What Does “Bitcoin Halving” imply?

Bitcoin halving is a pre-programmed occasion that reduces the reward for mining new Bitcoin blocks by half. It’s a basic side of Bitcoin’s design, geared toward sustaining its shortage and controlling the availability of recent Bitcoins over time. This occasion happens roughly each 4 years, with the newest halving occurring in Might 2020 and one other one set to happen in April 2024.

Bitcoin halving was instituted by Satoshi Nakamoto, the pseudonymous creator of Bitcoin, as a part of the unique Bitcoin protocol. Nakamoto’s imaginative and prescient was to create a decentralized, peer-to-peer digital forex that may function independently of central banks and governments. The halving mechanism was designed to imitate the shortage of valuable metals like gold and be sure that the entire provide of Bitcoins would by no means exceed its hard-coded restrict of 21 million.

How Does Bitcoin Halving Happen?

The halving occasion is straight associated to bitcoin mining—the course of by which new Bitcoin transactions are verified and added to the blockchain ledger. Miners use specialised laptop {hardware} to unravel complicated mathematical issues, and the primary miner to unravel the issue is rewarded with newly minted Bitcoins. This course of is named Proof-of-Work (PoW), and it serves as a consensus mechanism to make sure the integrity and safety of the Bitcoin community.

The halving course of is automated, deterministic, and constructed straight into the Bitcoin protocol’s code to implement scheduled reductions in new coin issuance with none centralized management or oversight. It’s triggered when a selected situation is met—when 210,000 blocks are mined. The interval between reaching this equates to roughly each 4 years.

The next set of actions should occur for the it stated that Bitcoin halving course of has happen:

Block Reward Discount: The reward for efficiently mining a brand new block and including it to the Bitcoin blockchain is routinely decreased by 50%. For instance, if the present block reward is 12.5 newly minted Bitcoins, it will likely be decreased to six.25 Bitcoins after the halving.

Code Execution: The discount in block reward is executed routinely by the Bitcoin protocol’s code throughout the complete community. No human intervention or centralized management is required.

Community Consensus: For the halving to achieve success, nearly all of miners and nodes on the Bitcoin community should replace their software program to the most recent model that enforces the brand new, decreased block reward.

Affirmation: The halving is confirmed as soon as the subsequent block is mined after the 210,000th block, and the brand new decreased block reward is paid to the miner who found that block.

Continued Operation: After the profitable halving, the Bitcoin community continues working as regular, with miners receiving the brand new decreased block reward for every block they mine going ahead.

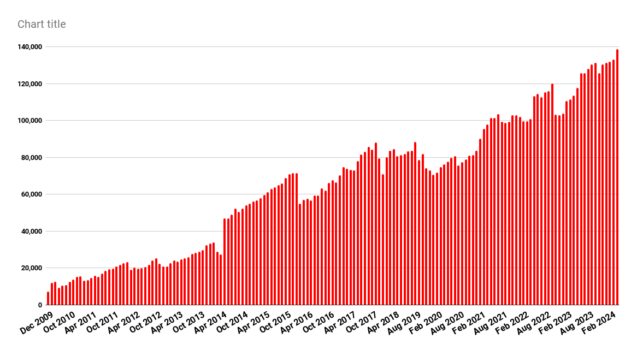

When Bitcoin was first launched in 2009, the reward for mining a brand new block was 50 Bitcoins. The primary halving occasion, which occurred on November 28, 2012, decreased it to 25 Bitcoins per block. Subsequent halvings occurred in 2016 (12.5 Bitcoins per block) and 2020 (6.25 Bitcoins per block). The subsequent halving, which is anticipated to occur in 2024, will see the mining reward decreased to three.125 Bitcoins per block.

What Are The Impacts of Bitcoin Halving?

Bitcoin halving is a vital occasion within the cryptocurrency’s life cycle, with far-reaching implications for varied members within the Bitcoin community. Its affect is multifaceted, affecting traders, miners, and the general well being of the Bitcoin ecosystem.

