The article under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

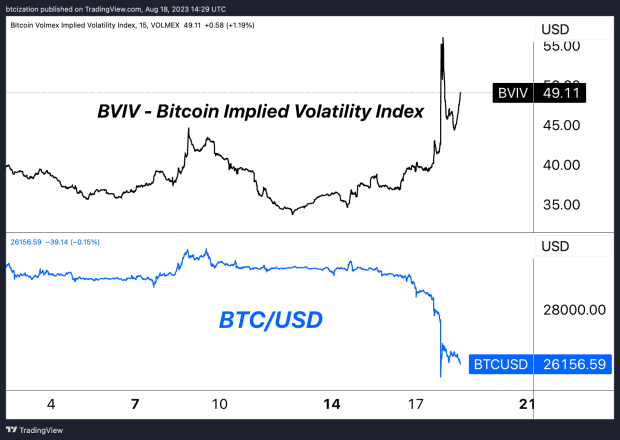

Aug. 17, marked the return of the much-awaited and infamous bitcoin volatility. After a number of months of consolidating across the $30,000 stage with traditionally low realized and implied volatility within the bitcoin market, the value lastly woke up, bringing in regards to the largest liquidation occasion bitcoin has seen in years. Opposite to some opinions by reporters and analysts, the bitcoin crash was not triggered by rumors of SpaceX promoting bitcoin or some other news-based occasion. Not like a inventory, bitcoin doesn’t have earnings calls or dangerous information about future prospects that may tank the value or dampen the community’s fundamentals.

Sure, occasions such because the approval (or dismissal) of a spot bitcoin ETF may change the market’s anticipated flows, however this was not the case throughout Thursday’s worth crash. As an alternative, the market transfer was a great, old school by-product liquidation, a easy occasion of extra sellers than patrons, with the decision being a price-clearing mechanism to the draw back.

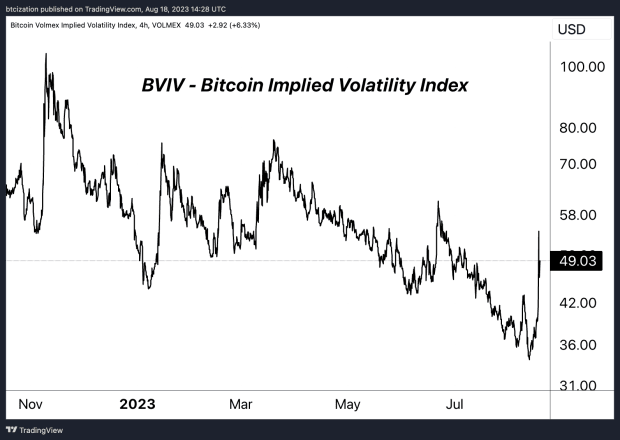

In earlier points, we wrote about bitcoin’s traditionally low realized and implied volatility, noting that such durations result in massive bounces in volatility and explosive breakouts in both path. Clearly, the current decision was to the draw back, however it may result in a brand new regime in bitcoin, at the very least quickly, because the market makes an attempt to discover a new equilibrium within the short-to-intermediate-term.

Since this was largely a by-product phenomenon, let’s discover a few of the mechanics behind this large transfer. In bitcoin, whereas the choices market is much less developed and mature in comparison with equities, there was progress relative to the futures market in recent times, and progress in each markets in comparison with the spot market since 2017. It is vital to notice that the proliferation of a futures/derivatives market isn’t essentially good or dangerous. With an equal quantity of lengthy and brief positions, the web impression over an extended sufficient timeframe is impartial. Nevertheless, within the shorter-to-medium time period, a creating derivatives market on prime of the spot market can result in massive dislocations that lead to sudden volatility, with the market buying and selling aggressively in a single path or the opposite to resolve the imbalance.

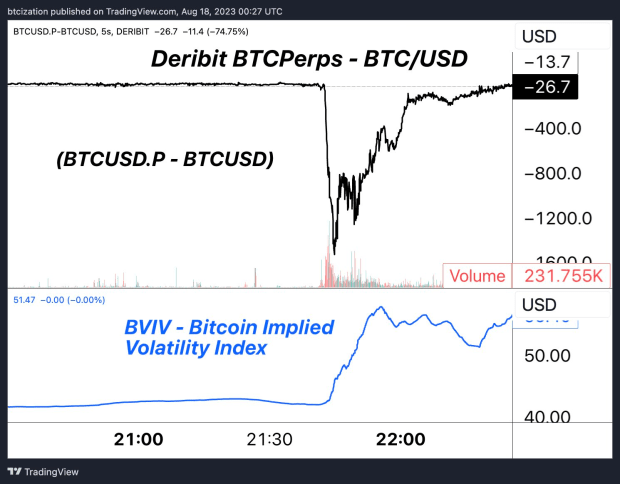

When observing a interval of downtrending implied volatility derived from pricing within the choices market, we are able to see what merchants and speculators suppose an asset’s future volatility will seem like. Brief volatility methods, whether or not easy or complicated, are basically bets on decrease and/or stagnant volatility sooner or later. On this case, observing the development in bitcoin’s implied volatility by way of the Volmex Bitcoin Implied Volatility Index (BVIV), we are able to conclude that promoting or shorting volatility turned a preferred commerce over the summer time months, successfully limiting the bitcoin market to a given worth vary.

