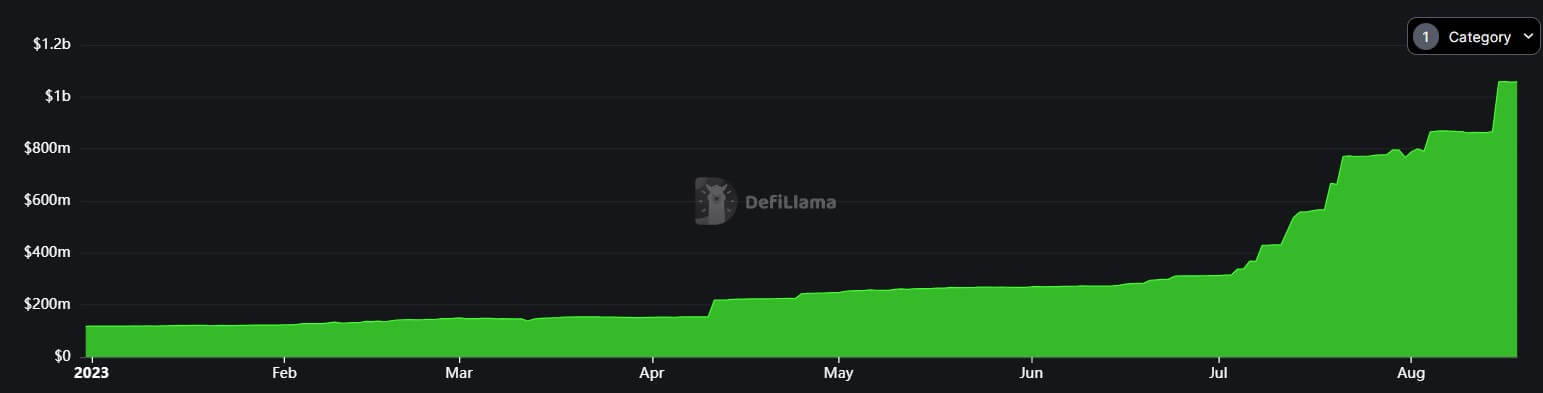

Decentralized finance (DeFi) protocols have seen a considerable lower within the complete worth of property locked (TVL) on them in latest months as a result of present bearish sentiments saturating the market.

Nevertheless, this decline has not impacted the Actual-World Property (RWA) subsector, which has skilled vital progress through the interval, with its TVL greater than doubling, in response to DeFillama information.

Per the info aggregator’s dashboard, RWA’s TVL has greater than tripled inside the previous few months to over $1 billion from the $270.29 million recorded on June 1.

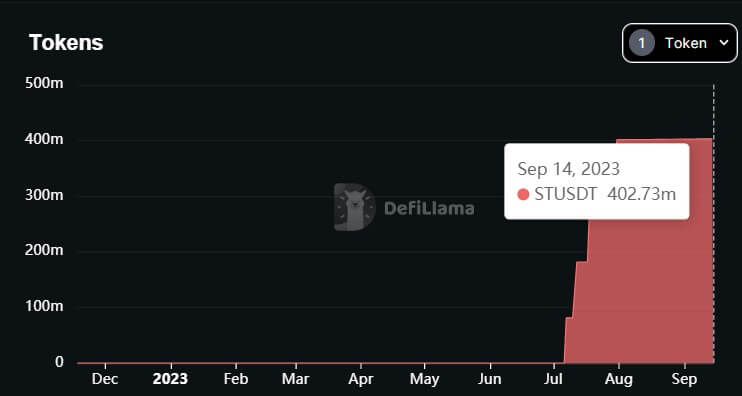

Based on information from DeFillama, one challenge, Staked Tether (stUSDT), stands out because the driving pressure behind the outstanding progress on this subsector.

What’s stUSDT?

