The Day by day Breakdown appears to be like on the newest GDP print, which confirmed an financial contraction for the primary time since early 2022.

Thursday’s TLDR

META & MSFT ship

GDP turns detrimental

BTC hits multi-month excessive

What’s Occurring?

Earlier than we dive in, let’s be sure to’re set to obtain The Day by day Breakdown every morning. To maintain getting our each day insights, all it is advisable do is log in to your eToro account.

Yesterday’s massive speaking level was the detrimental Q1 GDP print. Nonetheless, that dialogue appears to be taking a again seat to the large earnings responses from Meta and Microsoft.

Whew!

Bulls wanted mega-cap tech to report sturdy outcomes. Tech has a 30% weighting within the S&P 500 and has been the second-worst performing sector to this point this 12 months — about doubling the decline that SPY ETF has seen. Not solely are these a few of buyers’ favourite shares, however they’ve large weightings too.

That is nice to see, nevertheless it doesn’t ease among the worries round that detrimental GDP print, so let’s break that down.

Imports surged within the newest quarter, (which subtracts from US GDP). Imports jumped as companies positioned themselves forward of tariffs, making an attempt to keep away from pointless worth will increase. Additional, after 10 straight quarters of constructive contribution to GDP, authorities spending dipped. Given the Administration’s method to the federal authorities through DOGE, this contraction isn’t too shocking.

However outdoors of the noisy import/export information, enterprise and client spending was first rate. We’ve heard on company convention calls that client spending has been a bit of lumpy, however regular all through 2025.

That is the large one to know: Private consumption is greater than two-thirds of the GDP report. It confirmed annualized development in Q1, however posted its lowest determine in virtually two years. Shoppers proceed to spend, which is nice, however falling confidence appears to be holding them again.

Wish to obtain these insights straight to your inbox?

Join right here

The Setup — Meta

Final evening, Meta beat on earnings and income expectations and spoke optimistically sufficient on its convention name to get buyers excited. In response, shares are increased by about 5% to six% in pre-market buying and selling.

Yesterday we checked out some key ranges for Microsoft. With it above its 200-day in pre-market buying and selling, it’d be nice to see it clear this measure and keep above it in right this moment’s common session.

Can Meta do the identical factor?

Once I have a look at Meta, I see a inventory that discovered help close to $480, then cleared downtrend resistance (the blue line) forward of earnings.

You may discover the worth vary I added to the best facet of the chart, exhibiting what a 6% rally appears to be like like from yesterday’s shut. That places it proper close to $580, $100 a share off the latest lows, and proper into the 50-day and 200-day shifting averages.

Be at liberty so as to add a few of these measures to your individual Meta charts, too.

From right here, bulls will need to see META inventory cost by these measures and begin to use them as help. Bears will hope that these measures are resistance. If Meta does break by them although, a bigger rebound might ensue.

Choices

For some buyers, choices may very well be one different to take a position on Meta. Keep in mind, the chance for choices consumers is tied to the premium paid for the choice — and dropping the premium is the total threat.

Bulls can make the most of calls or name spreads to take a position on additional upside, whereas bears can use places or put spreads to take a position on the good points tapering off and Meta rolling over.

For these trying to study extra about choices, contemplate visiting the eToro Academy.

What Wall Road is Watching

MSFT – Microsoft shares are increased by about 9% in pre-market buying and selling. The corporate cruised previous analysts’ earnings and income expectations, and delivered sturdy cloud outcomes with its Azure unit. What’s extra, administration spoke favorably about bettering working margins for the 12 months.