Miners and Community Safety

For miners, Bitcoin halving presents each challenges and alternatives. Because the block reward is decreased by half, miners face a lower in income, which may result in some miners leaving the community resulting from diminished profitability. This exodus of miners can doubtlessly affect the community’s safety and processing energy, as fewer miners contribute to validating transactions and securing the blockchain.

Conversely, if Bitcoin’s value will increase considerably after the halving occasion, it could possibly offset the decreased mining rewards and incentivize extra miners to affix the community, finally strengthening its safety and decentralization.

Moreover, halving occasions can catalyze a shift within the mining trade, favouring bigger, extra environment friendly mining operations with entry to cheaper vitality sources and specialised {hardware}. Smaller mining operations and particular person miners might discover it more and more difficult to compete and stay worthwhile in a post-halving surroundings.

Community Well being and Dangers

Whereas Bitcoin halving is designed to take care of the cryptocurrency’s shortage and long-term worth, it isn’t with out dangers. One potential concern is the chance of a 51% assault, the place a single entity or group features management of greater than 50% of the community’s computing energy, permitting them to control the blockchain and doubtlessly double-spend cash.

After a halving occasion, if a major variety of miners go away the community resulting from decreased profitability, it may briefly lower the community’s general hash fee and make it extra susceptible to such assaults. Nonetheless, the Bitcoin community has confirmed resilient to those threats, and the inducement construction is designed to discourage such malicious behaviour.

Traders and Market Dynamics

For traders, Bitcoin halving is mostly perceived as a bullish occasion, because it reduces the availability of recent Bitcoins getting into the market whereas demand stays fixed or will increase. This supply-demand dynamic usually results in upward stress on Bitcoin’s value, making it a horny funding alternative.

Traditionally, Bitcoin’s value has exhibited important volatility and hypothesis round halving occasions as traders try and anticipate and capitalize on potential value actions. Whereas previous efficiency isn’t a assure of future outcomes, Bitcoin has sometimes skilled substantial value rallies within the months main as much as and following halving occasions.

Is Bitcoin Worth Actually Affected by Halving?

The connection between Bitcoin halving occasions and subsequent value actions has been a topic of intense debate and evaluation inside the cryptocurrency neighborhood. Whereas historic knowledge suggests a sample of bull markets following halvings, establishing a direct causal hyperlink between the 2 stays contentious.

Bitcoin Worth and Halving Occasion Relationships

Every of the three halving occasions which have occurred up to now in Bitcoin’s historical past has been adopted by a major value rally. The primary halving in 2012 noticed Bitcoin’s value surge from round $13 on the time of the occasion to a peak of $1,152 a yr later. Equally, the 2016 halving preceded a rally that took Bitcoin’s value from $664 to a excessive of $17,760 inside a yr. The latest halving in 2020 was adopted by a bull run that propelled Bitcoin’s value from $9,734 to a peak of $67,549 in November 2021.

Whereas these value actions are plain, it’s important to notice that correlation doesn’t essentially indicate causation. Numerous different components, akin to elevated institutional adoption, regulatory developments, and general market sentiment, may have contributed to those value rallies.

Potential Causes for Worth Will increase

One of many major arguments for why halving occasions may drive Bitcoin’s value larger is the supply-demand dynamic. By lowering the speed at which new Bitcoins are launched into circulation, halving occasions successfully constrict the availability of the cryptocurrency. If demand stays fixed or will increase, fundamental financial ideas recommend that the value ought to rise to take care of equilibrium.

Moreover, halving occasions can enhance the price of mining for Bitcoin miners, as their block rewards are decreased by half. To keep up profitability, miners might must promote their Bitcoin holdings at larger costs, contributing to upward value stress.

Moreover, halving occasions are inclined to generate important media consideration and hypothesis inside the crypto neighborhood, doubtlessly driving elevated demand and funding from each retail and institutional traders.

