WazirX, as soon as India’s largest crypto trade by buying and selling quantity, has secured a vital extension from Singapore’s Excessive Courtroom because it struggles to recuperate from a devastating $234 million hack and a yr of rising person frustration.

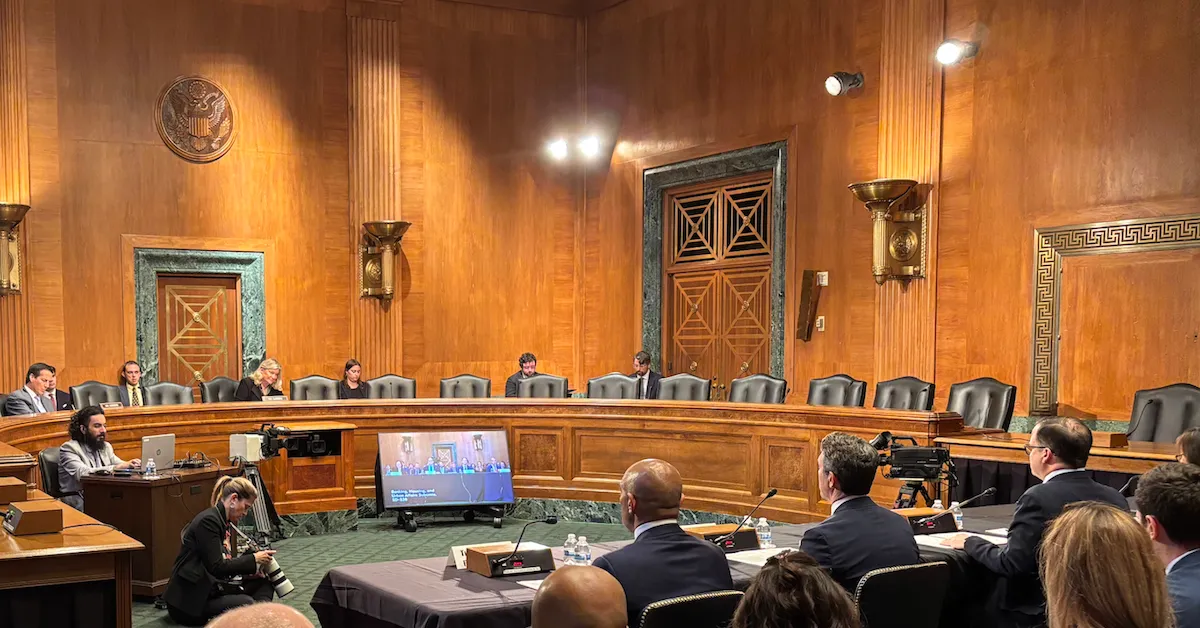

In a press release posted on social media, WazirX confirmed that the court docket will enable it to current new arguments supporting a revised restructuring plan and has prolonged the moratorium shielding the corporate from creditor lawsuits till a ruling is made.

The authorized reprieve buys WazirX time to salvage its controversial Scheme of Association, a court-supervised course of meant to reorganize its operations and settle claims from collectors and over 400,000 affected customers worldwide.

The trade’s troubles started in July 2024, when hackers exploited safety flaws to empty digital property from buyer wallets, making it one of many largest breaches to hit an Asian crypto platform that yr.

Within the months that adopted, WazirX’s guarantees to reimburse customers ran aground amid unclear communication, inner disputes with dad or mum agency Zettai Pte Ltd, and rising issues from regulators about fund tracing and governance.

To reassure collectors and regulators, WazirX has floated a plan to switch its core enterprise to a brand new entity, Zensui Company, registered in Panama.

The corporate stated this is able to assist distance the trade from Zettai’s lingering company problems and provides it the pliability to challenge so-called restoration tokens, blockchain IOUs pegged to unrecovered balances.

These tokens are meant to assist customers progressively reclaim between 75% and 80% of the crypto misplaced within the breach, with the precise payout tied to future market situations and platform income. Nonetheless, for a lot of, the tokens are an untested resolution that does little to ensure well timed restitution.

Regardless of these uncertainties, greater than 93% of voting collectors backed the restructuring plan in April. Nonetheless, the Singapore Excessive Courtroom declined to grant closing approval final month, citing gaps in transparency and governance.

With out an accredited plan, WazirX faces the prospect of pressured liquidation. Authorized specialists warn {that a} court-ordered wind-down might drag on for years, eat important funds in authorized charges, and depart collectors with decrease total restoration charges. In a worst-case state of affairs, the trade has warned that person repayments might be pushed again so far as 2030.

Friday’s extension marks what many see as the ultimate alternative for WazirX’s management to persuade the court docket, and its cautious group, {that a} structured restoration remains to be attainable.

The trade stated in its assertion:

“We’re awaiting the court docket’s instructions on the subsequent listening to and can share updates as quickly as now we have readability.”

No date has been introduced for the subsequent proceedings, leaving hundreds of customers nonetheless locked out of their accounts for practically a yr.

The trade now faces a fragile path ahead, balancing court docket calls for for governance reforms with the pressing want to revive buyer belief in an business nonetheless reeling from high-profile collapses like FTX and Zipmex.

For customers, the extension gives a flicker of hope however few ensures, and till the court docket indicators off on a closing plan, their crypto stays out of attain.

Talked about on this article