Fast Take

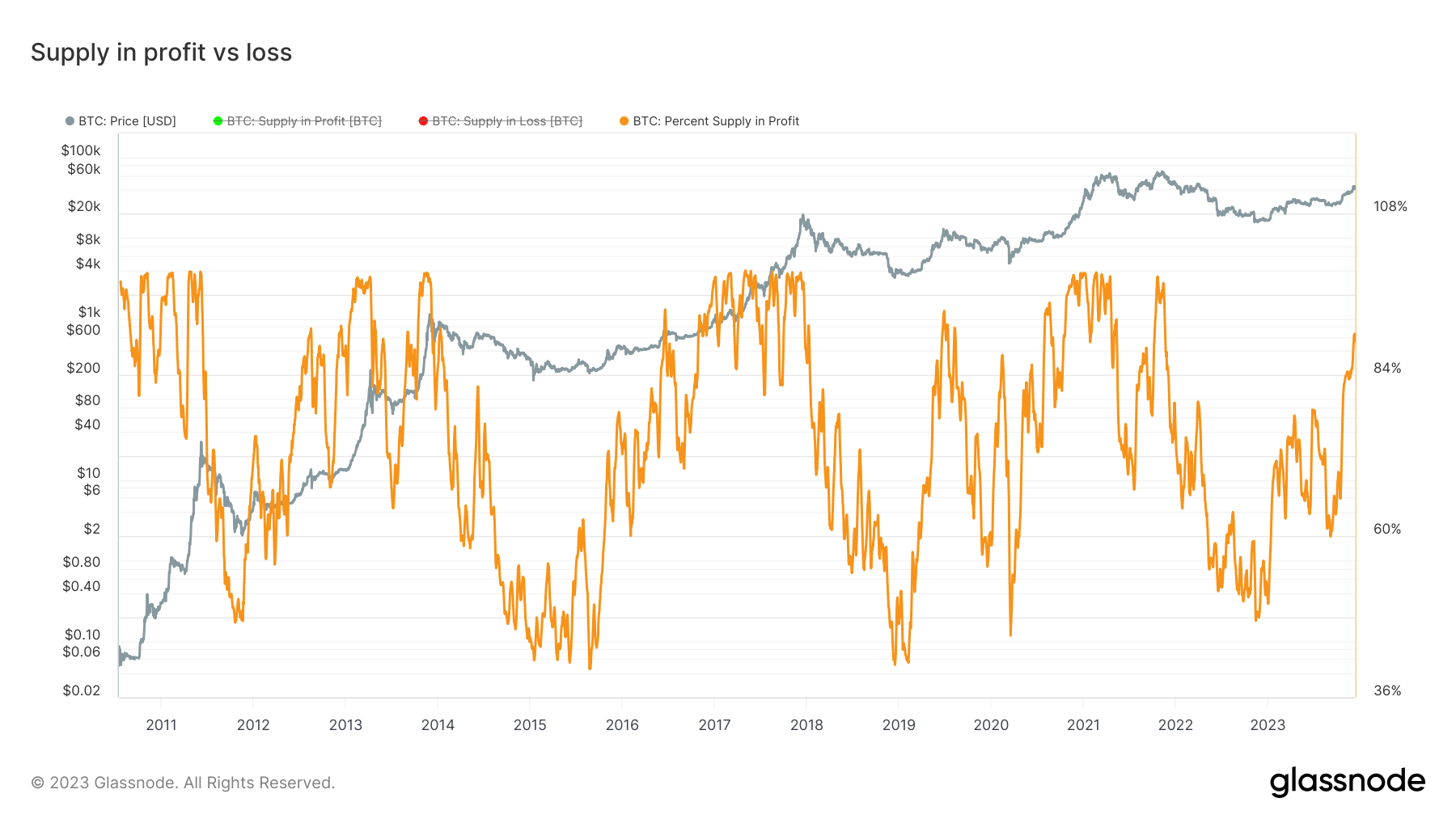

Analyzing the availability dynamics of Bitcoin reveals a telling story of revenue and loss convergence, a major indicator of market fluctuations. Of the roughly 19.3 million Bitcoin in circulation, an estimated 17.3 million are in revenue, leaving 1.9 million at a loss. The convergence of provide in revenue and loss – the place losses supersede income – serves as a marker for the underside in Bitcoin cycles. This phenomenon has been noticed recurrently throughout bear markets, significantly in 2015, 2019, 2020, 2021, and 2022.

Presently, the Bitcoin market is navigating one in all its most in depth divergence ranges, with nearly 89% of Bitcoin provide in revenue. That is solely barely beneath the cycle highs when the revenue determine hits a surprising 100% – a state of affairs indicative of a market peak the place each holder is in revenue. This development evaluation underscores the cyclical nature of the digital asset market and the inherent potential for revenue and loss convergence, serving as an indicator of market turns.

The put up Worthwhile Bitcoin provide nears cycle peak, might precede market correction appeared first on CryptoSlate.