When market individuals promote volatility by way of choices, market makers reply by adjusting their hedges within the underlying asset, making a stabilizing “pinning” impact close to sure worth ranges the place there may be substantial open curiosity. To take care of a impartial place, market makers dynamically purchase or promote the underlying asset in response to cost actions of choices, reinforcing the pinning impact. This equilibrium, nonetheless, could be shattered by sudden occasions or shifts in sentiment, inflicting market makers to quickly re-hedge. This results in a sudden and vital worth and volatility motion, reflecting the fragile and interconnected nature of choices buying and selling, market making and asset dynamics. That is exactly what occurred.

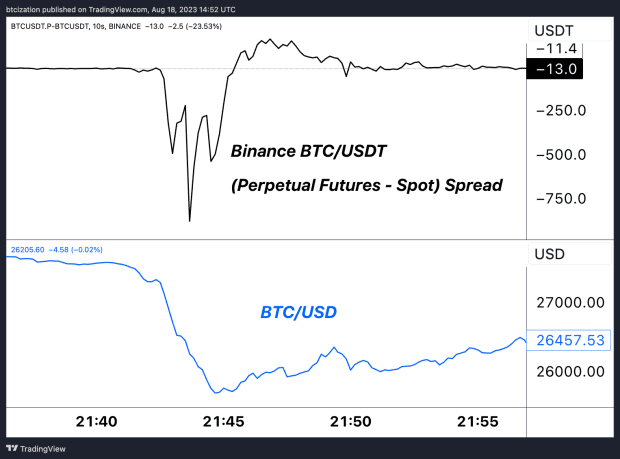

Taking a look at Deribit, the first choices market for bitcoin/crypto, the unfold between their perpetual swaps market and the spot bitcoin market widened massively as implied volatility expanded. Contributors who had been creating wealth by shorting or promoting volatility have been caught unexpectedly, main to an enormous dislocation and liquidation occasion.

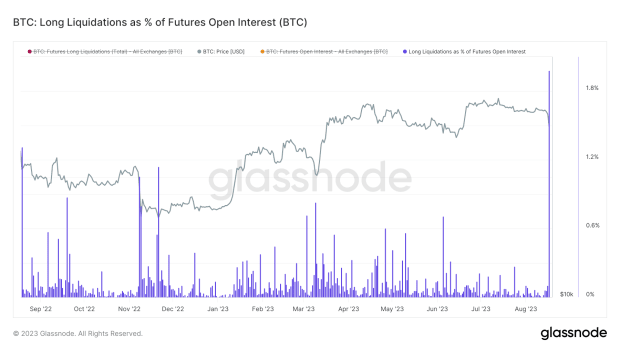

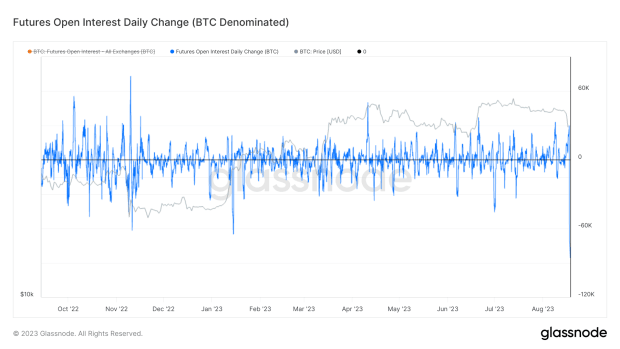

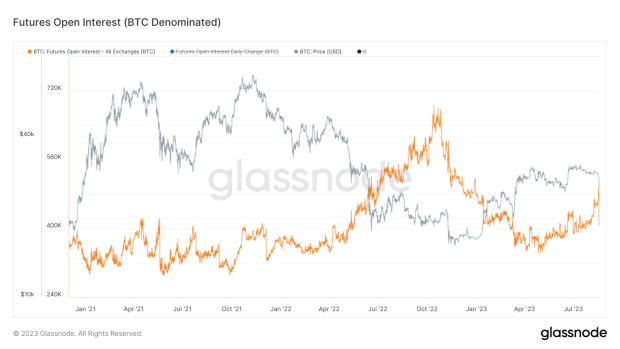

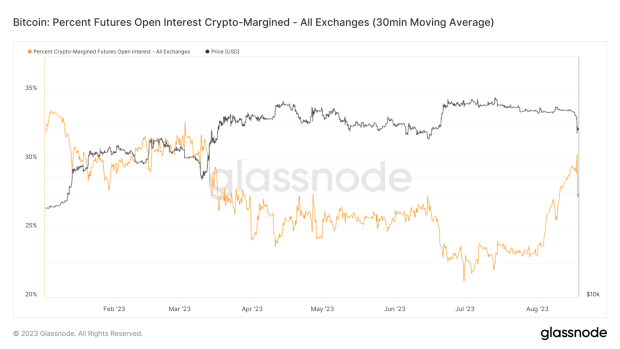

All that being mentioned, this wasn’t simply an options-driven occasion. There was rising leverage within the futures market as properly. Spot market volumes at multi-year lows mixed with rising by-product volumes and open curiosity along with volatility close to multi-year lows, was akin to lighting a match close to a pile of dynamite and ready for ignition. Alas, a spark was lit.

