Este artículo también está disponible en español.

Over the previous weekend, there was a notable rise in memecoin costs, pushed by heightened social buzz and elevated danger urge for food amongst crypto traders. The idea of a “memecoin supercycle,” which posits that memecoins will lead the upcoming crypto bull run, gained traction on X. On this context, crypto analyst Kai (@Kaiwen0x) launched a widely-shared article explaining the continuing attract of memecoins as a viable funding alternative.

The Case For Memecoins In The Crypto Bull Run 2025

Kai argues that memecoins are poised to outperform the market by 2025, suggesting that proudly owning a “curated basket of memecoins” may enable traders to surpass 99% of market members. “Exterior of Bitcoin and stablecoins, memecoin is the one class that has discovered a transparent product-market match. They mix one of the best options of an ICO (capital formation) and an NFT (neighborhood constructing) in delivering a killer product: world, permissionless hypothesis,” he states.

The analyst emphasizes that conventional crypto initiatives typically juggle each product improvement and token administration, whereas memecoins focus solely on the token itself. “Memecoins eliminated the product and made the token its total enterprise, with the worth of the token deriving from the eye generated by its neighborhood,” Kai explains. Citing knowledge from crypto analyst @MustStopMurad, Kai notes that in 2024, 16 of the highest 20 tokens throughout the prime 300 that outperformed Bitcoin have been memecoins.

Associated Studying

Kai identifies two important exterior elements that are essential for a memecoin surge. First, the macro liquidity and rates of interest should be favorable for the complete market: “The macro setup factors to greater liquidity and decrease rates of interest within the subsequent 12 months. Memecoins act as levered beta on Bitcoin, permitting you to seize most upside in a risk-on atmosphere,” Kai explains.

Second, the analyst references monetary nihilism, a time period popularized by Ikigai Funding CEO Travis Kling (@Travis_Kling). This concept suggests {that a} rise in monetary nihilism and the “YOLO” mindset is drawing extra members into speculative markets.

Internally, memecoins have proven they possess a transparent product-market match and profit from what is named the Lindy impact—the place the longer term life expectancy of some applied sciences or concepts is proportional to their present age, suggesting that memecoins are right here to remain. Moreover, memecoins are significantly adept at creating and sustaining compelling narratives, a crucial side in a market pushed by hypothesis and investor sentiment.

The Artwork Of Memecoin Choice

Kai delves into methods for choosing promising memecoins, emphasizing the significance of nuanced evaluation:Emotional Resonance: “I’m in search of memes that generate a robust emotional response. Is it humorous, relatable, catchy, highly effective, or memorable? The typical retail investor goes to be the final marginal bidder of our magic web cash, so you want to purchase and maintain what they emotionally resonate with,” Kai explains.

Ticker Simplicity: Favoring easy and highly effective tickers, ideally 3 to five letters lengthy, akin to WIF, GIGA, and BULL.

Holder Rely Development: Monitoring regular progress within the variety of holders as an indicator of accelerating adoption.

Vast Token Distribution: Preferring cash with broad distribution to keep away from centralization dangers.

Resilience to Drawdowns: Figuring out cash which have survived a number of important value drops and rebounded, indicating sturdy neighborhood assist.

Lively Neighborhood Engagement: Searching for an “energetic military of reply guys getting engagements on X,” which indicators a vibrant and engaged neighborhood.

Trade Listings: Noting that bulletins of centralized change (CEX) listings can considerably influence a token’s valuation.

Absence of Insiders: Being cautious of cash with insider involvement, akin to pre-sales or enterprise capital backing, which might result in uneven taking part in fields.

Potential Dangers and Invalidation Situations

Kai acknowledges the dangers related to investing in memecoins:

Macro Regime Change: A big rebound in inflation or a reversal of financial easing may invalidate the macro thesis for being lengthy on danger belongings.

Idiosyncratic Occasions: Occasions like main change hacks, regulatory shifts, or important market collapses may disproportionately have an effect on memecoins.

US Election Outcomes: “Counterintuitively, memecoins may underperform this cycle if Trump wins the election,” Kai speculates.

Emotional Attachment: He cautions in opposition to changing into too emotionally invested in anyone neighborhood, as this may cloud judgment. “Identification can create emotional ties that cloud your judgment as an investor.”

Associated Studying

Kai emphasizes the significance of understanding investor psychology within the crypto market. “In the end, the query returns to: ‘What does the common crypto investor really care about?’ It’s not the tech. It’s not the product. It’s the token—embodying greed and the expectation of larger revenue—that finally consumes this investor,” he writes.

