The Day by day Breakdown appears on the S&P 500 as we wrap up Q2 earnings season. Elsewhere, Palantir bulls search for help.

Earlier than we dive in, let’s ensure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our each day insights, all it’s good to do is log in to your eToro account.

What’s Occurring?

Roughly 97% of S&P 500 corporations have reported Q2 earnings, and up to now it’s been much better than anticipated. We already know what lots of the corporations have been saying on Wall Road — first from the banks and bank card firms, then with retailers.

Now listed below are among the key stats from the quarter, with Q2’s earnings report card for the businesses which have reported up to now:

81.4% of S&P 500 corporations have beat analysts’ expectations, placing the S&P 500 on tempo to determine its greatest “beat fee” since Q3 2021.

Conversely, the speed of earnings misses — the “miss fee” — stands at simply 14.5% proper now. That’s the bottom miss fee in nearly 4 years (Q3 2021).

Analysts got here into the quarter anticipating about 2.8% earnings progress. Exiting the quarter, S&P 500 corporations are clocking a progress fee nearer to 10.7% proper now. That unfold — 7.9 share factors — is likely one of the widest spreads in a number of years.

Corporations that beat Q2 earnings estimates posted a rally that was roughly in-line with the typical (going again to 2020). Nonetheless, firms who missed expectations have seen the worst response up to now this decade, down a median of 5.3% — nearly double the typical decline of two.9% within the prior quarters since 2020. Particularly, tech and healthcare shares have been punished most for lacking.

On the income entrance, 68.8% of corporations are beating estimates, the best beat fee since This autumn 2021. For context, final quarter that determine stood at simply 51.1% and hasn’t topped 60% since Q1 2023.

If you’re questioning what among the longer-term implications from this quarter could also be, look no additional than the S&P 500’s anticipated earnings per share over the following 12 months, because it hits a brand new all-time excessive.

Wish to obtain these insights straight to your inbox?

Join right here

The Setup — Palantir

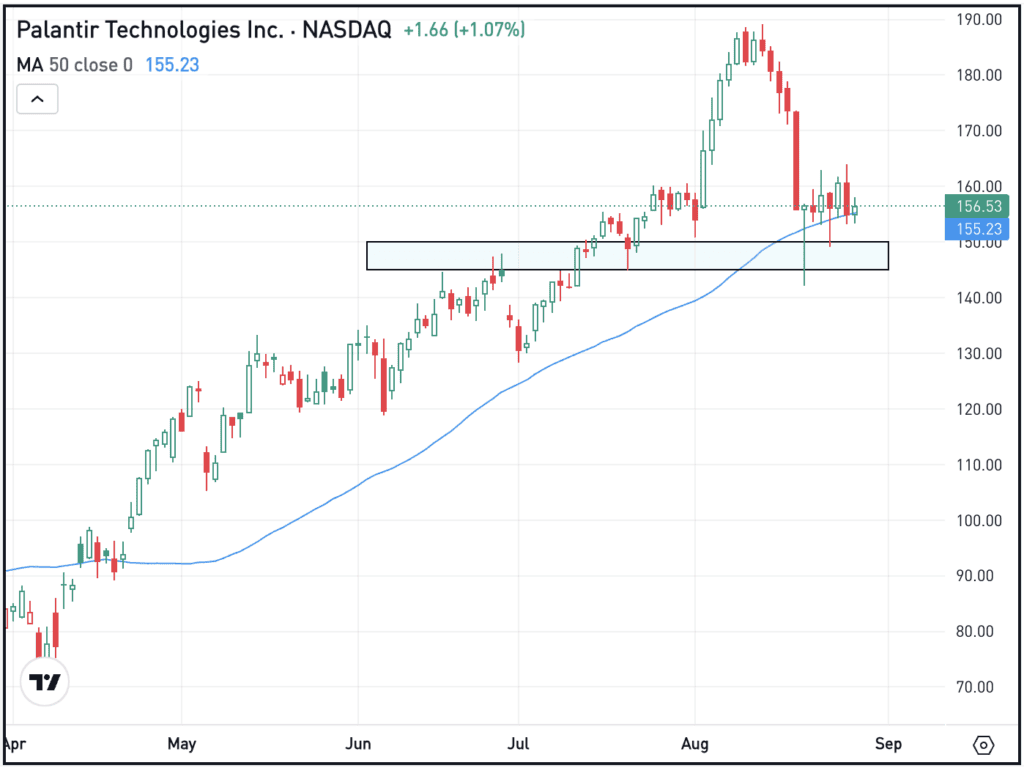

Palantir has been on a tremendous run up to now this yr. Regardless of the inventory’s present pullback, shares are nonetheless up 109% up to now in 2025 and are up 421% over the previous yr. Bulls are on the lookout for a bounce amid the present pullback, and a minimum of for now, shares are discovering help close to the $150 space, in addition to the 50-day transferring common.

If this space stays help, bulls will wish to finally see a rally over the $165 degree — which has been latest resistance over the previous week — opening the door to doubtlessly larger costs. Nonetheless, if present help breaks, bearish momentum may ensue.

Choices

Shopping for calls or name spreads could also be one technique to reap the benefits of a potential rally. For name patrons, it might be advantageous to have ample time till the choice’s expiration.

People who aren’t feeling so bullish or who’re on the lookout for a deeper pullback, places or put spreads could possibly be one technique to take benefit.

For these trying to study extra about choices, think about visiting the eToro Academy.

Disclaimer:

Please be aware that on account of market volatility, among the costs could have already been reached and situations performed out.