As the worldwide crypto trade matures and shifts towards regulation, nations are jockeying for place because the world’s main crypto hub. However what’s a crypto hub precisely? It’s not only a regulatory protected haven; it’s a dynamic intersection of innovation, investor confidence, institutional participation, and public-private collaboration.

Among the many frontrunners, Hong Kong, the United Arab Emirates (UAE), and Singapore are locked in a high-stakes race, every deploying strategic insurance policies, infrastructure, and capital to draw blockchain expertise, institutional gamers, and innovation. Which nation is main in cryptocurrency as of 2025? Let’s break it down.

The Regulatory Struggle Room: Who’s Writing the Finest Guidelines?

The race to construct probably the most engaging and future-proof crypto regulatory framework is heating up. Every contender is staking its declare to be the nation that turns into the international crypto hub.

Hong Kong has bounced again with function. As soon as sidelined by China’s crypto ban, it now boasts a licensing regime for Digital Asset Buying and selling Platforms (VATPs), with 11 licenses granted as of June 18, 2025. Whereas 15 functions had been rejected or withdrawn and 9 are nonetheless pending, Hong Kong’s efforts present dedication, not chaos. The launch of the ASPIRe roadmap—centered on Entry, Safeguards, Merchandise, Infrastructure, and Relationships—indicators a long-term imaginative and prescient to deal with market fragmentation and construct a resilient crypto ecosystem. It’s paying off: a 2024 Chainalysis report reveals Hong Kong main Japanese Asia with an 85.6% development in crypto exercise.

Is Dubai a crypto hub within the Center East? All indicators level to sure. The UAE has moved rapidly and boldly. With the launch of VARA in 2022, the world’s first devoted crypto regulator, Dubai, set new requirements for regulatory velocity and scope. It’s clear that complete guidelines cowl all the things from NFTs to staking and custody, making it a go-to vacation spot for international crypto companies in search of construction with out extreme friction.

Additionally Learn: Evaluating the United Arab Emirates’ Crypto Ambitions

Singapore stays probably the most measured of the three. Ruled by the Financial Authority of Singapore (MAS), the city-state’s regulatory structure is outlined by stability, compliance, and long-term threat administration. Beneath the Cost Providers Act (PSA) and the Digital Cost Token (DPT) regime, companies are required to fulfill excessive requirements in threat mitigation and client safety. Whereas this has earned Singapore a popularity for security and belief, it additionally means a slower tempo of adoption. Notably, MAS has now mandated that crypto companies halt abroad Digital Token (DT) actions by June 30, 2025, except they safe a Digital Token Service Supplier (DTSP) license, signalling an excellent tighter grip on cross-border compliance. However is Singapore a crypto-friendly nation? Completely—although in a cautious, institutional method.

Associated: Hong Kong and Singapore Lead Asia’s Race to Turn into Crypto Hubs Amid International Increase

Taxation, Capital Controls, and Institutional Enchantment

The center of what makes a rustic a crypto hub usually lies in taxation and capital mobility. Which nation is the crypto hub materials primarily based on these components? Let’s dig in.

Hong Kong is making a calculated push. With a territorial tax system taxing solely domestically derived earnings at 15–16.5%, it already gives a aggressive edge. Nonetheless, in November 2024, the federal government proposed a major improve: tax exemptions on cryptocurrency positive factors for hedge funds, personal fairness companies, and institutional funding automobiles. This transfer, geared toward positioning Hong Kong as Asia’s prime crypto hub, pairs nicely with its gateway entry to each mainland China and international capital markets, creating an irresistible components for institutional gamers.

The UAE, nevertheless, might need the last word cheat code. With zero revenue tax, no capital positive factors tax, full international possession in free zones like DMCC and DIFC, and crypto-friendly banks, it has develop into a magnet for high-net-worth people and crypto whales. The liberty to maneuver capital with no restrictions solely sweetens the deal. Is Dubai a crypto hub within the truest sense? Sure—and it’s constructed for whales and wealth managers.

Singapore stays strategic. Whereas there’s no capital positive factors tax, crypto earnings from enterprise actions are taxed as revenue. Nonetheless, MAS’s help for innovation just like the International Finance and Tech Community (GFTN) retains it interesting for fintech builders, even when it’s extra measured.

