On-chain information suggests the Bitcoin short-term holders haven’t been capitulating through the crash, an indication {that a} shift has occurred out there.

Bitcoin Quick-Time period Holders Haven’t Been Doing A lot Loss-Promoting Lately

As identified by analyst James Van Straten in a put up on X, the BTC short-term holders haven’t been sending a lot BTC at a loss lately, regardless of the plunge the asset’s worth has suffered.

The “short-term holders” (STHs) discuss with the Bitcoin buyers who purchased their cash throughout the previous 155 days. These buyers make up one of many two most important divisions of the BTC market, with the opposite cohort being often known as the “long-term holders” (LTHs).

Statistically, the longer an investor holds their cash, the much less seemingly they’re to promote at any level. As such, the LTHs are thought of the resolute facet of the market, whereas the STHs are thought of the weak arms.

Typically, the STHs simply promote each time a change out there occurs, like a crash or rally. As such, these buyers might be anticipated to have participated in some promoting through the newest plummet within the coin as effectively.

One technique to monitor whether or not these buyers are promoting or not is to trace their change deposits. Holders don’t at all times deposit to those platforms for promoting, as they provide different companies as effectively, however inflows throughout a rally/crash are most of the time a sign of a selloff.

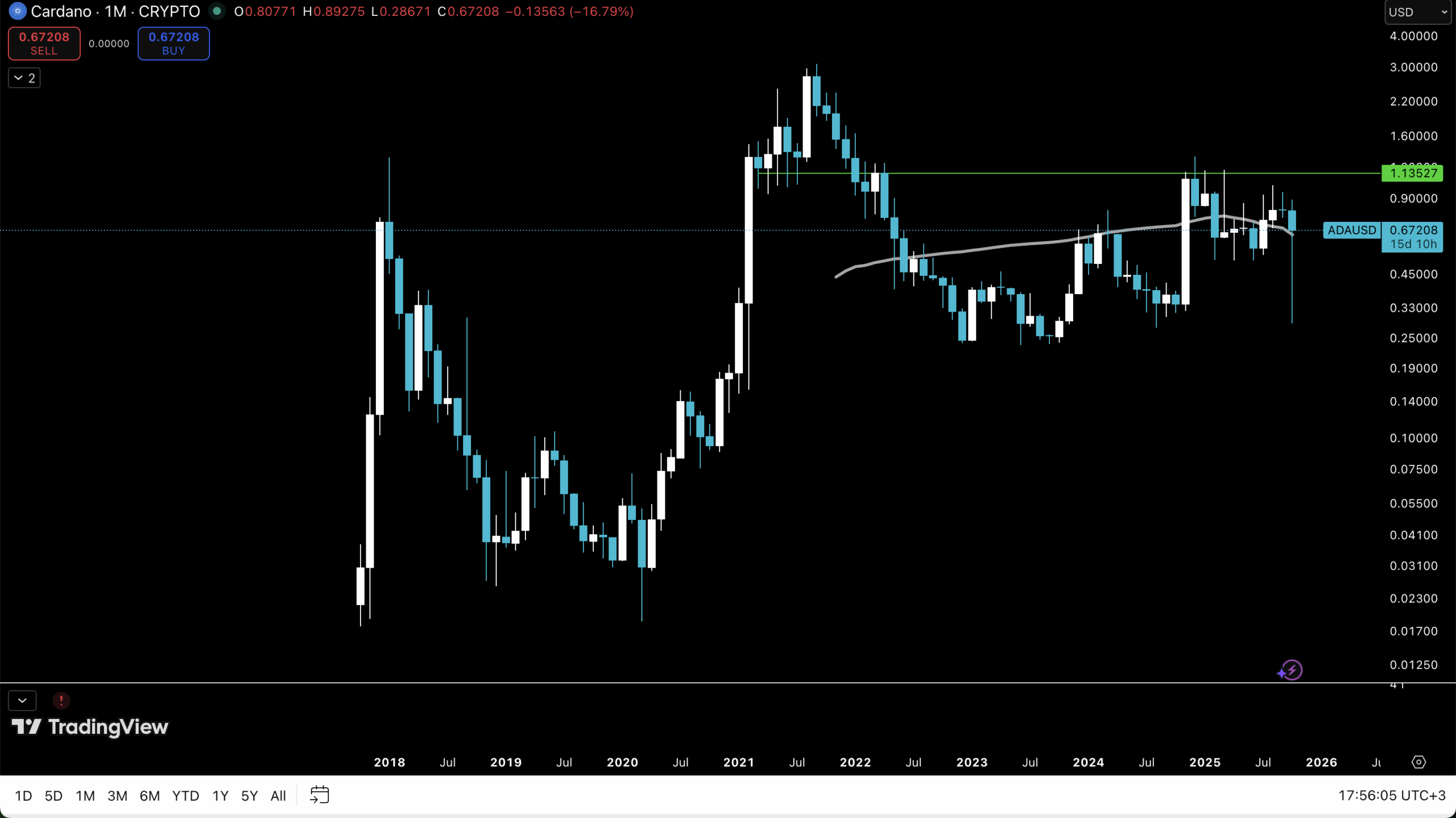

Within the present dialogue, the whole change switch quantity for this cohort isn’t of curiosity, however solely the a part of it that’s being deposited at a loss. As Straten has highlighted within the chart beneath, a curious sample has emerged on this loss change influx quantity for the STHs.

The worth of the metric seems to have been on the decline in latest weeks | Supply: @jvs_btc on X

As displayed within the above graph, the Bitcoin switch quantity from the STHs in loss to exchanges registered an enormous spike again in January, because the market downturn following the approval of the spot exchange-traded funds (ETFs) occurred.

Within the worth decline that adopted the highest in Might, the metric additionally registered a big spike, though notably smaller in scale than the January one. It could seem that in each of those drawdowns, the STHs had proven a major capitulation response.

Throughout the newest crash, nevertheless, the pattern doesn’t seem to have been the identical. “What is basically attention-grabbing is that in these previous two days, Bitcoin dropped 12%, however STHs despatched little or no Bitcoin to exchanges at a loss,” notes the analyst.

This could recommend that these weak arms have gained some energy lately. “Lettuce arms have gotten barely much less erratic, indicators of a maturing market,” says Straten.

BTC Worth

Bitcoin has proven some restoration from the crash through the previous 24 hours as its worth has now returned again to the $60,700 stage.

Appears to be like like the worth of the asset has shot up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, Glassnode.com, chart from TradingView.com