Counterarguments and Concerns

Critics of the halving-price correlation argue that the halving occasions are extensively anticipated and, subsequently, already priced into the market effectively prematurely. They contend that rational market members would have already factored within the upcoming provide discount, rendering the precise halving occasion much less impactful on costs.

Some analysts recommend that the value rallies noticed after halving occasions could also be extra attributable to speculative mania and the self-fulfilling prophecy of traders anticipating value will increase, quite than any basic modifications in provide and demand dynamics.

Nonetheless, it’s vital to notice that the affect of halving on Bitcoin’s value isn’t all the time rapid or simple. Market sentiment, regulatory developments, and general adoption charges additionally play a major function in figuring out the cryptocurrency’s worth.

What Subsequent After Issuing the Most Variety of Bitcoin?

The Bitcoin protocol is designed such that there’s a hard-coded restrict of 21 million Bitcoins that may ever be created. This finite provide is a basic side of Bitcoin’s shortage and worth proposition; it differentiates the token from conventional fiat currencies that may be printed indefinitely by central banks.

Whereas it could look like a distant prospect, it’s essential to know what is going to occur as soon as the final Bitcoin is mined, an occasion anticipated to happen across the yr 2140. By this time, all scheduled halving occasions may have taken place, and the block reward for miners might be zero.

Transition to Transaction Charge-based Incentive Mannequin

As soon as the ultimate Bitcoin has been mined and the block reward turns into zero, the inducement construction for miners will transition fully to a transaction fee-based mannequin. On this mannequin, community customers (these shopping for, promoting, or transferring Bitcoins) can pay charges to miners for processing and validating their transactions on the blockchain.

These transaction charges will function the first incentive for miners to proceed contributing their computing energy to safe the community and keep the integrity of the Bitcoin blockchain. The charges might be collected and distributed to miners proportionally primarily based on the quantity of labor they contribute to the community.

Dynamic Charge Adjustment

To make sure a clean transition and keep incentives for miners, the Bitcoin protocol contains mechanisms for dynamic charge adjustment. Because the block reward diminishes and ultimately reaches zero, the community will routinely alter the charge construction to incentivize miners adequately.

This adjustment course of will doubtless contain miners collectively setting charge ranges that cowl their operational prices and supply an inexpensive revenue margin, making certain the continued viability of mining operations and the safety of the community.

Community Safety and Decentralization

One of many potential issues surrounding the transition to a fee-based incentive mannequin is the affect on community safety and decentralization. With out the block reward as an incentive, there’s a threat that mining may develop into much less enticing, resulting in a possible centralization of mining energy or a lower within the general hash fee of the community.

Nonetheless, the Bitcoin protocol is designed to mitigate these dangers by varied mechanisms, akin to problem changes and the inherent financial incentives for miners to take care of a safe and decentralized community. So long as there may be adequate demand for Bitcoin transactions and customers are prepared to pay acceptable charges, the inducement construction ought to stay intact, making certain the continued operation and safety of the community.

Finally, the utmost issuance of 21 million Bitcoins isn’t an endpoint however quite a transition to a brand new section within the cryptocurrency’s evolution. By design, Bitcoin is a self-sustaining and self-regulating system, and its potential to adapt and thrive past this milestone might be a testomony to the robustness of its underlying structure and the continued dedication of its world neighborhood.

Conclusion

The affect of Bitcoin halving isn’t all the time simple. Whereas it’s designed to extend shortage and doubtlessly drive up the value of Bitcoin, different components akin to market sentiment, adoption charges, and regulatory developments additionally play a major function in figuring out the cryptocurrency’s worth.

Furthermore, as Bitcoin continues to achieve mainstream adoption and institutional curiosity, the affect of halving occasions on value dynamics might evolve. As extra refined traders and market members enter the area, the potential for environment friendly pricing and a extra rational response to those occasions may emerge.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, and Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”