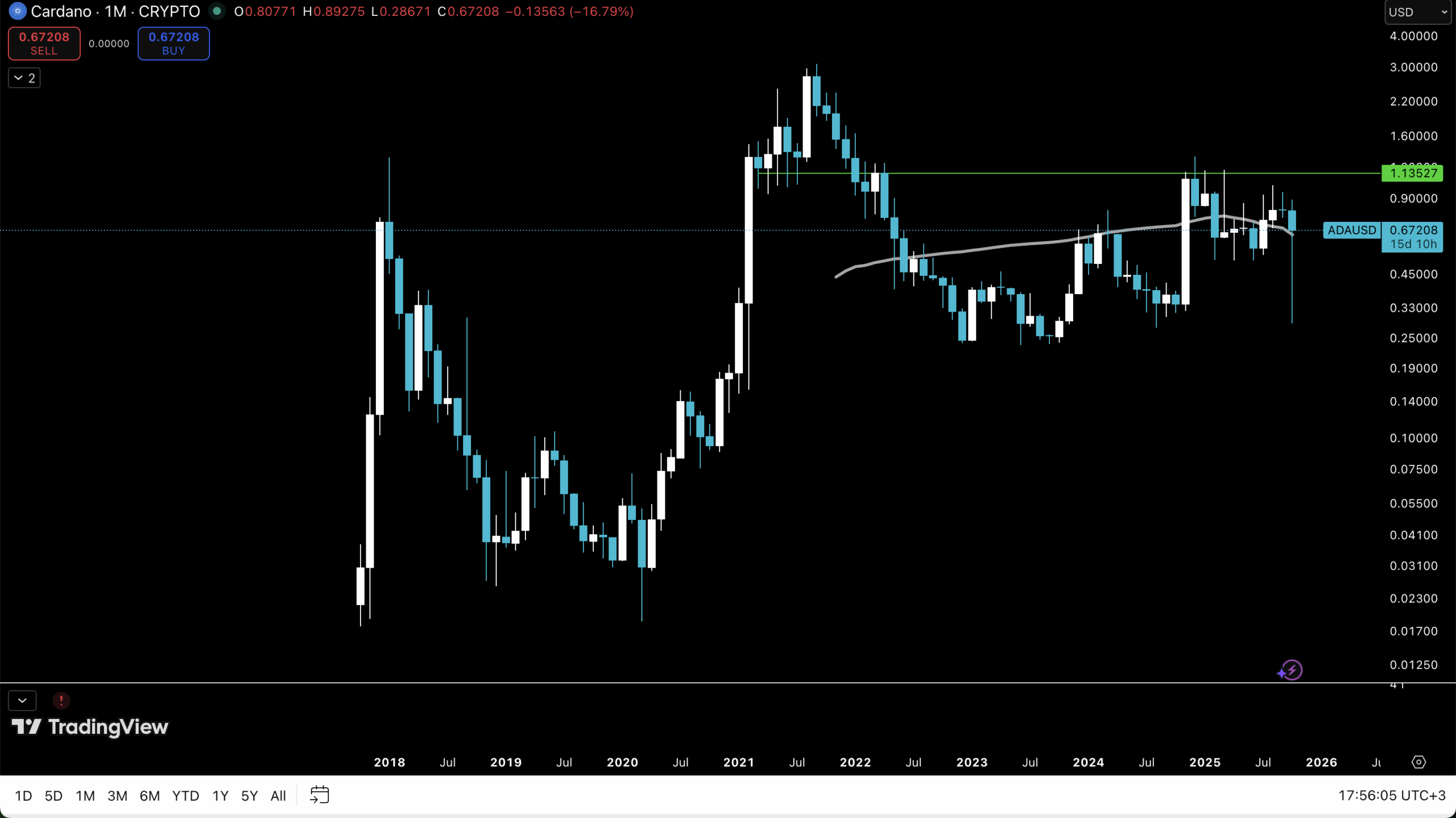

TRON (TRX) has been experiencing muted efficiency in current weeks, buying and selling at $0.3389 on the time of writing. This represents a 21.4% decline from its all-time excessive of $0.4313, recorded late final yr.

Regardless of comparatively steady worth ranges in current days, the dearth of upward momentum suggests buyers is likely to be fastidiously anticipating a catalyst that might decide the token’s subsequent main transfer.

Amid this market setting, analysts are carefully monitoring TRON’s on-chain knowledge. One key remark comes from CryptoQuant contributor CryptoOnchain, who examined community exercise and resistance ranges.

In line with the analyst, TRX is at the moment testing its historic resistance zone, a degree that might show decisive in whether or not the asset pushes towards larger targets or dangers one other setback.

Associated Studying

TRON Community Exercise and Potential Breakout

CryptoOnchain famous that TRON’s community exercise is at report ranges, with day by day lively addresses (DAA) surpassing 2.6 million, the very best determine in its historical past.

This surge in person exercise displays robust underlying demand for the community, even whereas TRX’s worth has struggled to interrupt larger. Traditionally, such progress in addresses has acted as a basic driver for worth power, signaling that demand for TRON’s blockchain companies stays resilient.

The analyst highlighted that TRX sits slightly below its historic resistance. If the token had been to shut above its all-time excessive and maintain that degree, the breakout goal might vary between $0.48 and $0.52, aligning with TRON’s On-Chain Worth Bands metric.

Nevertheless, CryptoOnchain cautioned that this situation relies upon closely on TRON sustaining its lively tackle momentum. A decline in DAA might undermine the bullish setup, exposing TRX to draw back danger.

The outlook additionally ties into broader market circumstances. The CryptoQuant analyst believes {that a} potential altseason, a interval of great good points throughout altcoins, might present the momentum wanted for TRX to realize a breakout. On this context, continued excessive community demand and person exercise would assist additional worth appreciation.

Whale Exercise and Stablecoin Dynamics

In a separate evaluation, CryptoQuant contributor Amr Taha examined stablecoin flows on the TRON community, significantly the exercise of huge wallets.

Information confirmed that previously 24 hours, wallets holding over $100 million in USDT dominated TRON’s transaction quantity, coinciding with Bitcoin regaining momentum above the $110,000 degree.

This focus of huge transfers is important as a result of it typically precedes shifts in broader crypto market sentiment. A notable instance occurred on August 12, when $100M+ wallets moved roughly $3.9 billion in USDT throughout the TRON community.

That wave of transfers straight coincided with a 5% rally in Bitcoin, highlighting the function of stablecoin liquidity in driving market cycles.

Associated Studying

Taha added that the distribution of day by day USDT pockets adjustments reinforces this development. Wallets with balances above $100M accounted for almost 35–36% of whole day by day exercise, a degree almost equivalent to August’s inflows.

Such concentrated whale exercise means that stablecoin flows on TRON stay a number one indicator for market positioning and potential capital rotations into danger belongings like TRX and Bitcoin.

Featured picture created with DALL-E, Chart from TradingView