Victoria d’Este

Revealed: October 06, 2024 at 10:00 am Up to date: October 04, 2024 at 5:11 pm

Edited and fact-checked:

October 06, 2024 at 10:00 am

In Transient

AI is revolutionizing the insurance coverage business, enhancing operational effectivity and offering personalised providers, with over a 3rd of shoppers now able to work together with AI in high-stress eventualities.

Globally, synthetic intelligence is step by step altering sectors, and the insurance coverage business isn’t any exception. AI is altering the best way clients have interaction with insurers by rising operational effectivity and providing faster, extra individualized providers. AI in insurance coverage is changing into an increasing number of fashionable amongst clients worldwide; it’s not only a theoretical prospect.

Greater than a 3rd of insurance coverage clients worldwide at the moment are ready to work together with AI, particularly in high-stress eventualities like processing claims, in line with latest research. This transformation in buyer habits marks a brand new interval in insurance coverage providers and marks a major turning level for the sector.

The Present State of AI in Insurance coverage

Due largely to its intricate operations and authorized framework, the insurance coverage sector has traditionally been hesitant to undertake new expertise. But, AI is eradicating these obstacles by offering options that may deal with each operational difficulties and buyer calls for. Today, it’s thought that utilizing AI expertise is important to stay aggressive.

Insurance coverage corporations are realizing that clients need flawless service and are rising extra relaxed with digital interactions. Thus, incorporating AI into the insurance coverage sector will not be solely a progressive step, but additionally a required one to maintain up with altering buyer calls for.

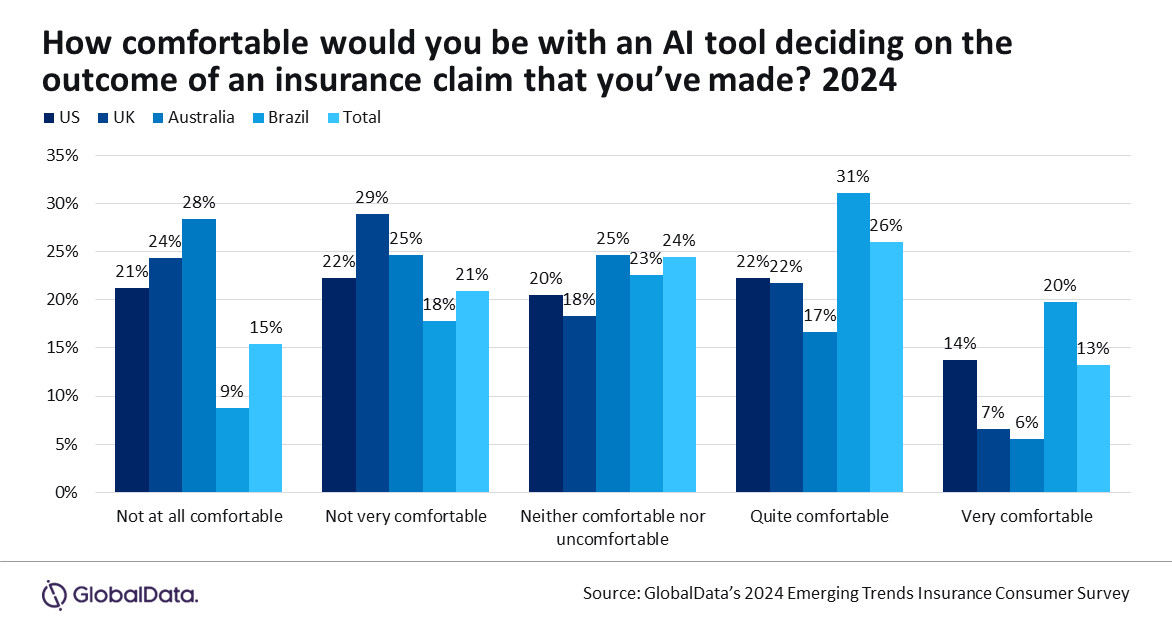

In accordance with GlobalData’s “2024 Rising Traits Insurance coverage Shopper Survey,” a large portion of shoppers are amenable to interacting with their insurers by way of AI. The ballot, which was carried out throughout 11 nations and obtained responses from greater than 5,500 individuals, affords insightful info on how AI is seen within the insurance coverage business worldwide.

