In a deep dive into the Solana blockchain community, Visa elucidated its causes for choosing Solana as part of its stablecoin settlement pilot in the present day. As Bitcoinist reported, Visa introduced final week that they’re increasing their stablecoin pilot to Solana. The worldwide funds behemoth’s resolution comes on the heels of its ongoing efforts to modernize cross-border cash transfers by harnessing the ability of blockchain expertise.

Why Visa Selected Solana

Visa’s exploration, penned by Mustafa Bedawala and Arjuna Wijeyekoon, underscores Solana’s spectacular transaction throughput. Though the blockchain has not but matched Visa’s staggering capability of 65,000 transactions per second, it boasts a mean of 400 user-generated transactions per second. This determine may even surge to over 2,000 during times of heightened demand. For context, Ethereum, one of many main blockchain networks, manages a mean of simply 12 transactions per second.

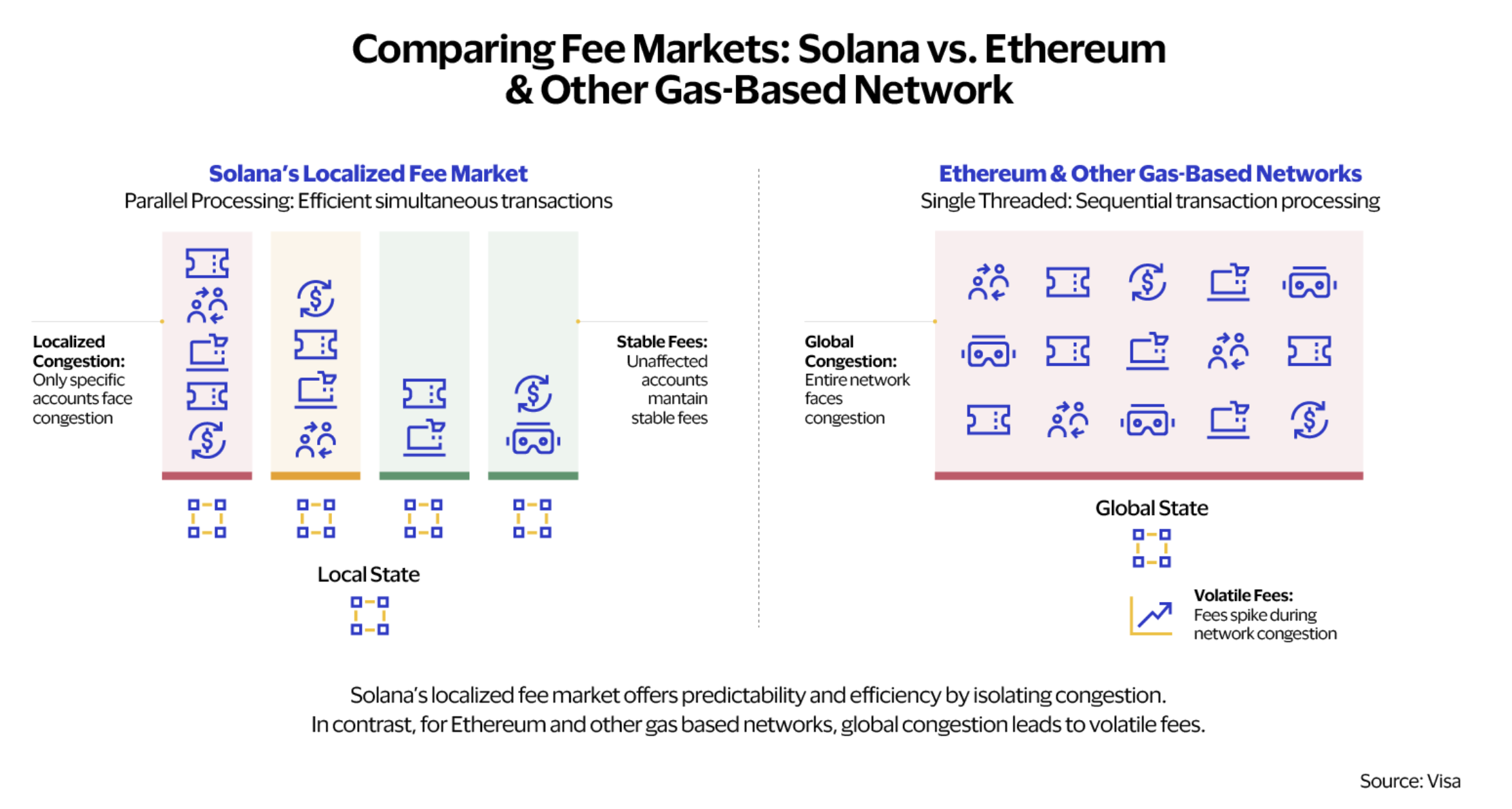

A foundational factor of Solana’s excessive transaction throughput is its potential to course of transactions in parallel. This parallel transaction processing ensures that transactions affecting separate accounts may be executed concurrently. That is in distinction to different blockchains like Ethereum, which course of transactions sequentially.

The authors elucidate, “Transactions impacting separate accounts may be executed concurrently, enabling Solana to effectively help fee and settlement eventualities.” This multi-threaded strategy is instrumental in mitigating community congestion, guaranteeing {that a} bottleneck in a single phase doesn’t compromise your complete community’s throughput.

One other compelling function of Solana is its low and predictable transaction prices. Usually, SOL’s transaction charges are lower than $0.001, making it a gorgeous choice for fee operations looking for each effectivity and price financial savings. This stands in distinction to the fluctuating charges of Bitcoin and Ethereum, which might fluctuate based mostly on community demand.

The blockchain’s distinctive strategy to charges ensures that congestion in a single account doesn’t influence others. As an illustration, if there’s a surge in demand for a selected asset, comparable to an NFT, solely the charges for that exact account will see a rise. This localized price market is carefully tied to the blockchain’s parallel processing capabilities.

