In response to Bloomberg, decentralized finance (DeFi) initiatives function via automated contracts and are often helmed by collective entities slightly than single people.

This collaborative nature of governance has usually posed challenges for regulators. Nonetheless, main monetary establishments at the moment are questioning the narrative surrounding DeFi.

DeFi’s Central Figures: A Regulatory Perspective

The Worldwide Group of Securities Commissions (IOSCO), a distinguished international securities requirements physique, has offered recent insights into the DeFi realm. They advise regulators to shift focus in direction of people and organizations that straight management crucial points resembling design, upkeep, and different parts of DeFi ecosystems.

IOSCO’s suggestion stems from a basic realization articulated by Tuang Lee Lim, chair of IOSCO’s board-level fintech activity pressure. Lim highlighted a prevalent false impression about DeFi’s decentralization, stating that “accountable individuals” might be recognized inside these preparations.

Such an method is obvious in current authorized confrontations. A noteworthy occasion is the US case regarding Twister Money, an Ethereum-based decentralized crypto mixer. Authorities pinned down two authentic builders on completely different costs.

Notably, the US Treasury Division sanctioned Twister Money final yr. This occasion triggered a number of lawsuits from main trade entities difficult the federal government’s overreach.

Suggestions And Implications For DeFi Initiatives

IOSCO’s report goes past mere statement. It has actively proposed methods for understanding DeFi’s working mechanics. Among the many ideas is the necessity to discern the place DeFi platforms align with prevailing monetary laws.

There’s additionally an emphasis on transparency, with a name for platforms to brazenly disclose potential conflicts of curiosity. Moreover, IOSCO known as for enhanced worldwide cooperation between regulatory our bodies and enforcement companies, a step in an more and more globalized monetary panorama.

Whereas the report doesn’t highlight any particular person venture, it does allude to sure parts. For instance, it references the dynamics in decentralized autonomous organizations (DAOs) the place allegedly lower than 1% of token holders usually wield 90% of the voting energy.

Such metrics present regulators with a lens to establish the central figures in DeFi setups. Valerie Szczepanik, head of the US Securities and Alternate Fee’s strategic hub, aptly summarized the sentiment by questioning:

Who’s elevating cash for the venture, who’s in control of sustaining it? Who was steering the path of any specific venture? Oftentimes, there are small teams of individuals really controlling it.

In response to Bloomberg, this current growth aligns with IOSCO’s broader intentions for crypto asset regulation, as seen from their framework launched earlier this yr. A public session concerning these suggestions stays open.

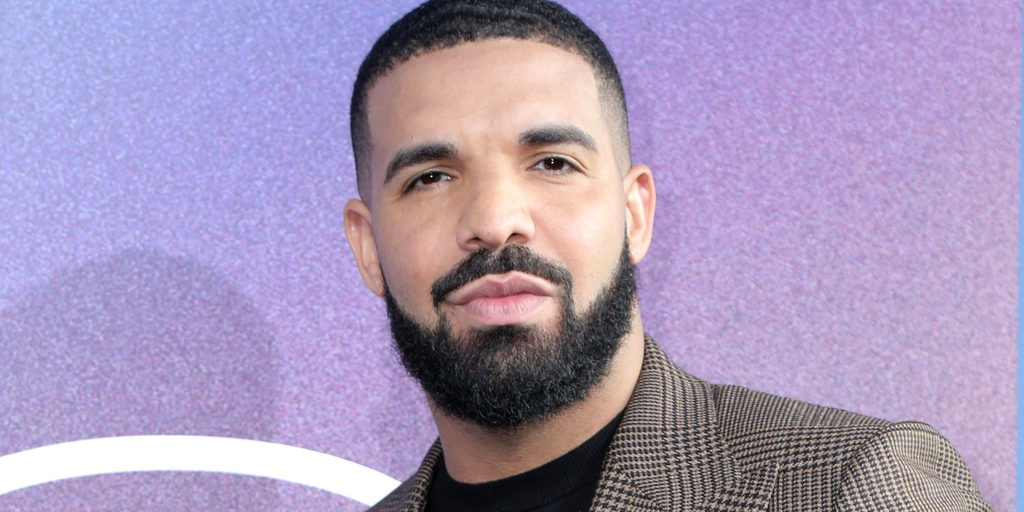

Featured picture from Unsplash, Chart from TradingView