The Day by day Breakdown takes a better take a look at leveraged ETFs, which have been extremely unstable within the present market surroundings.

Friday’s TLDR

Leverage can damage

Breaking down Berkshire inventory

The Backside Line + Day by day Breakdown

Leverage can are available many kinds nowadays. As an example, it could possibly come from choices, margin, and leveraged ETFs*. Whereas leverage can flip into an addictive use of capital when instances are good, the state of affairs can get fairly darkish when volatility will increase.

Observe the current efficiency of some well-liked leveraged ETFs (primarily based buying and selling volumes):

Traders utilizing leveraged-bull ETFs could also be struggling this 12 months. As an example, whereas the QQQ ETF is down 4.5% for the 12 months, the 3x leveraged lengthy ETF (TQQQ) is down greater than 16%. Or discover how the semiconductor ETF — the SMH — is down 9.3% for the 12 months, whereas the 3x leveraged ETF (SOXL) is down nearly 30% this 12 months!

You would possibly see “3x leveraged ETFs” however then surprise why these autos aren’t actual multiples of the underlying asset. For instance, why the TQQQ ETF is down 16.4% as an alternative of down 13.5% (a -4.5% loss for QQQ multiplied by 3). This is named “decay.”

Leveraged ETFs lose worth over time attributable to every day rebalancing to take care of their leverage ratio. This course of can erode returns over time, and significantly in unstable markets. As an example, even when the underlying index have been to stay flat, the worth of the leveraged ETF can lower attributable to this every day rebalancing mechanism.

On the desk above, you’ll discover that the leveraged-bear ETFs are up on the 12 months — which is predicted given the current worth motion — however maybe not up fairly as a lot as buyers would have hoped in some circumstances.

Once more, that’s “decay” at work.

There Are Positives, Too

Regardless of a number of the pitfalls of leveraged ETFs, they are often useful too.

Lengthy-term buyers in these belongings can endure from decay — even after they’re proper on the course of the underlying index or asset. Nevertheless, short-term buyers utilizing these autos attempting to make the most of present market situations or as a hedge on their portfolio can revenue from them when timed appropriately.

The Backside Line

Finally, unstable environments like this spotlight the hazards and the alternatives that may come from utilizing leveraged ETFs. They are often worthwhile in some circumstances, however they will also be harmful when buyers have an excessive amount of publicity to them — particularly when the underlying course seems to be fallacious.

Typically talking, the extra leverage that’s concerned, the higher timing buyers will want.

On the flip facet, some ETFs exist — just like the SPLV, which follows the 100 least unstable shares within the S&P 500 — that aren’t designed to seize volatility, however keep away from it.

No matter buyers determine — be it with or with out leveraged ETFs, utilizing choices to hedge, elevating money to buffer elevated volatility, or standing agency and doing nothing — it needs to be primarily based on what’s finest for their very own threat tolerance, funding objectives, and portfolio.

*Leveraged ETFs observe belongings and attempt to multiply their returns. For instance, if a 2x leveraged ETF have been to extend in worth, that improve can be double an an identical, non-leveraged ETF. Nevertheless, if that 2x leveraged ETF decreases in worth, that lower will double, too. They’re sometimes short-term merchandise and usually are not applicable for all buyers.

Need to obtain these insights straight to your inbox?

Join right here

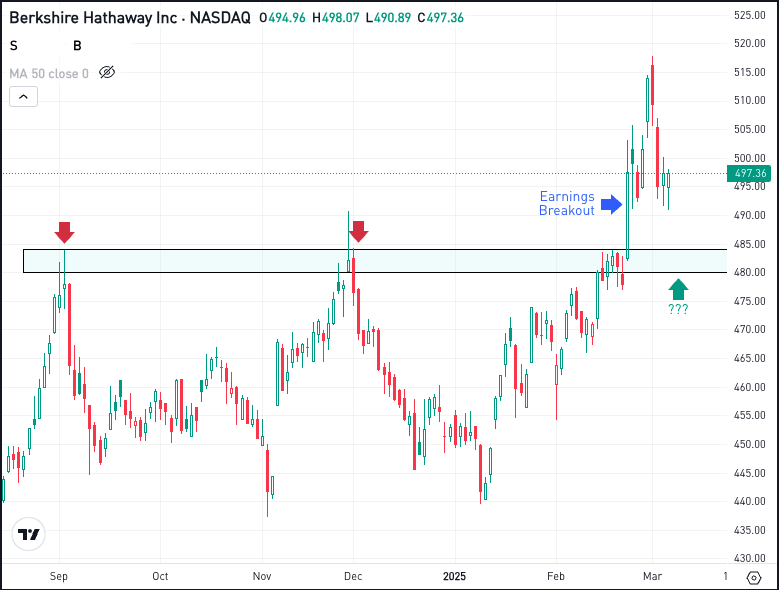

The setup — Berkshire Hathaway

Thursday was a troublesome day in markets, however Berkshire Hathaway truly held up fairly nicely. Regardless of the 1.8% fall for the S&P 500, BRK.B fell simply 0.1%.

To not point out, shares are up nearly 10% on the 12 months, whereas the S&P 500 is definitely down about 2.5% to date in 2025. In different phrases, Warren Buffett’s agency has been doing fairly nicely these days.

That’s why some buyers could also be watching this one in case of a dip.

Keep watch over the $480 to $485 space. Ought to BRK.B pull again that far, it will signify a dip of about 7% from the current report highs.

If Berkshire pulls again and holds this space as help, we may see a rebound. If help fails, then extra bearish momentum may ensue.

Choices

One draw back to BRK.B is its share worth. As a result of the inventory worth is so excessive, the choices costs are extremely excessive, too. This could make it tough for buyers to method these firms with choices.

In that case, many merchants might choose to only commerce a couple of shares of the widespread inventory — and that’s tremendous. Nevertheless, one various is spreads.

Name spreads and put spreads permit merchants to take choices trades with a a lot decrease premium than shopping for the calls outright. In these circumstances, the utmost threat is the premium paid.

Choices aren’t for everybody — particularly in these situations — however spreads make them extra accessible. For these seeking to study extra about choices, contemplate visiting the eToro Academy.

Disclaimer:

Please word that attributable to market volatility, a number of the costs might have already been reached and situations performed out.