The SEC has obtained six XRP ETF functions during the last a number of weeks as curiosity in conventional crypto funding automobiles continues rising

Coinshares despatched a proposal for XRP and Litecoin ETFs whereas Grayscale despatched one for XRP amid a number of proposals for Solana ETFs

The SEC has obtained a minimum of six functions for XRP exchange-traded funds (ETFs) from main issuers like Canary Capital, Grayscale, Bitwise, WisdomTree, 21Shares, and Coinshares.

The newest utility, Grayscale, started the 21-day remark interval on Friday the place members of the general public can submit suggestions on the proposed ETF.

Whereas this occurs, 5 Solana ETF functions from 21Shares, Bitwise, Grayscale, VanEck, and Canary await a choice.

The rise of curiosity in ETFs

The latest swarm of ETF functions is emblematic of a shift within the regulatory panorama to a extra pleasant setting. This shift started on the twilight of former Securities and Change Fee (SEC) chair Gary Gensler’s tenure with the approval of the Bitcoin and Ethereum ETFs in 2024.

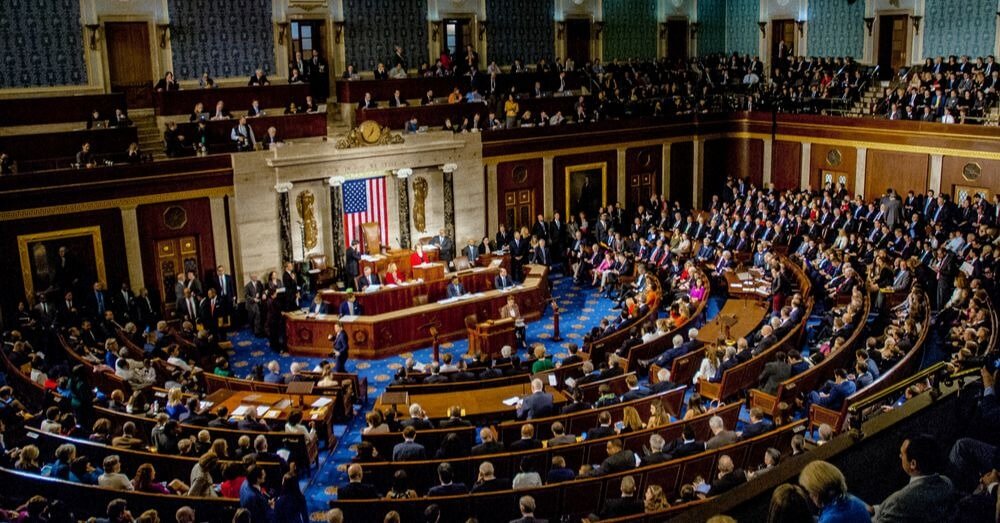

Now that Mark Uyeda, a pro-crypto official, is in workplace, mixed with probably the most pro-crypto Congress the US has ever seen, the regulatory panorama is predicted to be friendlier. Moreover, Ripple Labs’ win in opposition to Gensler’s SEC has additionally positioned it in a beneficial development place.

President Donald Trump signed an government order to create a sovereign wealth fund that may embody cryptocurrencies. Whereas Bitcoin is predicted to be on the checklist, latest developments might place XRP within the fund as effectively.

In January, Trump met with Brad Garlinghouse, CEO of Ripple, who’s pushing for the sovereign wealth fund to include a couple of cryptocurrency, ideally XRP as effectively.

Some ideas on maximalism… let me say this as clearly as I can – the crypto business has an actual shot, right here and now, to realize the numerous objectives we now have in frequent, IF we work collectively as a substitute of tearing one another down. This isn’t, and by no means will likely be, a zero-sum sport.

• I personal…

— Brad Garlinghouse (@bgarlinghouse) January 27, 2025

An XRP ETF approval might cement the crypto as a candidate for the reserve.

Ripple is the third largest crypto by market cap and trades at $2.48 as of publishing.

Litecoin ETF approval

Regardless of this, Bloomberg ETF analysts James Seyffart and Eric Balchunas consider {that a} Litecoin ETF has a 90% likelihood of being permitted in 2025.

In a put up on X, the pair primarily centered on Dogecoin, Litecoin, Solana, and XRP. Of their view, Dogecoin ETF has a 75% likelihood of approval, a Solana ETF has a 70% likelihood, and an XRP ETF has a 65% approval ranking.

Seyffart added that it’s unlikely the market will see an XRP ETF till the entire Ripple/XRP/SEC case is settled, completed, or has some form of end result.

“The SEC must untangle that mess,” he mentioned.