Key Takeaways:

UBS completes the primary absolutely in-production, end-to-end tokenized fund transaction utilizing Chainlink’s Digital Switch Agent (DTA) customaryDigiFT acts as on-chain distributor to course of reside subscription and redemption of the uMINT money-market token on EthereumSeamless institutional fund lifecycle runs on-chain with automated compliance, cross-chain connectivity, and real-time knowledge sync

UBS simply set a brand new milestone for institutional blockchain adoption. In a reside transaction with Chainlink and DigiFT, the worldwide banking big processed the primary ever subscription and redemption of a tokenized fund absolutely on-chain not as a pilot, however in a manufacturing atmosphere.

This transfer demonstrates that tokenized property are not a theoretical future; they’re being applied on a scale by one of many world’s strongest monetary establishments.

Learn Extra: Chainlink Companions with Polymarket to Speed up $100B Community of Oracle Ecosystem

UBS Brings Actual-World Finance Totally On-Chain

With greater than 6 trillion of property underneath administration, UBS applied a reside fund workflow with its UBS USD Cash Market Funding Fund Token (uMINT) that was developed on Ethereum. Chainlink DTA customary, a technical customary utilized by the financial institution to automate fund processing in blockchains and inside banking methods, was employed.

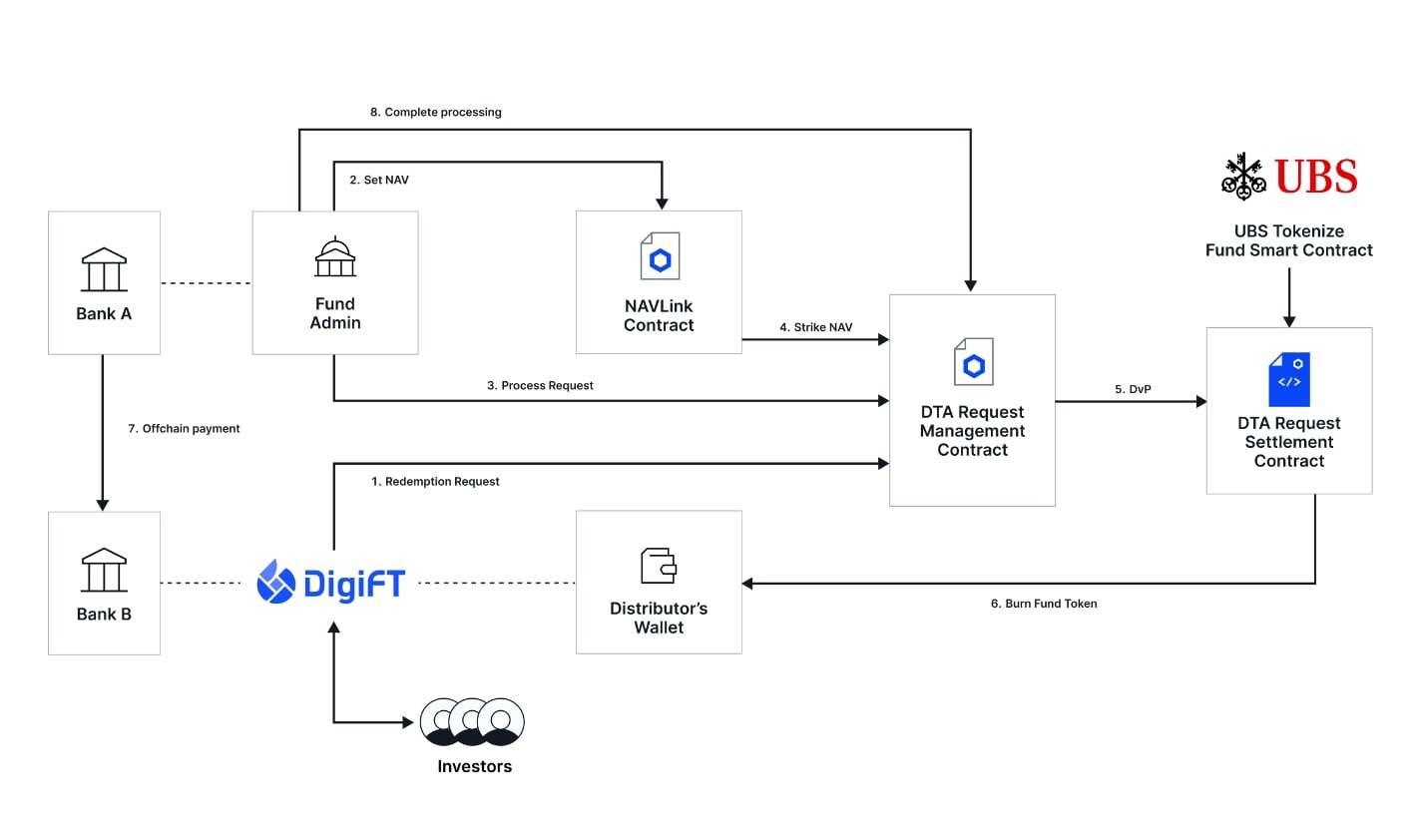

DigiFT was the licensed on-chain distributor and offered and registered investor subscription and redemption orders in actual time.

Your entire life cycle of the fund transaction was addressed within the workflow:

Order initiationExecutionSettlementReconciliation throughout on-chain and off-chain methods

The reason being that it’s the first time an essential financial institution automated these steps efficiently on blockchain structure with no sandbox atmosphere. UBS states that its Tokenize venture will allow the on-chain supply of regulated monetary merchandise with out sacrificing institutional-level compliance and safety.

That is after earlier partnership between UBS and Chainlink in Singapore in Mission Guardian which is a regulatory-focused venture exploring tokenized finance and interoperability.

Learn Extra: Wall Road’s Quiet Crypto Takeover: New Charts Reveal Who’s in and Who’s Nonetheless Blocking Entry

How Chainlink’s Infrastructure Powered the Workflow

The idea of Chainlink Digital Switch Agent customary is the guts of this innovation that integrates mission-critical parts applied by regulated monetary establishments:

Chainlink Runtime Surroundings (CRE) is the one which synchronizes actions inside banking methods and blockchain.Cross-Chain Interoperability Protocol (CCIP) is the reassurance of interoperability and safe messaging between chains which are each private and non-privateAutomated Compliance Engine (ACE) enforces institutional compliance guidelines programmaticallyNAVLink offers fund processes with verified Web Asset Worth pricing feeds