Visa additionally highlighted the significance of transaction finality, which measures the pace at which actions are confirmed on a blockchain community. SOL targets a slot time of 400 milliseconds, making it considerably sooner than lots of its rivals. Most functions on Solana use “optimistic affirmation” for his or her finality, a mechanism that enables for faster transaction confirmations.

When it comes to community availability, as of July 2023, Solana has a powerful 1,893 lively validators and a further 925 RPC nodes. This huge variety of nodes, unfold throughout over 40 international locations, ensures the community’s resilience and reliability. The authors spotlight the importance of this range, stating it makes the community “extra strong towards occasions comparable to pure disasters or change in entry coverage by the supplier.”

Moreover, the range of validator purchasers on Solana enhances its resilience. Whereas vulnerabilities would possibly plague one shopper, others stay unaffected, decreasing the danger of a singular software program flaw destabilizing the community. The introduction of a number of validator purchasers, comparable to Jito-Solana and Firedancer, underscores the undertaking’s dedication to community stability.

Assembly Trendy Calls for

Thus, Visa’s resolution to combine Solana is rooted within the blockchain’s distinctive technological benefits, together with its excessive throughput, low prices, and important node presence. As Visa continues its stablecoin settlement pilot, the corporate goals to determine if SOL can meet the rigorous calls for of contemporary company treasury operations.

This transfer by Visa follows its earlier integration of the Ethereum blockchain for USDC transfers in a 2021 pilot undertaking in Australia. With the latest extension of its fee operate with the stablecoin USDC to Solana, Visa continues to place itself on the forefront of blockchain-based fee options. Cuy Sheffield, Head of Crypto at Visa, remarked on the mixing, stating that by leveraging stablecoins like USDC and world blockchain networks, Visa goals to reinforce the pace of cross-border settlements.

At press time, SOL traded at $18.06 after bouncing off the 61.8% Fibonacci retracement stage.

Featured picture from Medium, chart from TradingView.com