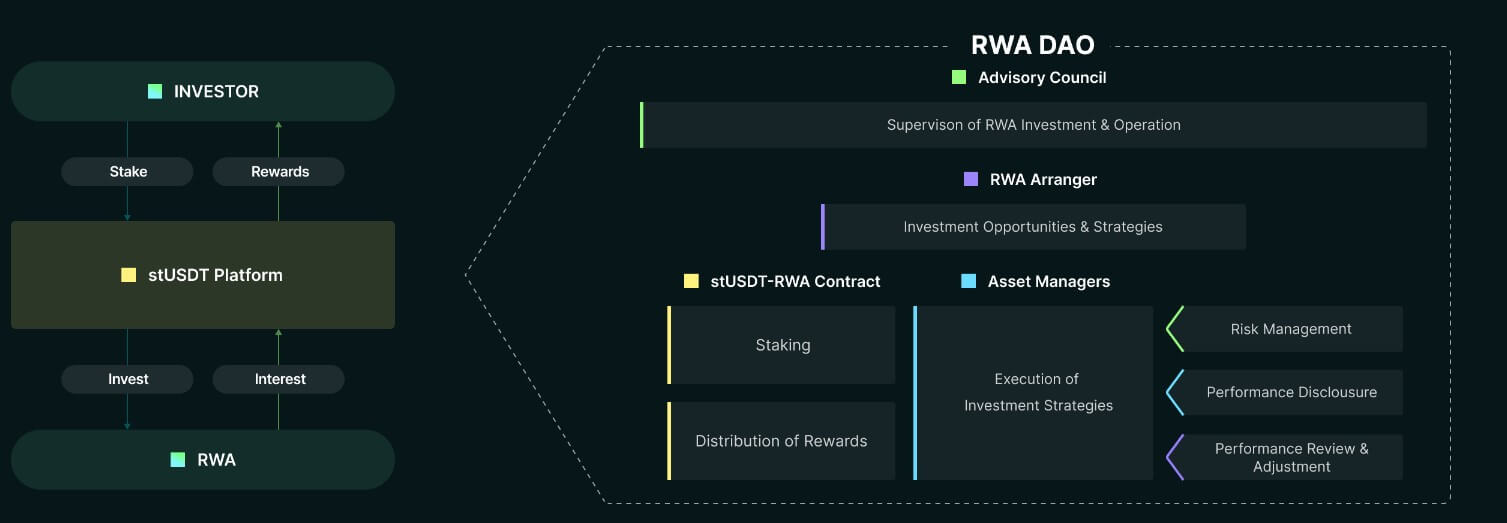

stUSDT is the primary RWA platform on the TRON community designed to operate as a cash market fund.

Based on its web site, stUSDT is the receipt token customers obtain upon staking USD stablecoins on the platform. The protocol says it pays a yield of 4.21% on the stablecoin in return for investing them in real-world property.

The protocol’s web site claims partnerships with crypto initiatives like Tether (USDT) and Justin Solar-linked firms like HTX (previously Huobi) and JustLend.

In the meantime, stUSDT stated it’s ruled by the Actual World Asset Decentralized Autonomous Group (RWA DAO), “providing customers a clear, truthful, and safe channel for RWA funding.”

Since its launch, the challenge has loved a meteoric rise, with its TVL step by step approaching $1 billion in lower than three months. This implies stUSDT accounts for greater than 80% of the whole worth locked in RWA regardless of being comparatively new to the market in comparison with rivals like Ondo Finance and others.

However, issues have emerged relating to the protocol, together with allegations of Justin Solar using it to finance his investments.

Considerations about stUSDT

stUSDT has come beneath scrutiny, primarily as a result of its governance and transparency. Whereas the stUSDT web site claims to spend money on short-term authorities bonds, the precise particulars relating to the sorts of bonds in its portfolio stay undisclosed.

This lack of transparency, particularly in comparison with different RWA protocols like Ondo Finance, has raised vital issues throughout the crypto group. The only supply of details about the protocol’s investments has been its Each day Rebase updates on its Medium web page.

Ralf Kubli, a board member on the Casper Affiliation, instructed CryptoSlate that whereas “stUSDT is basically positioning itself as a solution to Alipay’s “Yu’e Bao,” a cash market fund product supplied by Alibaba., it fails to deal with the underlying points with RWAs. Kubli stated:

“These present tokenization practices nonetheless fail to deal with the underlying subject that we’ve been speaking about time and time once more, i.e. guaranteeing that each one money flows associated to the RWAs are algorithmically outlined throughout the asset itself.

At present, most tokenized monetary merchandise do nothing greater than take a PDF of the monetary contract and hash it into the token. A human nonetheless should entry and skim this definition and course of it accordingly. That is under no circumstances modern and is actually not scalable.”

Including to the apprehension is the governance construction of the stUSDT protocol. Throughout its launch, it was asserted that stUSDT can be ruled by the RWA DAO and operated beneath a custody settlement with JustLend DAO.

Nevertheless, CryptoSlate couldn’t affirm any info on the RWA DAO and couldn’t affirm the integrity of its partnership with Tether.

In addition to that, on-chain information reveals {that a} portion of stUSDT’s provide is linked to addresses managed by Justin Solar, and additional scrutiny reveals a considerable presence of stUSDT on HTX, the place greater than $400 million price of the asset is domiciled, per DeFillama information.