Fast Take

As diminishing mining rewards within the Bitcoin community trigger anxieties over the safety funds, analyzing the market’s conduct gives a special perspective.

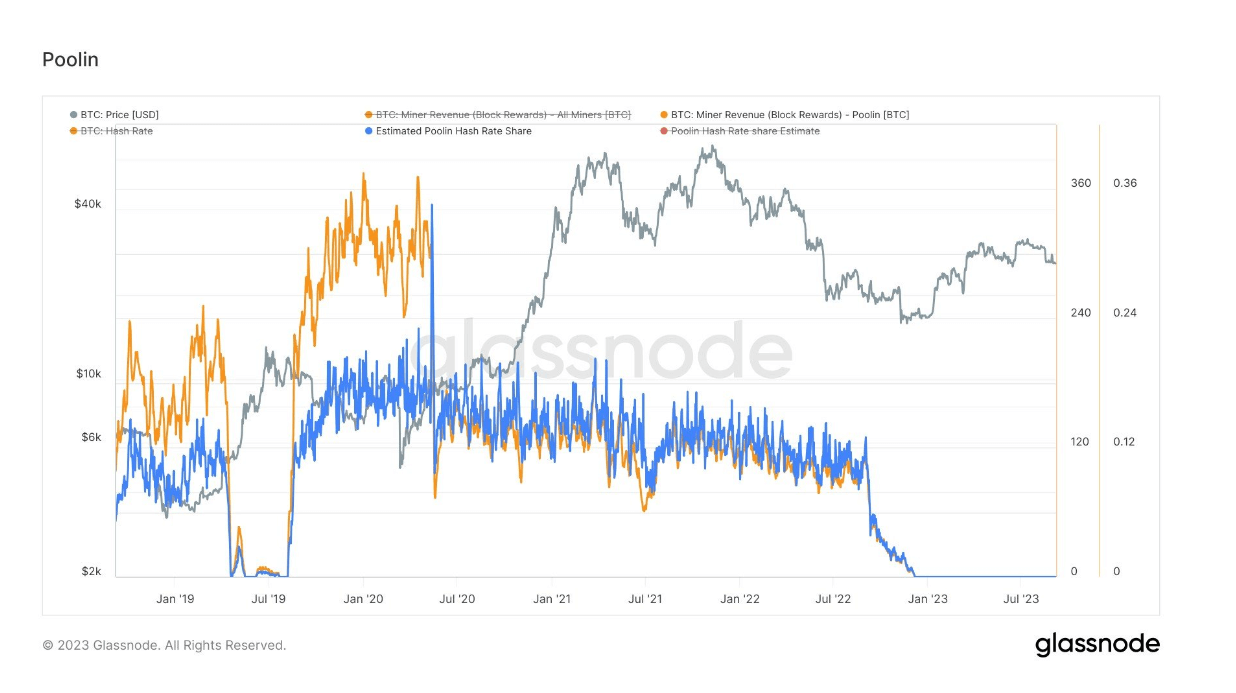

A 12 months in the past, Poolin, a big participant with 20% of the hash price in 2020, noticed its share cut back to zero, elevating considerations over Bitcoin’s safety. Nevertheless, no discussions in regards to the safety funds ensued. As an alternative, different mining swimming pools stuffed the void left by Poolin in a basic free market response, demonstrating the market’s capability to self-correct and keep steadiness.

This indication of resilience underscores that mining operations will persist so long as there may be entry to cheap power, which Earth has in abundance.

Regardless of considerations over diminishing rewards, the important parameters of the Bitcoin community – hash price, issue, and charges – will proceed to regulate dynamically, guaranteeing steady operation. This adaptability ensures that probably the most environment friendly miners survive, reinforcing the community’s stability and safety.

The self-regulating nature of Bitcoin’s mining infrastructure gives an insightful perspective into its resilience, making a case for its sustainability even amidst diminishing mining rewards.

The publish Bitcoin community adapts as mining rewards lower, showcasing market resilience and sustainability appeared first on CryptoSlate.