Picture: GlobalData

The research reveals that 39% of respondents worldwide mentioned they might really feel relaxed letting AI handle the decision of their insurance coverage claims. This statistic is notable, contemplating that submitting a declare is ceaselessly a irritating process for policyholders, but many are ready to belief AI with such very important judgments.

AI has a number of makes use of within the insurance coverage business, from streamlining claims processing to offering individualized coverage suggestions and automating administrative chores. AI methods, similar to chatbots, could, as an example, reply consumer questions, ship real-time coverage info, and help clients within the claims course of extra shortly and successfully than standard methods. These applied sciences are fairly useful for insurers who wish to make data-driven selections since they’ll swiftly look at large quantities of information.

Moreover, by seeing developments that human assessors may overlook, AI may help within the extra environment friendly detection of fraudulent claims. In the long run, these developments save bills, improve accuracy, and pace up response instances for insurers in addition to clients.

An basic shift in belief is highlighted by the truth that greater than one-third of customers really feel snug utilizing AI within the insurance coverage claims course of. Up to now, the insurance coverage sector has largely trusted human middlemen to determine and protect connections with policyholders. And as AI methods advance in sophistication and dependability, they’re beginning to achieve traction.

Regional Variations in AI Acceptance

Not each space of the insurance coverage business is ready to make use of AI. The survey’s findings present that shopper acceptance of AI differs enormously amongst nations. Whereas sure areas are enthusiastic about synthetic intelligence in insurance coverage, others are nonetheless extra hesitant. For instance, simply roughly one in 5 customers in Australia, which the report signifies is among the least receptive nations, are keen to have interaction with AI for claims processing.

This means that shopper opinions concerning AI are enormously influenced by cultural, governmental, and market-specific variables. Insurance coverage corporations should take these variations under consideration when launching AI-based items and providers in varied areas. It’s unlikely {that a} one-size-fits-all technique would succeed, so insurers should customise their AI plans to deal with the wants and issues of shoppers in every area.

Insurance coverage Trade Drivers of AI Acceptance

Though there are regional variations within the uptake of AI, the overall pattern is clear: clients are rising more and more receptive to AI in insurance coverage, which presents an enormous probability for insurers to face out in a crowded business. Companies that efficiently combine AI applied sciences will improve buyer satisfaction by offering faster, extra correct, and extra handy providers, along with rising operational effectivity.

Prospects that worth ease and pace will discover it particularly attractive as a result of claims could also be processed swiftly and routinely with out the necessity for human involvement. Insurance coverage corporations which don’t use AI could also be at a aggressive drawback since rivals who do use the expertise are prone to improve their market share.