Tradition and Politics: Belief, Threat, and the Vibe Examine

Crypto could also be constructed on code, however belief, notion, and politics form the place folks put their cash. Tradition counts, particularly when figuring out which nation is main in crypto adoption at each institutional and retail ranges.

Hong Kong is a paradox. Whereas it’s a part of China, its authorized system nonetheless operates independently underneath the “one nation, two methods” precept. This has saved institutional confidence excessive. Ranked the second most crypto-friendly metropolis globally, with a median of $97,000 in crypto holdings per consumer, Hong Kong indicators a deep conviction from each retail and institutional buyers. There’s authorized belief, market entry, and a starvation for relevance on the worldwide crypto stage.

The UAE, however, is unabashedly bullish. With sturdy backing from the highest, together with Sheikh Mohammed’s pro-crypto imaginative and prescient, it has rapidly advanced right into a beacon for international crypto elites. The Golden Visa program makes Dubai a real crypto hub, and the current removing from the FATF gray listing boosts its legitimacy. Blockchain already powers many authorities providers, and Dubai’s way of life, mixed with its regulatory boldness, makes it really feel like a real crypto capital.

Singapore stays the disciplined participant. Globally revered, politically steady, and tech-forward, it gives unmatched security and regulatory maturity. But, its cautious stance—particularly on retail-facing crypto promoting—retains the cultural vibe reserved.

CBDC and Stablecoin Experimentation: The Innovation Race

Within the competitors to develop into the main crypto hub, it’s not sufficient to only regulate—you’ve bought to innovate. What’s a crypto hub with out experimentation? And that’s precisely what these areas are doing via daring experimentation with CBDCs and stablecoins.

Hong Kong is firing on all cylinders. The e-HKD pilot, launched in 2023 by the Hong Kong Financial Authority (HKMA), is testing superior use instances like programmable funds, tokenized deposits, and cross-border remittances. In Could 2025, Hong Kong handed the Stablecoin Ordinance, with licensing necessities set to take impact by August. Including its wholesale CBDC work via Mission Ensemble and experimentation with AI-finance sandboxes, Hong Kong seems each regulatory and experimental.

The UAE isn’t far behind. Its Digital Dirham, anticipated by late 2025, is designed to spice up real-time settlements, particularly in commerce finance. By means of mBridge, the UAE companions with China, Thailand, and the BIS to discover using cross-border CBDCs. In the meantime, the DFSA has already acknowledged USDC and EURC as regulated tokens—setting a precedent for stablecoin legitimacy.