Nonetheless, the crypto analyst advises traders to stay vigilant and adaptable: “To keep away from getting wrecked, we have to monitor macro circumstances for any indicators of a regime shift. We should additionally regulate idiosyncratic occasions that would invalidate the thesis for investing in any particular token.” Kai concludes, “Good luck, and for the love of canines, don’t mid-curve this (nonetheless) 100x alternative.”

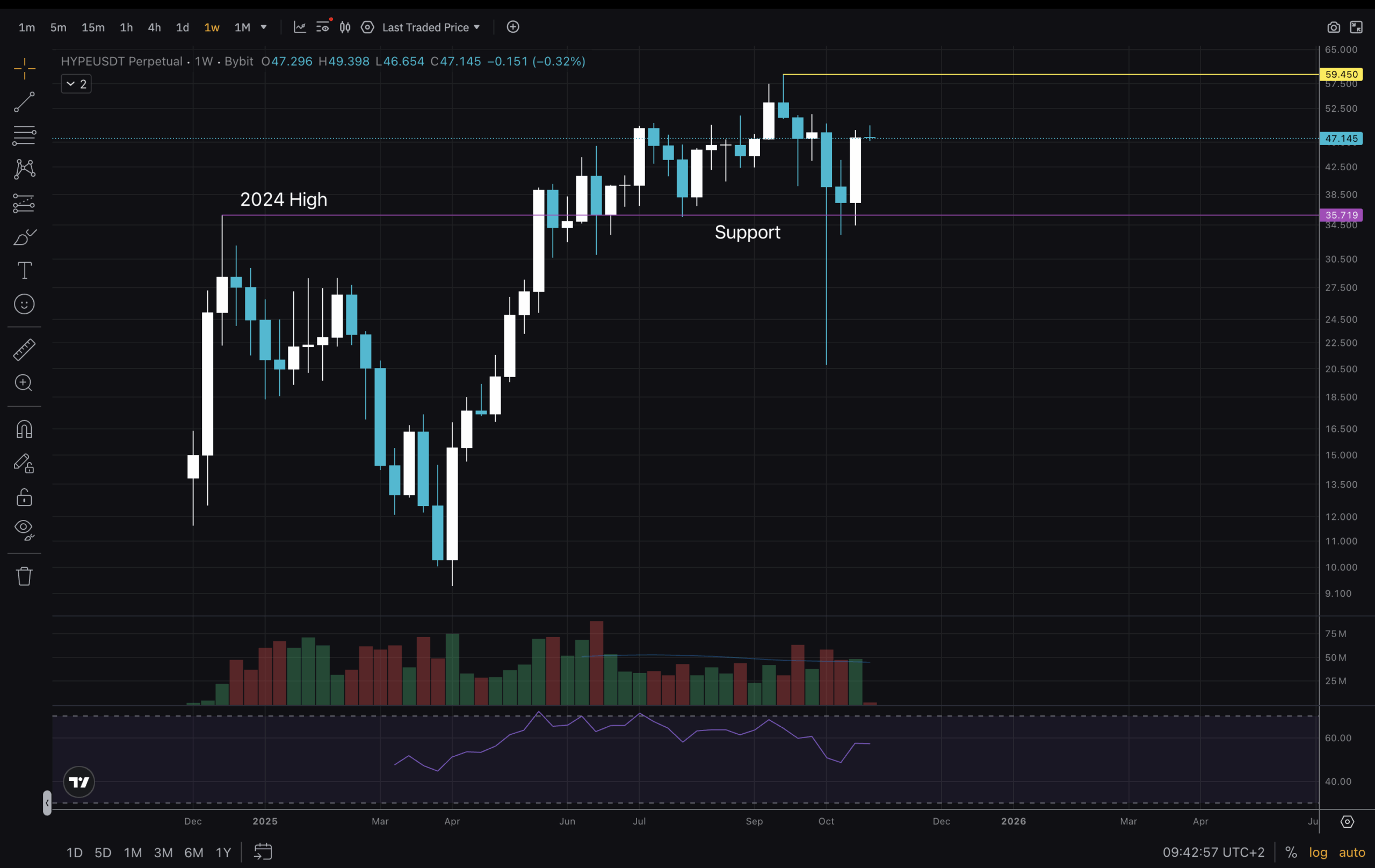

At press time, WIF traded at $2.67.

Featured picture from iStock, chart from TradingView.com