Please see this week’s market overview from eToro’s international analyst group, which incorporates the most recent market information and the home funding view.

Give attention to November’s jobs report and Powell’s speech

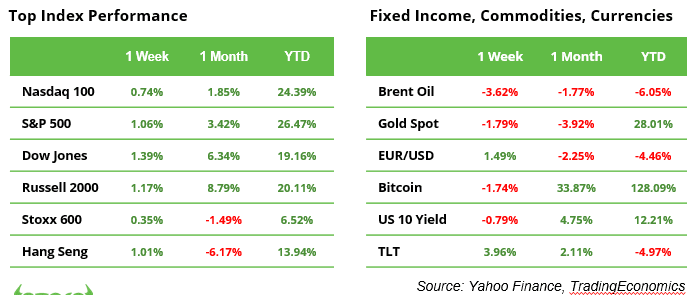

In a shortened buying and selling week on account of Thanksgiving, the S&P 500 Index closed at a document excessive of 6,032 factors. With a achieve of 5.7% (see chart), November has been the perfect month of 2024 to this point for the benchmark. Yr-to-date, the index is up 27.5%. This stellar efficiency has pushed its valuation to 22x ahead earnings, considerably above the 10-year historic common of 18x.

Traders are carefully monitoring U.S. authorities coverage expectations as Donald Trump prepares to enter the White Home on January 20, 2025. Regardless of his feedback about imposing tariffs as excessive as 25% on Mexico and Canada, and an extra 10% on China, the announcement of nominees with extra reasonable profiles has led many to consider that Trump could govern extra softly than initially anticipated. Final week, the U.S. greenback softened barely, whereas the 10-year Treasury yield fell by 23 foundation factors, from 4.41% to 4.18%.

This week, market consideration will flip to November’s jobs report on Friday and Federal Reserve Chair Jerome Powell’s speech on Wednesday. These occasions will supply key information and steerage forward of the Fed’s assembly on December 17-18. At the moment, markets are pricing in a 67% likelihood of one other 25-basis-point rate of interest reduce. An unemployment price of 4.2%, barely greater than October’s 4.1%, is predicted to help this outlook.

A important take a look at Trump’s financial agenda

Donald Trump is planning important tax cuts to stimulate financial development and increase company income. Nevertheless, this technique comes at a big price: diminished tax revenues are more likely to widen the funds deficit and additional improve the nationwide debt of $36 trillion. To deal with the ensuing financing hole, Trump appears to be counting on greater import tariffs. Nevertheless, commerce wars current substantial dangers: 1) They’re notoriously troublesome, if not unimaginable, to “win.“ 2) U.S. shoppers finally shoulder the burden of rising costs, and3) Financial weak spot limits the effectiveness of protectionist insurance policies.

Tariffs may additionally drive up inflation, constraining the Federal Reserve’s means to decrease rates of interest additional. Mixed with rising debt, diminished fiscal flexibility, and elevated market dangers, these components pose important threats to financial stability. The nomination of Scott Bessent as U.S. Treasury Secretary gives hope for stability. The hedge fund supervisor, recognized for his pragmatic method, is predicted to concentrate on safeguarding the economic system fairly than unconditionally advancing Trump’s political agenda.

Large macro week forward: will contemporary information result in a year-end rally?

A wave of financial information this week may form market sentiment as buyers search affirmation of the economic system’s resilience. The ISM studies on Monday and Wednesday take heart stage. Manufacturing PMI, at the moment at 46.5 (its lowest since July 2023), could present early indicators of restoration if it edges nearer to 50. In the meantime, Providers PMI, at 56 (its highest since August 2022), may spark recession fears if it weakens considerably.

ISM employment information may even set the stage for Friday’s jobs report, with key questions on the desk: Will job development stay subdued, and will the unemployment price tick greater?

Final week, the S&P 500 rebounded close to document highs, reflecting market optimism. Robust macro information may set off a breakout, whereas weaker figures could immediate short-term profit-taking with out derailing the broader uptrend. Moreover, softer information may gas rate-cut hypothesis, offering a security internet towards important sell-offs.

OPEC+ meets on 5 December to debate its oil manufacturing technique

The OPEC+ alliance, managing a number of manufacturing cuts totaling over 3.9 million barrels per day (bpd), faces stress from unstable oil costs and unsure demand. Discussions could embody extending a 2.2 million bpd voluntary reduce, amid geopolitical tensions and shifting market circumstances. Including to the complexity is the return of president-elect Trump, whose insurance policies could affect U.S. manufacturing and enforcement of sanctions on Iran.

Information releases and earnings studies

Macro information:

2 Dec. U.S. Manufacturing PMI, China Manufacturing PMI

3 Dec. JOLTS job openings

4 Dec. U.S. Providers PMI, China Providers PMI

5 Dec. U.S. Commerce Steadiness

6 Dec. Non-Farm Payrolls, US Unemployment price

Company earnings:

3 Dec. Salesforce

4 Dec. Synopsys

5 Dec. UiPath, Lululemon, Ulta Magnificence

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.