With bearish stress mounting in Bitcoin’s market dynamics, the flagship asset is more likely to expertise additional value decline within the upcoming days. Nonetheless, a number of help ranges proceed to behave as a roadblock to current detrimental strikes, holding off towards an prolonged correction.

Trendline Assist To Decide Bitcoin’s Subsequent Part

Bitcoin’s value motion hangs within the stability as crypto skilled and dealer Rekt Capital attracts a essential trendline help as the first protection towards additional losses. Rekt Capital’s evaluation addresses BTC’s doable subsequent part in gentle of the heightened volatility that has befallen the market.

The skilled believes that holding this trendline help would possibly stabilize the market, permitting BTC to muster sufficient momentum for a rebound towards larger ranges. This reveals the significance of sustaining the help, in any other case, Bitcoin dangers deeper correction.

Delving into value actions, Rekt Capital highlighted that BTC is having hassle sustaining the $101,000 vary low as indicated by the black line in his chart. Nonetheless, it continues to retest the blue diagonal line on the $99,158 degree as help.

Since this blue diagonal defines a pattern, additional value declines into the decrease $90,000s could be prevented so long as it stays a help level. A break beneath the help is more likely to alter market dynamics as speculations a couple of bear season in sight emerge throughout the group.

Regardless that Bitcoin has lately confronted a big detrimental transfer following a common market crash, the asset continues to dominate your entire crypto sector. Rekt Capital outlined that BTC’s dominance is steadily climbing, whilst its value fluctuates.

An increase in BTC’s sovereignty implies that traders are persistently selecting it as a safer asset in gentle of unstable intervals. Because of this, the analyst declares that Bitcoin season remains to be intact till additional discover, with merchants searching for stability in BTC throughout unfavorable occasions.

Whereas BTC continues to dominate the market, the tide will finally flip in favor of altcoins within the foreseeable future, inflicting a possible begin of the much-anticipated altcoin season. Within the meantime, Rekt Capital urges traders and merchants to be affected person, indicating his confidence in an impending altcoin season.

Huge Funds Flowing Into BTC To Bolster Value Spike

Regardless of waning value performances, traders are displaying substantial curiosity in BTC as evidenced by large funds flows within the historic Spot Bitcoin Change-Traded Funds (ETFs). Community economist and creator Timothy Peterson reported that capital inflows have surpassed $40 billion, marking its highest degree ever.

Knowledge reveals that the month-to-month quantity invested in Bitcoin spot ETFs has risen to about $5 billion since October. Particularly, the trade product web fund flows resumed its progress after a 1 month in stasis.

Thus the economist is assured {that a} persistent rise in capital influx would set off a month-to-month value enhance for BTC between $10,000 to $15,000. This progress suggests heightened adoption and demand for publicity to BTC by means of monetary merchandise.

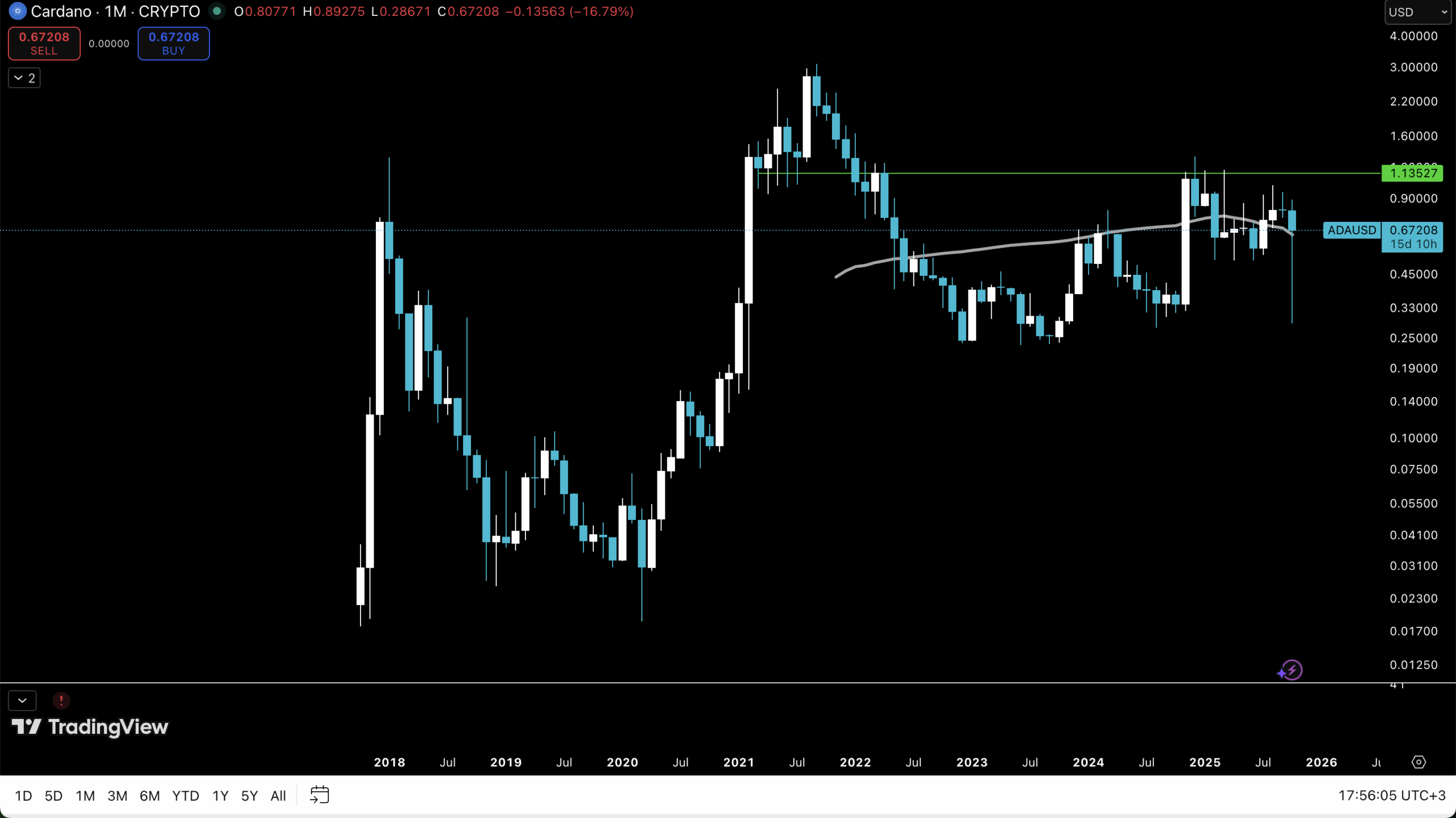

Featured picture from Adobe Inventory, chart from Tradingview.com