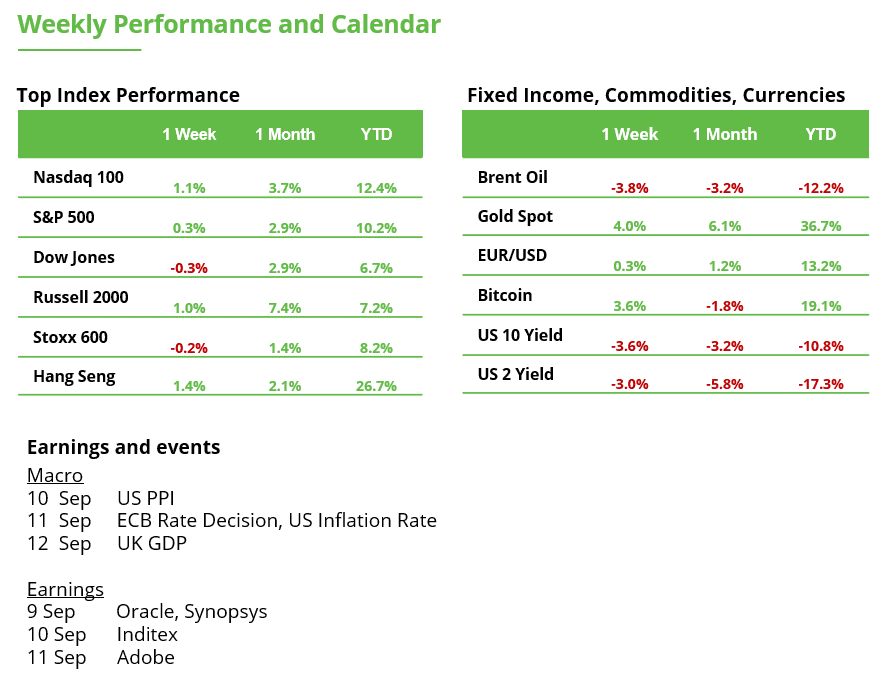

Analyst Weekly, September 8. 2025

Markets are juggling combined indicators. Payrolls upset, pushing the Fed nearer to cuts. China’s restoration is slim, with e-commerce and tourism profitable however subsidies fading. Volatility dangers are rising as funds crowd into short-vol bets. And with ECB and US inflation knowledge forward, coverage readability would be the week’s catalyst.

US Payrolls: Funding Takeaways

Payrolls flop: August US payrolls barely budged at +22K (June even revised damaging). That’s principally stall velocity.The report suggests the Fed will probably minimize -25bp on Sep 17, with the potential for a extra aggressive -50bp or a sequence of regular cuts in Sep/Oct/Dec.

Who’s hiring? Healthcare, personal training, and leisure & hospitality are nonetheless including jobs. Cyclicals like manufacturing and goods-producing? Within the pink.

Cracks exhibiting: Unemployment ticked as much as 4.3%, underemployment is creeping larger, workweek hours are shrinking, and temp jobs are sliding. Shoppers may really feel the pinch.

Wages regular: Paychecks are rising round 3.7%-4% y/y, steady sufficient to help spending with out triggering inflation, for now. That offers the Fed room to ease.

Funding Takeaway: 1. Price-sensitive sectors (housing, REITs, development tech) stand to learn because the Fed exits restrictive coverage. 2. Small caps might be huge winners if charges fall. These firms are likely to rely extra on shorter-term debt, making them particularly delicate to borrowing prices. Encouragingly, over half of small-cap shares have seen earnings estimates revised larger in latest months, a uncommon optimistic shift. For context, because the late Nineties, this determine has usually stayed under the 50% threshold. 3. The curve may steepen if cuts are gradual, supporting financials. 4. Healthcare demand seems to be resilient; defensive healthcare equities might outperform from right here, as market positioning has not caught up but.