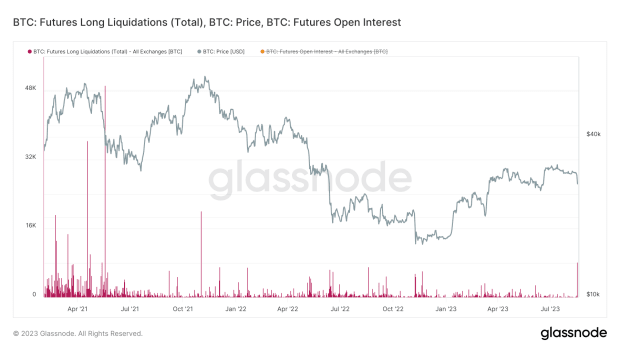

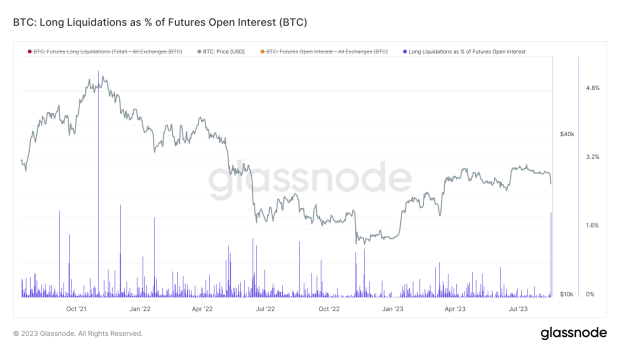

In bitcoin-denominated phrases, the day by day change in open curiosity was bigger than the collapse of FTX, with 89,000 BTC much less open curiosity than 24 hours prior.

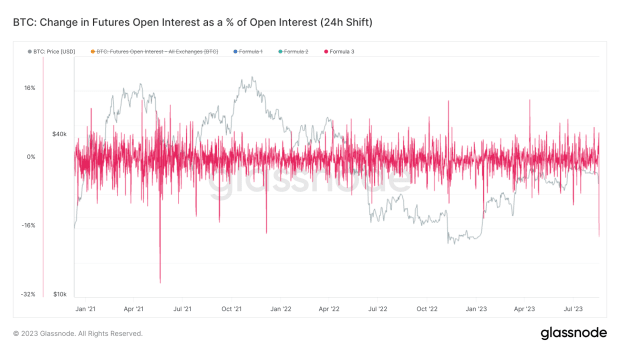

As a proportion of the futures market, with a 24-hour interval to match up the timelines, the transfer was equal to 18% getting worn out or closing, one thing that hasn’t been seen since December 2021.

Wanting solely at open curiosity liquidations, Glassnode finds 8,141 BTC getting liquidated throughout Thursday’s transfer, the most important since November 2021, and roughly 2% of open curiosity that forcefully acquired liquidated or margin referred to as.

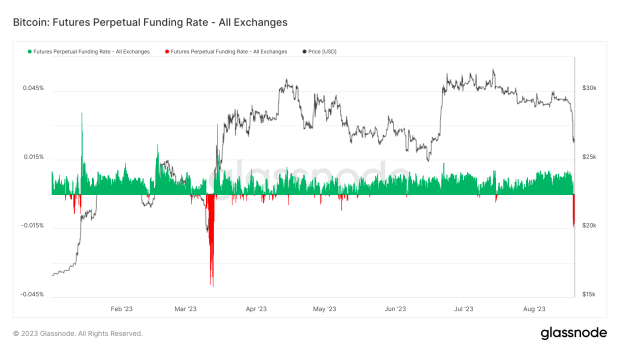

Looking at funding charges — the variable rate of interest paid between lengthy and brief positions within the perpetual futures market to incentivize merchants to maintain the contract worth near the spot market — funding fell to its lowest stage for the reason that March banking disaster when Silicon Valley Financial institution failed and USDC depegged. This exhibits simply how massive the dislocation within the derivatives market was relative to the spot market. Whereas it’s too early to attract conclusions a few vital brief bias available in the market as a result of unfavorable funding fee, we are going to monitor the market over the approaching days and weeks. A interval of sustained unfavorable funding with rising open curiosity may result in situations conducive to a brief squeeze, though this has but to develop.

Remaining Notice:

In conclusion, whereas Thursday’s transfer was the most important bout of volatility seen all 12 months and the most important bitcoin derivative-driven phenomenon in fairly a while, it’s typical of durations of extraordinarily low realized and implied volatility in any market, not to mention that of a notoriously unstable and unpredictable digital asset nonetheless in its monetization part. Within the brief time period, we now count on a pickup in volatility and higher uncertainty as the value tries to discover a new equilibrium level, with loads of information forward concerning potential bitcoin spot ETF approvals heading into 2024.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles instantly in your inbox.