s earnings within the decrease part).

The SPY and QQQ ETFs closed increased by 2.6% yesterday. This morning, they’re up one other 2.2% and a pair of.7% in pre-market buying and selling, respectively.

What a distinction a day could make — and that saying is especially true on Wall Avenue. On Monday, shares had a wipe out. A day later, these beneficial properties have been erased and now we’re one other doubtlessly robust day within the markets.

Tuesday’s rally was kickstarted by feedback made by Treasury Secretary Scott Bessent in a closed-door investor summit that the commerce path with China is unsustainable and should de-escalate. Individually, President Trump made constructive feedback towards a cope with China, and regardless of prior feedback suggesting in any other case, mentioned he didn’t wish to hearth Fed Chair Powell.

Put all of them collectively and it’s not exhausting to see why shares are popping this morning. The query is, can this rally maintain itself? For the SPY, I’m nonetheless protecting a detailed eye on the 21-day shifting common and the $545 to $550 zone. Right here’s why.

Need to obtain these insights straight to your inbox?

Enroll right here

The Setup — Bitcoin

Bitcoin has been spectacular currently, because it now sports activities a ten% acquire for the week and has been forward of the current rally in shares. Bitcoin hasn’t been resistant to the pullback this 12 months, nevertheless it’s been decoupling from its correlation to tech shares, which is strictly what buyers wish to see.

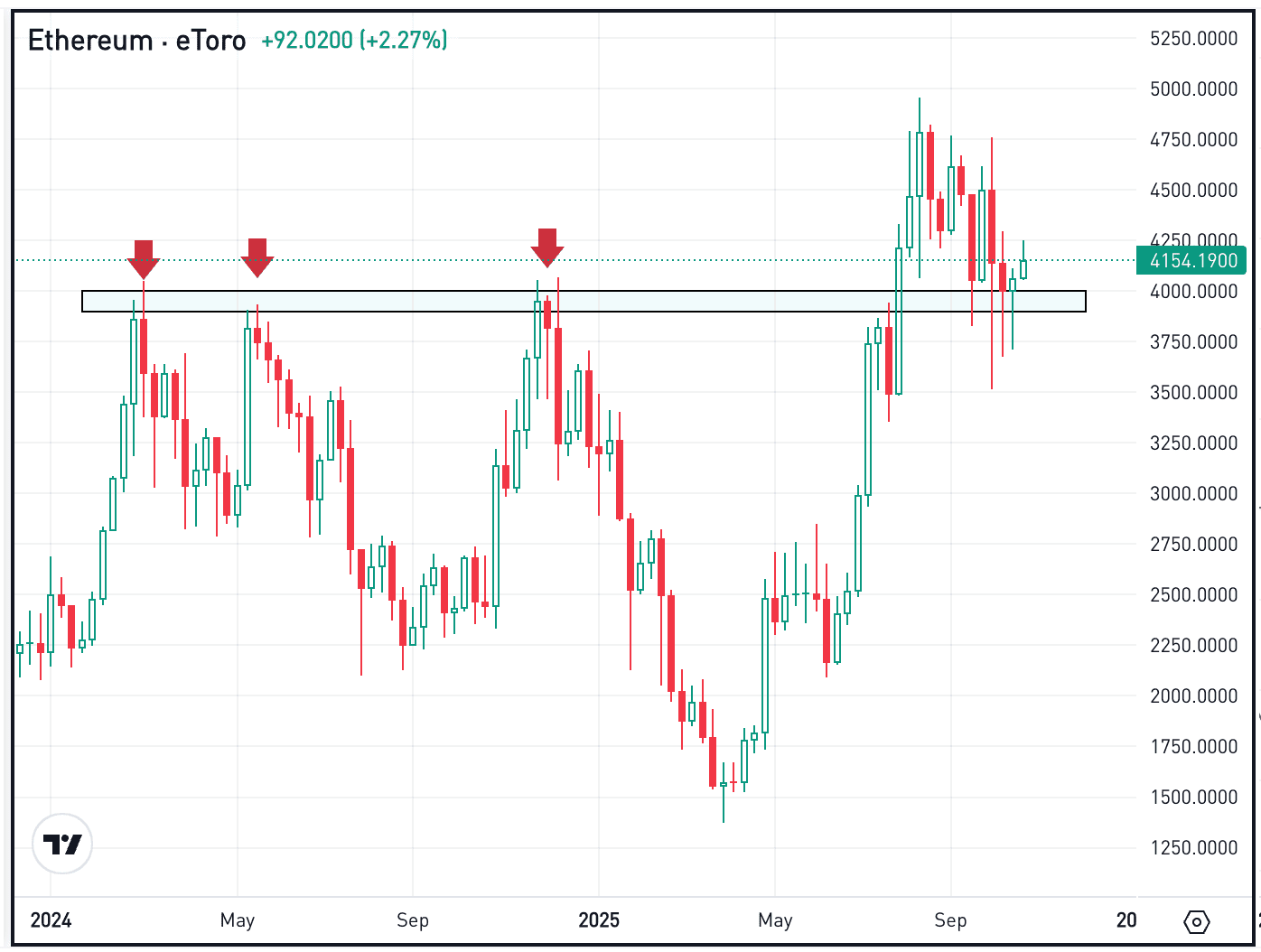

The current rally has been sufficient to thrust Bitcoin above some key ranges, together with the 200-day shifting common, in addition to a serious assist/resistance zone (blue field):

From right here, it’s fairly easy. Bulls wish to see BTC maintain up inside or above these main areas. If it might do, extra upside momentum can proceed. Nevertheless, if BTC breaks beneath these ranges, the promoting strain may re-accelerate.

The rally in BTC has given life to different cryptocurrencies as properly, together with Ethereum and Bitcoin Money. It’s additionally given a elevate to the IBIT ETF — which buyers can commerce choices on — in addition to crypto-related shares like MicroStrategy, MARA Holdings, and Riot Platforms, amongst others.

What Wall Avenue is Watching

TSLA – Tesla shares are up about 7% in pre-market buying and selling regardless of the corporate badly lacking earnings and income expectations. Income of $19.3 billion missed estimates of $21.4 billion, whereas earnings of 27 cents a share missed expectations of 43 cents a share. Each figures have been down 12 months over 12 months as properly.

Nevertheless, Musk mentioned he can be committing extra time again to Tesla, which is one thing buyers badly wished to listen to. Additional, he spoke promisingly about future applied sciences and merchandise. This can be a nice reminder to buyers that it’s the response to the information that always issues greater than the information itself. Try the chart for TSLA.

T – Shares of AT&T are rising in pre-market buying and selling after the agency delivered a top- and bottom-line earnings beat. Additional, the corporate reported better-than-expected postpaid internet cellphone subscribers. T inventory nonetheless pays a 4.1% dividend yield.

Disclaimer:

Please notice that because of market volatility, a number of the costs might have already been reached and eventualities performed out.