China Consumption: Slender Restoration Forward

China’s client restoration in 2026 is anticipated to be uneven: digital platforms and choose client manufacturers profit, however reliance on subsidies limits sustainable development. Traders ought to favor e-commerce platforms with scale and types positioned in companies, sportswear, and cosmetics, whereas being cautious on home equipment and capital-intensive supply ventures.

Development outlook is modest: China’s retail gross sales is closely reliant on subsidies, which is resulting in “subsidy fatigue,” notably in classes like house home equipment.

Tourism and spending shifts assist manufacturers: Authorities stimulus within the second half of 2025 may add 833 billion yuan in spending, although consensus expects as much as 1.2 trillion yuan. A $42B increase is anticipated from extra inbound tourism and fewer abroad spending by Chinese language customers. Beneficiaries embrace Anta, Midea, Shiseido, Laopu Gold, Pop Mart, and Xiaomi (EV & IOT Development).

E-commerce stays dominant however pressures earnings: Platforms like Alibaba,JD.com, Meituan, and Douyin are driving development via promotions, on-line exclusives, and partnerships (e.g., with Xiaohongshu/RedNote and WeChat). Nonetheless, competitors and new ventures (cloud kitchens, satellite tv for pc shops) weigh on margins.

Sector standouts:

Digital platforms and tourism performs look greatest positioned.

Residence home equipment, capital-heavy meals supply ventures, and subsidy-reliant sectors face extra headwinds.

Sportswear & cosmetics may see stronger demand through online-exclusive launches.

Luxurious, gadgets, and home equipment face slower development as subsidies lose effectiveness.

September Brings Volatility Threat

In each the S&P 500 (SPY) and Nasdaq 100 (QQQ), traders are paying far more for draw back safety than for upside bets.

For one-month choices, the hole between the price of put choices and name choices is the widest it’s been in nearly two years. Hedge funds are betting closely that volatility will keep low, their largest such guess since early 2021. If volatility all of the sudden jumps, these funds might be compelled to cowl their positions shortly, pushing costs larger.

After chopping inventory publicity in April, funds that modify positions based mostly on volatility have now purchased closely again into equities. However as a result of they’ve already carried out most of that purchasing, they’ve much less room so as to add extra help now.

Put merely, lots of the forces that had been serving to the market earlier at the moment are fading in September.

That mentioned, choices sellers’ positions (lengthy gamma positioning in SPX) may assist preserve day-to-day market swings in test.

Tremendous Thursday: ECB Resolution and US Inflation Information

This week options two highlights on the financial calendar: the ECB price resolution and the US inflation knowledge – each scheduled for Thursday, making it a very powerful buying and selling day of the week. No change in rates of interest is anticipated from the ECB at 2:15 p.m. The main focus will as a substitute be on Christine Lagarde’s press convention at 2:45 p.m., notably her feedback on the impression of tariffs and Europe’s weak financial development.

In between, at 2:30 p.m., the US client value knowledge for August will probably be launched. It will likely be the final inflation test earlier than the upcoming Fed assembly. A price minimize in September is already totally priced in, supported by final Friday’s weak US labor market report. However, there are good explanation why traders ought to pay shut consideration to inflation developments proper now. Tariffs typically work with a delay and will nonetheless have an effect on price expectations for the rest of the 12 months. Furthermore, core inflation remained elevated in July at 3.1% year-over-year.

Bond Market Assessments Medium-Time period Resistance

It has been a while since long-term bond costs (iShares 20+ 12 months Treasury Bond ETF, or TLT) marked a brand new low within the broader downtrend. The final low was in October 2023 at 82.30. Final week, the ETF closed 2.45% larger at 88.56, representing a rebound of greater than 7% from the lows. With this transfer, the market has reached a Honest Worth Hole between 88.36 and 90.22. This zone acts as medium-term resistance. A breakout above it may entice extra patrons. Traders ought to intently monitor value motion round this space.

