Information reveals the Ethereum open curiosity has seen a pointy rise just lately, an indication that quick holders could also be piling up on the futures market.

Ethereum Open Curiosity Has Shot Up Lately

As identified by an analyst in a CryptoQuant publish, the ETH open curiosity has spiked because the cryptocurrency’s value has been declining, a sample that has additionally been seen just a few occasions previously month.

The “open curiosity” right here is an indicator that retains monitor of the full quantity of Ethereum futures market contracts which are at the moment open on all by-product exchanges. This metric naturally counts each lengthy and quick contracts.

When the worth of this indicator goes up, it signifies that the futures market customers are opening up extra positions proper now. Often, every time extra positions seem, extra leverage additionally emerges available in the market, which is one thing that would instigate extra volatility within the asset’s value.

Then again, the metric’s worth lowering may result in the cryptocurrency turning extra steady, because it implies that some holders are closing up their futures place at the moment.

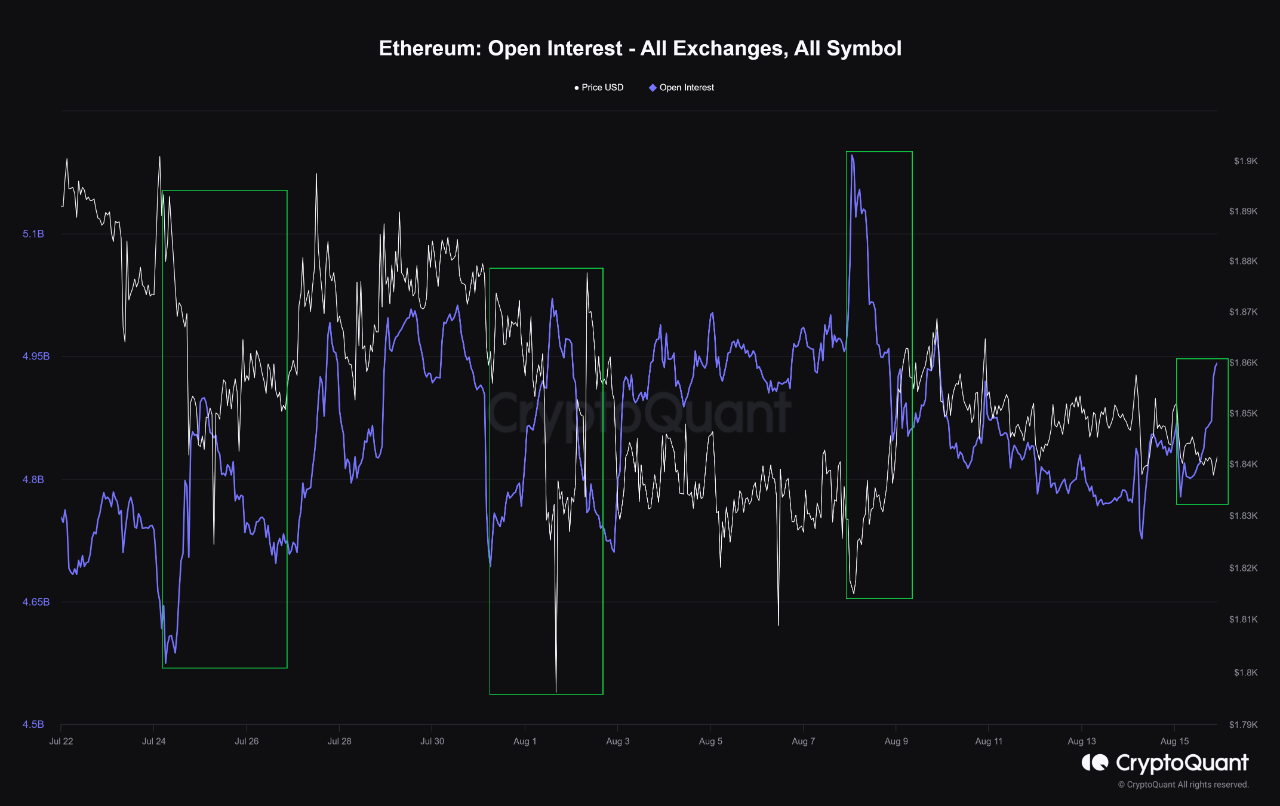

Now, here’s a chart that reveals the development within the Ethereum open curiosity over the previous month:

The worth of the metric appears to have registered some rise in current days | Supply: CryptoQuant

As highlighted within the above graph, the Ethereum open curiosity has noticed a speedy uptrend through the previous couple of days. On this identical interval, the ETH value has taken a success, suggesting that it’s attainable that these new positions on the futures market have come from quick holders.

Within the chart, the quant has additionally highlighted earlier situations just like the present one, the place the open curiosity registered an increase as the worth of the cryptocurrency slammed down.

It seems to be like there have been three occurrences of this development through the previous month and every of those was shortly adopted by the asset’s worth going by means of a surge because the open curiosity, in flip, wound down.

The sharp open curiosity plummets in these situations would suggest that the worth surges maybe triggered what’s known as a “liquidation squeeze.” In a squeeze, a mass quantity of liquidation takes place without delay, brought on by a pointy swing within the value.

The liquidations in these occasions solely find yourself offering additional gasoline for the worth transfer that ignited them to start with, thus leading to much more liquidations. Within the aforementioned situations, a brief squeeze would have taken place, that means that almost all of the contracts that had been liquidated had been shorts.

It’s attainable that the present open curiosity rise may go an identical approach for Ethereum if the contracts amassing in the marketplace are certainly quick ones. Any value volatility that arises out of this, nonetheless, would solely be momentary, as the worth surges previously month already confirmed.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,800, up 2% within the final week.

Appears like the worth of the asset has gone down through the previous day or so | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com