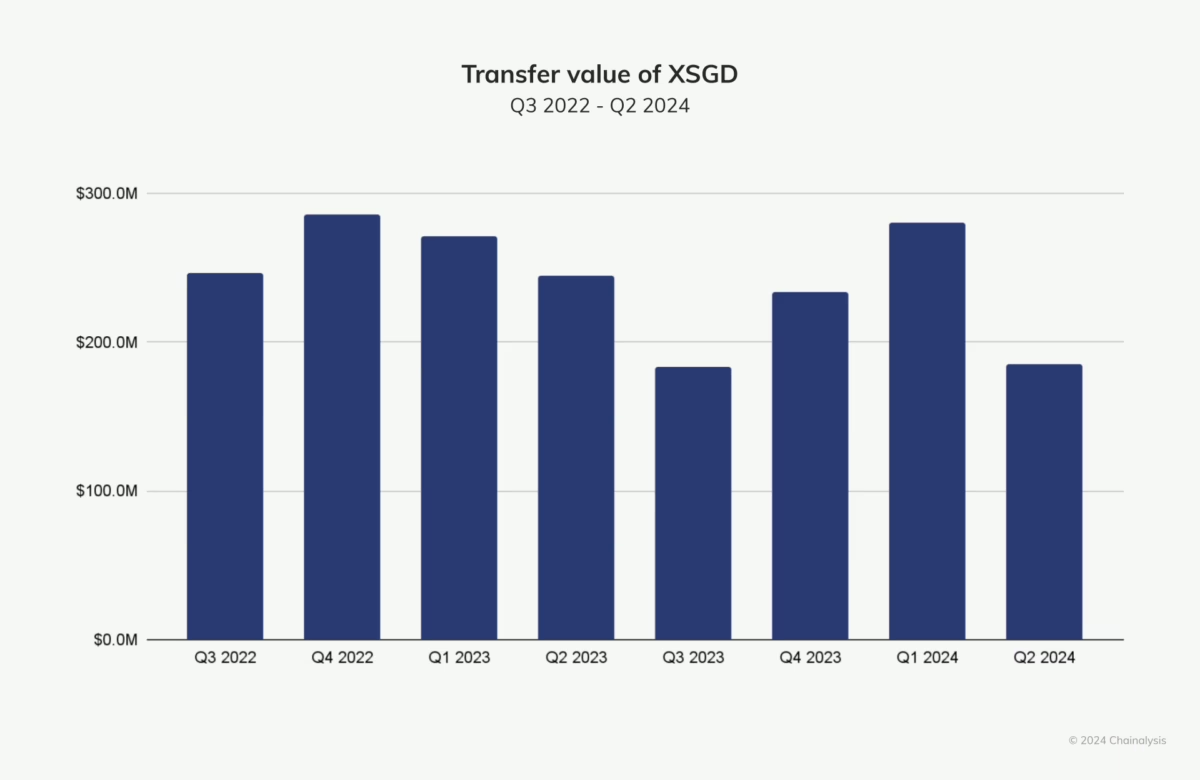

Singapore is taking a measured but forward-looking strategy to digital foreign money innovation. By means of Mission Orchid, it’s exploring retail-focused CBDC use instances, together with 2024 pilots of Function-Certain Cash (PBM) with companies like Seize, enabling tokenized retail vouchers and programmable funds. Within the stablecoin house, XSGD, launched by StraitsX in 2020, stands out for being totally backed 1:1 by reserves held with DBS Financial institution and Normal Chartered. StraitsX is licensed by the Financial Authority of Singapore (MAS) as a Main Cost Establishment, giving XSGD regulatory legitimacy and multi-chain deployment capabilities. Since Q3 2022, XSGD has persistently recorded quarterly switch volumes exceeding $200 million, highlighting sturdy market confidence.

This belief is additional supported by MAS’s August 2023 stablecoin regulatory framework, which units strict guidelines for issuer reserves, asset segregation, and custody. Singapore’s cautious mix of innovation and regulation positions it as a trusted chief in retail digital finance. Is Singapore a crypto-friendly nation? In relation to retail belief and innovation, sure—quietly so.

Last Scorecard

So Who’s Profitable the Crypto Crown in 2025?

Because the digital mud settles in 2025, the race to develop into the world’s main crypto hub has reworked right into a fierce contest of execution, imaginative and prescient, and adaptableness. From regulation to innovation, every contender, Hong Kong, the UAE, and Singapore, has carved out a definite id within the international crypto panorama.

Hong Kong stands out as probably the most outstanding comeback tales. It has efficiently blended regulatory readability with daring innovation. With the ASPIRe roadmap, a strong stablecoin licensing regime, and CBDC pilots backed by monetary giants, Hong Kong isn’t simply reopening its doorways—it’s reinventing its crypto economic system. Add to that new tax incentives and deep institutional curiosity, and town positions itself because the nexus of East-meets-West capital and regulation.

The UAE brings unmatched tax benefits, capital freedom, and cultural momentum. Its early mover standing with VARA, plus the fast rollout of the Digital Dirham and mBridge collaborations, reveals that it’s not only a playground for crypto elites—it’s severe about constructing a compliant, progressive ecosystem. Dubai’s attract as a life-style and enterprise vacation spot solely strengthens its enchantment as a crypto magnet.

Singapore, whereas much less flashy, performs the lengthy recreation with methodical precision. Its cautious stance on retail publicity and promoting may restrict fast hype. Nonetheless, its international respect, monetary self-discipline, and constant help for tokenization via Mission Orchid and GFTN maintain it firmly within the recreation.

Verdict: In 2025, Hong Kong wears the crown—quick, fearless, and institutionally backed. The UAE is the closest challenger, providing freedom, tax energy, and a compelling way of life. Singapore stays a silent drive, disciplined, steady, and all the time a contender in the long term. The worldwide crypto race isn’t over, however the frontrunners are actually unmistakably clear.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”