TLT on the weekly chart

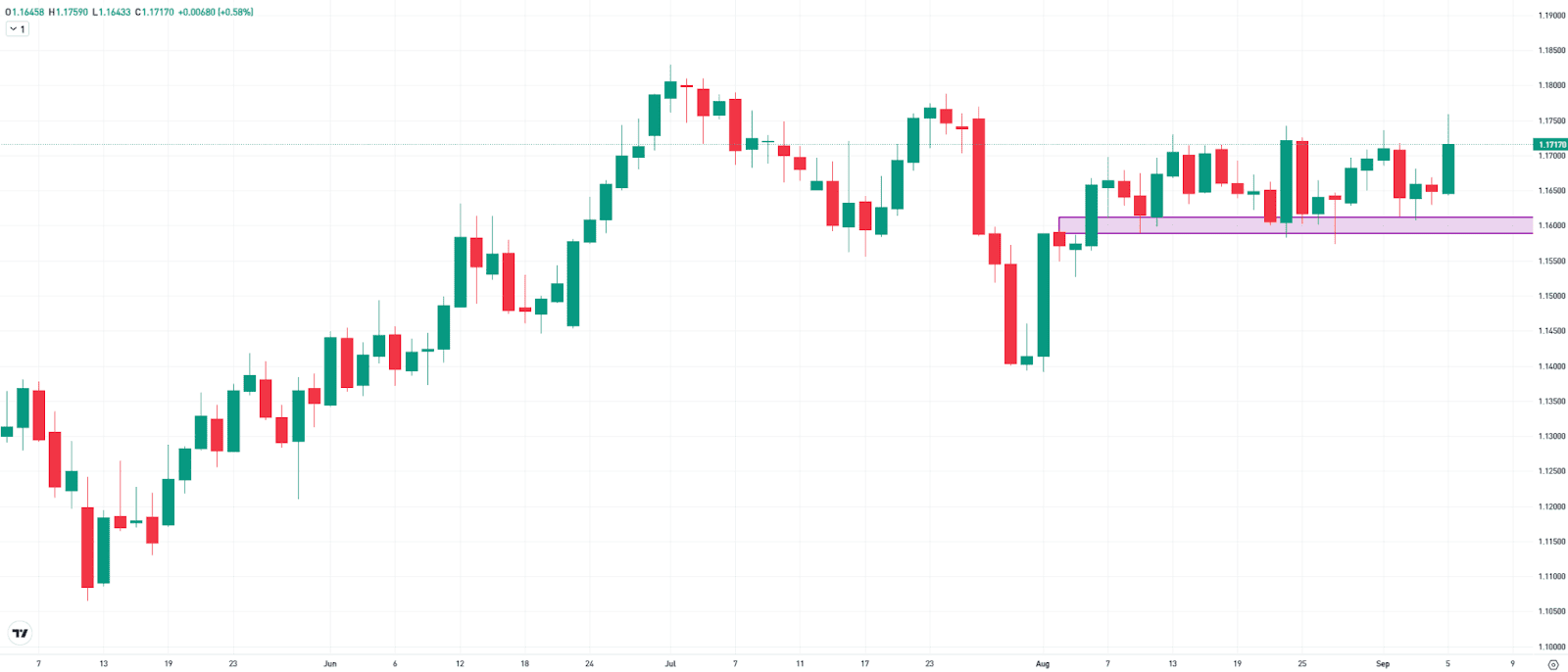

EURUSD: Sideways Section Inside an Uptrend

EURUSD is in an total upward pattern. Nonetheless, the final excessive dates again a bit. On July 1, a peak was reached at 1.1829. Since then, the pair has been shifting sideways for a few month and closed at 1.1717 on Friday. The world round 1.1730 has repeatedly capped stronger upward strikes, most lately final Friday. The Honest Worth Hole between 1.1587 and 1.1610, which was created by the rally at first of August, serves as an necessary help stage and was efficiently defended twice final week. Solely a breakout from this sideways vary may re-establish a clearer short-term pattern construction.

EURUSD on the every day chart

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.