These traits construct a controlled-grade pipeline during which conventional markets will talk with decentralized infrastructure.

Sensible contract automation and synchronized settlement dramatically cut back handbook processes, a game-changer in a market the place world fund operations exceed $100 trillion.

Tokenization Is Getting into Its Actual Adoption Cycle

Tokenized property have accelerated quickly throughout world finance however most deployments up to now have been pilots or proofs-of-concept. The rationale why this UBS transaction is exclusive is as a result of it occurred throughout manufacturing.

The shift is an indicator of institutional belief in blockchain-based infrastructure and a gateway to mainstream adoption in all varieties of property, together with:

Cash-market merchandiseBonds and structured notesNon-public funds and various propertyActual-world collateral for DeFi rails

The usage of tokenization would carry nice benefits to institutional markets:

Actual-time settlementDecrease reconciliation pricesImproved transparencyAutomated complianceInteroperability throughout banking networks and chain ecosystems

Traders On-chain funds create accelerated liquidity cycles, decreased middle-layer frictions, and programmable monetary merchandise.

The Institutional Blockchain Playbook Is Forming

UBS isn’t transferring alone. BlackRock, JPMorgan, HSBC, Franklin Templeton, and Constancy are all increasing tokenized fund or asset flows. The treasury tokenization market alone might develop right into a multi-trillion-dollar section inside this decade as corporations race to digitize capital markets infrastructure.

UBS’ reside deployment indicators that the shift from paper-based and legacy digital rails to programmable finance is actively underway.

Institutional Voices Weigh In

UBS management described the occasion as a foundational inflection level for smart-contract-driven finance.

“This transaction represents a key milestone… These improvements drive larger operational efficiencies and new potentialities for product composability,” Mike Dargan, Group COO & CTO, UBS

Chainlink co-founder Sergey Nazarov emphasised confidence in safe, compliant institutional on-chain migration: “This milestone reveals conventional finance can transition on-chain with institutional-grade reliability and regulatory alignment.”

DigiFT founder Henry Zhang highlighted real-time visibility and reconciliation as transformative benefits for fund operations. Collectively, the messages sign that tokenization is evolving past experimentation into mainstream infrastructure for world banks.