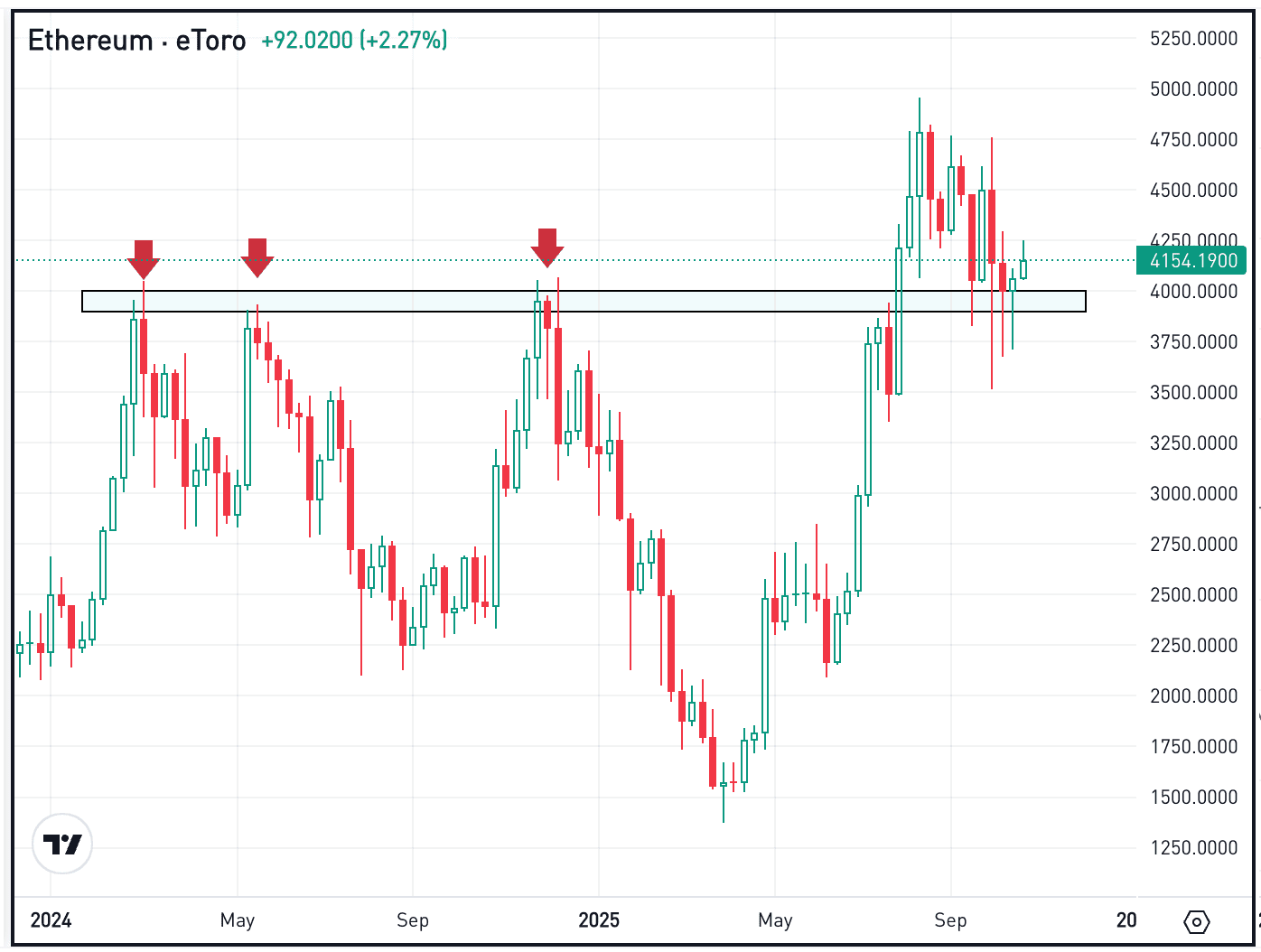

BTC – Bitcoin has been holding up nicely over the previous few weeks and continues to inch increased. It’s now at its highest stage since February twenty fourth, formally hitting a multi-month excessive. It’s received some questioning if $100K is subsequent and whether or not it will possibly elevate different cryptocurrencies, like ETH. Take a look at the chart for BTC.

Disclaimer:

Please notice that because of market volatility, among the costs might have already been reached and situations performed out.