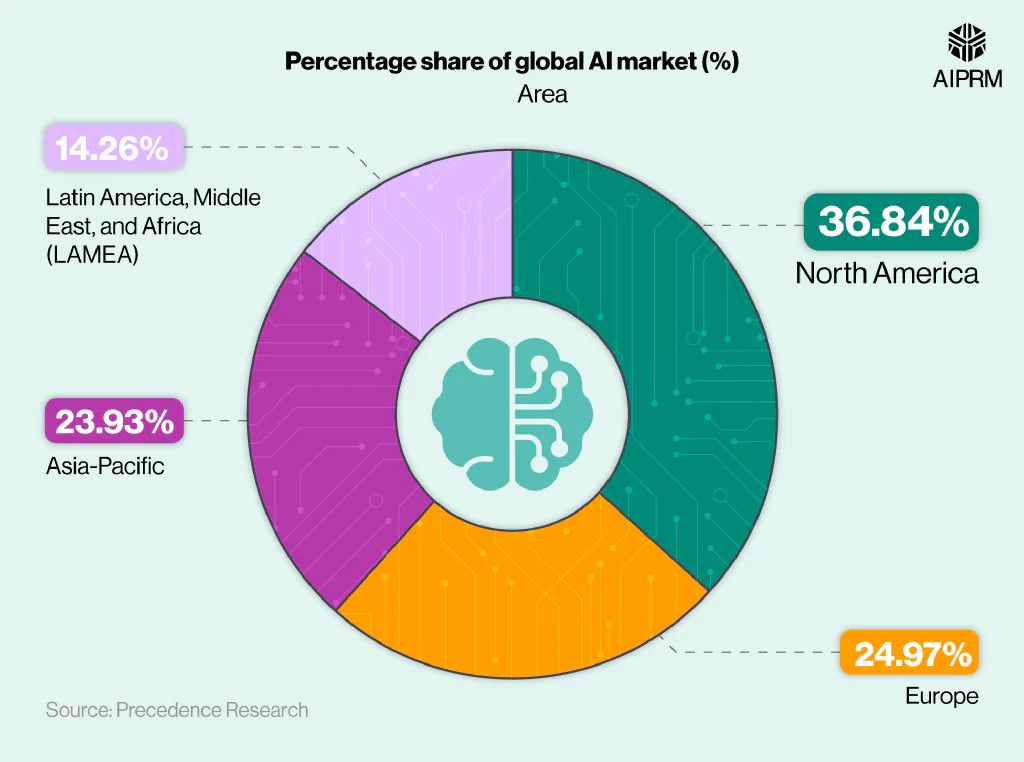

Picture: AIPRM

The likelihood for higher buyer experiences is among the important explanation why customers are accepting AI in insurance coverage. Up to now, customers have ceaselessly skilled a prolonged and tedious process whereas dealing with insurance coverage claims. The expertise could be irritating as a result of to prolonged wait intervals, paperwork, and the unpredictability of outcomes.

AI has the power to streamline the claims process and provides policyholders faster, extra clear settlements, thereby eliminating many of those ache factors. In a fraction of the time it could take a human adjuster, AI methods, as an example, to swiftly consider the specifics of a declare, cross-reference it with coverage info, and ship an correct choice. Your entire consumer expertise could also be considerably improved by this pace and effectivity.

Nonetheless, AI use within the insurance coverage sector continues to be in its infancy. Lots of the AI options that at the moment are in use, together with chatbots, aren’t but subtle sufficient to fully fulfill buyer expectations. Quite a few clients have expressed dissatisfaction with AI options which might be unable to answer intricate queries or supply the type of individualized help they need.

Potential Advantages of AI in Insurance coverage

AI can help insurers in addressing among the most necessary points confronting the sector in the mean time, along with enhancing consumer experiences. Amongst these difficulties is fraud. An necessary situation that prices insurers billions of {dollars} yearly is insurance coverage fraud. Synthetic intelligence strategies are particularly well-suited to deal with this downside due to their speedy knowledge evaluation and talent to identify developments that time to fraudulent actions.

AI methods, as an example, are in a position to evaluate claims with previous knowledge and determine any variations or odd developments that require extra analysis. This helps insurers keep away from penalizing sincere policyholders with rising premiums because of false claims, whereas concurrently helping them in decreasing fraud-related losses.

Danger evaluation is one other space the place synthetic intelligence could also be very helpful. Up to now, insurers have evaluated danger and set charges utilizing statistical fashions and historic knowledge. Nevertheless, by real-time knowledge from sources like Web of Issues (IoT) units, AI can advance danger evaluation.

Within the context of auto insurance coverage, as an example, synthetic intelligence (AI) could monitor driving habits and supply individualized premium strategies based mostly on actual danger through the use of knowledge from linked cars. This diploma of customization can encourage policyholders to take safer actions and allow insurers to offer extra reasonably priced charges.

Disclaimer

According to the Belief Venture pointers, please be aware that the knowledge offered on this web page will not be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation when you’ve got any doubts. For additional info, we advise referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.