Fast Take

Because the approval of Bitcoin ETFs on Jan. 11, the value efficiency of the digital asset has illustrated an unpredictable sample, peaking round $49,000 earlier than dipping beneath $40,000. As of now, Bitcoin hovers round $48,000. This risky conduct extends to crypto equities and Bitcoin ETFs, which have displayed divergent performances.

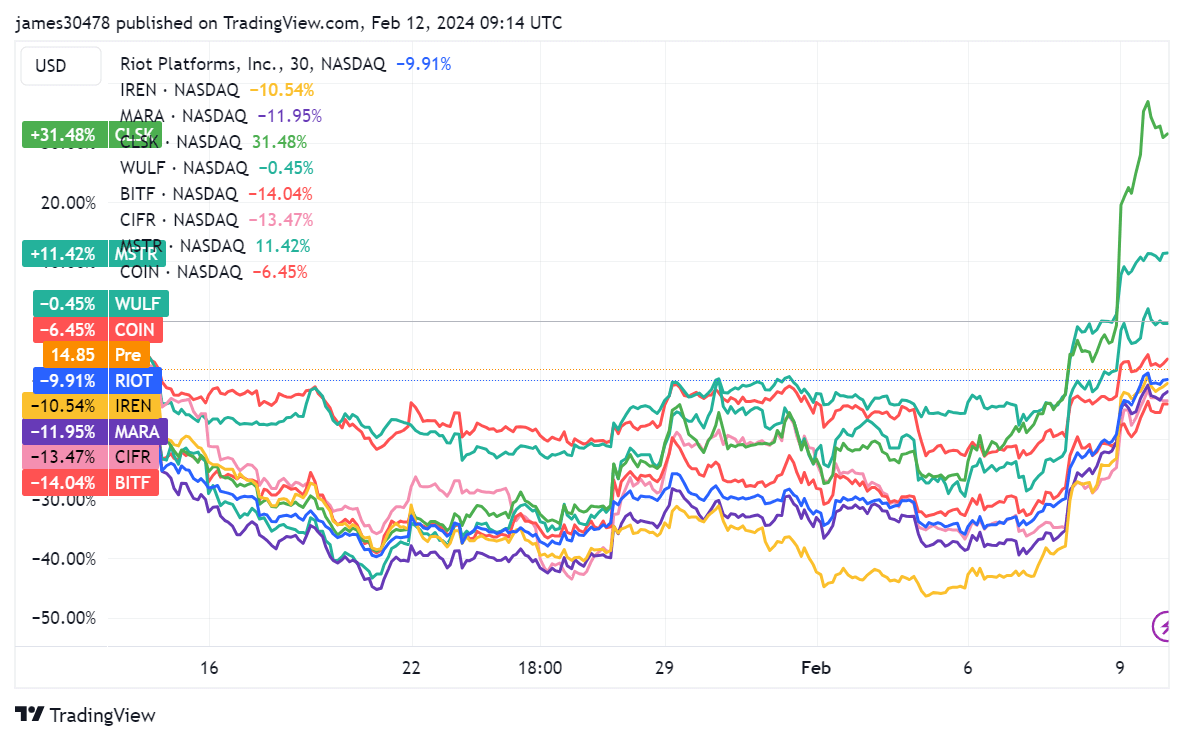

Bitcoin-related mining shares corresponding to Iris Power and Marathon Digital Holdings have notably skilled double-digit declines of 11% and 12%, respectively. Nevertheless, not all equities mimic this downward trajectory. CleanSpark and MicroStrategy, as an example, have seen their inventory costs surge by 31% and 11%, respectively. In the meantime, Coinbase suffered a 6% decline and is about to launch its This autumn 2023 earnings report on Feb. 15.

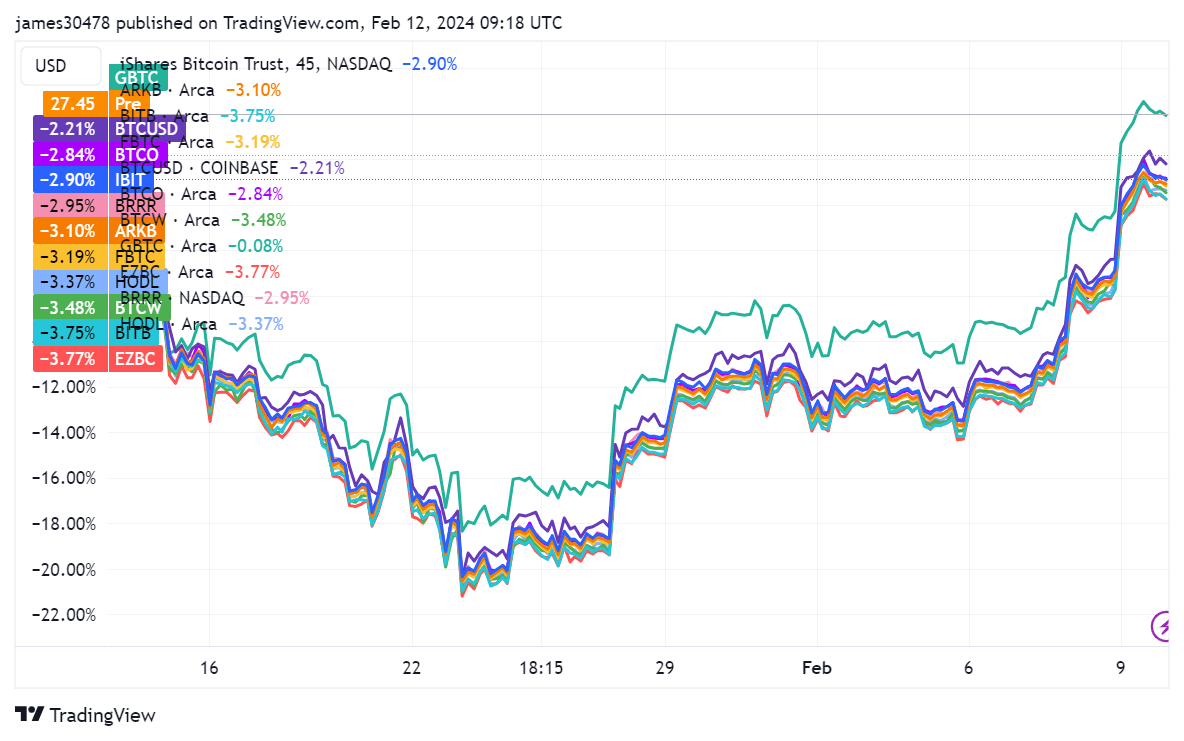

Owing to the slight decline in Bitcoin for the reason that ETF approval, Bitcoin ETFs have recorded roughly a 3% drop, with GBTC remaining comparatively flat. GBTC now data a small premium of 0.02% to its internet asset worth (NAV), in line with YCharts. However, the current Bitcoin resurgence of over $48,000 has injected optimism within the pre-market, with many ETFs and crypto equities witnessing an increase.

The publish Divergent performances spotlight resilience and challenges for Bitcoin ETFs and equities appeared first on CryptoSlate.