Listed below are two Ethereum metrics which might be at present exhibiting values that will result in a rebound for the cryptocurrency’s worth.

Ethereum Might Rebound Off The Present Market FUD

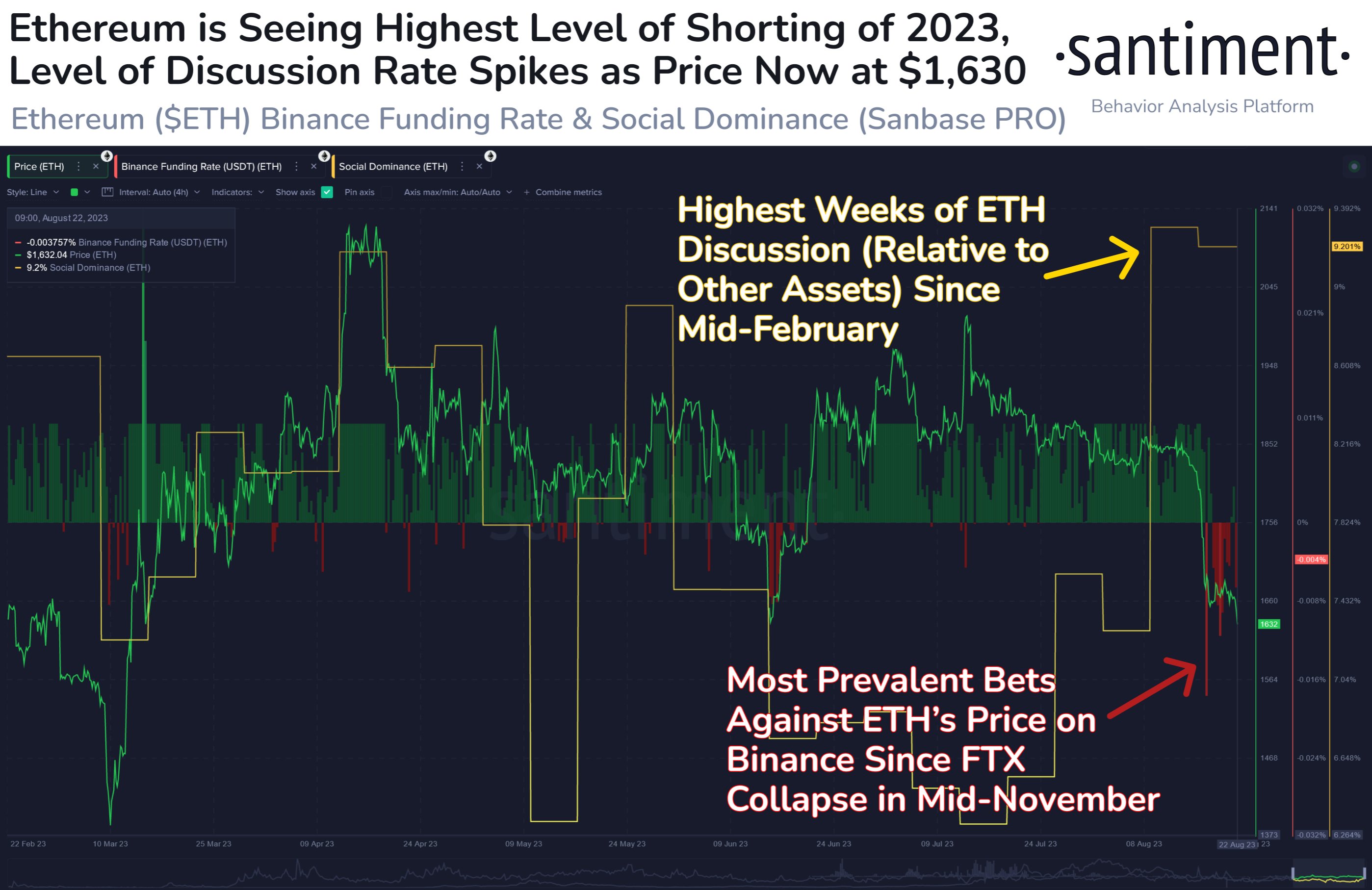

In line with information from the on-chain analytics agency Santiment, the gang appears to have began to guess towards ETH up to now few days. There are two metrics of relevance right here: the Binance Funding Charge and the Social Dominance.

First, the “Binance Funding Charge” retains monitor of the periodic price that Ethereum by-product contract holders on the Binance platform are paying to one another at present.

Associated Studying: Bitcoin Lengthy-Time period Holders Keep Sturdy, Present Little Response To Crash

When the worth of this metric is adverse, it implies that the brief holders are paying the lengthy traders proper now. Such a pattern suggests {that a} bearish mentality is the dominant drive out there.

Then again, constructive values indicate a bullish sentiment is shared by the bulk because the lengthy traders are paying a premium to the shorts with a purpose to maintain onto their positions.

Now, here’s a chart that reveals the pattern within the Ethereum Binance Funding Charge over the previous few months:

The worth of the metric seems to have been fairly pink in latest days | Supply: Santiment on X

As displayed within the above graph, the Ethereum Binance funding charge had been constructive proper earlier than the crash, however following it, the metric rapidly turned extremely adverse.

The rationale behind this fast shift was the truth that the lengthy holders had been liquidated within the crash, whereas speculators had rapidly jumped in to brief whereas the chance nonetheless seemed to be there.

The funding charge has turn out to be much less adverse over the previous few days, however it nonetheless stays at notable pink values nonetheless, implying that almost all of the traders are nonetheless betting towards the cryptocurrency.

The chart additionally reveals the info for the opposite indicator of curiosity right here, the “social dominance.” This metric tells us concerning the quantity of dialogue that Ethereum is receiving on the main platforms, relative to the highest 100 belongings within the sector.

As is seen within the graph, this indicator had been at comparatively excessive values throughout the lead-up to the crash, implying that a lot of traders had been speaking concerning the asset.

It’s onerous to say which approach these discussions have been leaning from this indicator alone, however with the encompassing context just like the funding charges being constructive, it might be a secure assumption that these talks have been an indication of optimism and hype out there.

Traditionally, Ethereum and different markets have tended to indicate strikes opposite to what nearly all of merchants predict. This impact might have been in play when ETH crashed after the discussions across the coin had hit excessive ranges.

The social dominance of the coin hasn’t calmed down after the crash, which means that traders proceed to interact in a excessive quantity of speak concerning the asset. Given the shift within the sentiment on the by-product market, although, it’s potential that these excessive discussions at the moment are reflecting the diploma of FUD that’s current within the sector.

Similar to how the optimism probably led to the crash earlier, this present FUD can as a substitute end in a rebound for Ethereum, with the shorts which have now piled up probably appearing as gas by way of a mass liquidation occasion.

ETH Value

On the time of writing, Ethereum is buying and selling at $1,642, down 10% within the final week.

ETH hasn’t moved a lot for the reason that plummet | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet